Ready to get started?

Easily integrate next-generation payments and financial data into any app. Build powerful products your customers love.

With Worldpay’s recent acquisition by Global Payments for $24.2 billion, many UK businesses are taking a fresh look at their current payment setup. For years, Worldpay has been one of the go-to names in the industry—but with major ownership changes, questions around pricing, support, and flexibility are beginning to surface. As payment technology continues to evolve, businesses are no longer tied to legacy systems. From faster settlement speeds to open banking-powered solutions, modern alternatives now offer better value, smoother integrations, and more transparency.

If you’re looking to reduce fees and improve how you get paid, here are five standout Worldpay alternatives for UK businesses in 2025.

1. Atoa

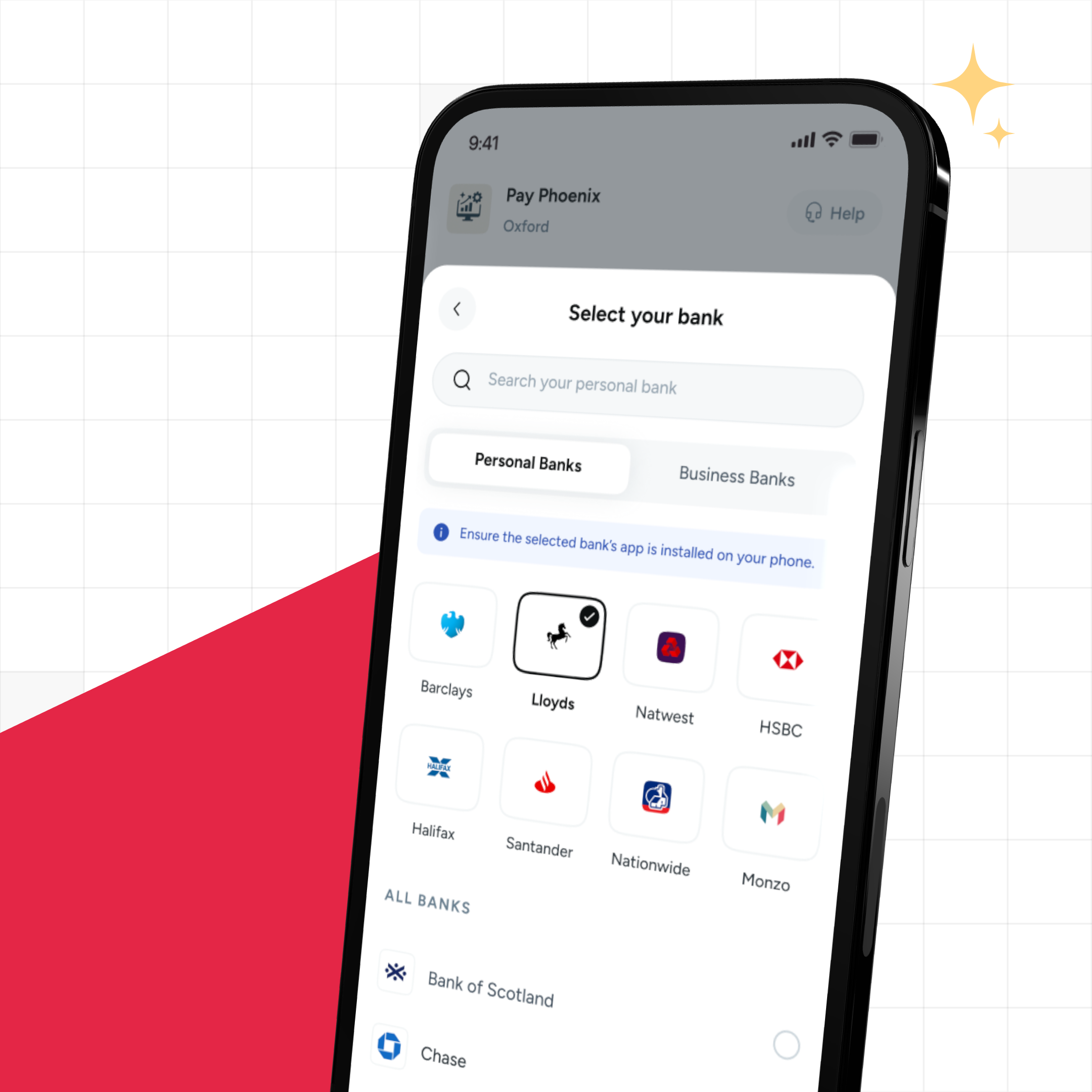

Using open banking rails, Atoa lets customers pay directly from their bank app. No card networks, no terminals, no middlemen. Payments are instant, and since the process is verified through the bank, chargebacks simply don’t exist.

For businesses, this means lower fees, faster cash flow, and less admin. Atoa connects easily with tools like Xero, QuickBooks, and Sage, making transaction and reconciliation effortless. It’s particularly useful for sectors like hospitality, retail, law services, travel, car dealerships, and healthcare, where in-person and remote payments are common. Whether through QR codes, SMS links, or invoices, Atoa offers a fast, secure, and modern way to get paid—making it one of the top WorldPay alternatives for UK businesses.

2. Stripe

Stripe has built its reputation on being developer-friendly and endlessly customisable. It supports a wide range of payment methods like cards, digital wallets, payment links, and more, making it an excellent fit for online businesses and subscription platforms.

Stripe’s powerful APIs let businesses tailor every aspect of the checkout experience. It’s a great choice if you’re running an ecommerce store or platform with international customers, and need something highly flexible. While its pricing is transparent, Stripe may come with a steeper learning curve for smaller teams without development resources.

3. Square

Square provides a tidy all-in-one solution for small to medium-sized businesses. Alongside card processing, it includes a point-of-sale (POS) app, tools to create an online store, invoice generation, and inventory tracking.

Its hardware options are affordable and mobile-friendly, making Square ideal for shops, cafés, salons, and pop-up stalls. Its per-transaction fees can add up for high-volume businesses. The system is easy to set up and use, especially if you’re just starting out and want a reliable platform.

4. Adyen

Adyen is often the platform of choice for large businesses and global brands that want unified commerce across channels. It allows you to accept payments in-store, online, or with a mobile phone using a single backend, giving you a clear picture of your operations.

Its real strength lies in data-driven insights, fraud prevention, and multi-currency support. Adyen isn’t necessarily the cheapest option, but for businesses operating at scale, it offers powerful tools to optimise revenue, reduce payment friction, and maintain full control over the customer journey.

5. GoCardless

GoCardless is best known for helping businesses collect recurring payments through Direct Debit, but it has recently added Instant Bank Pay by leveraging open banking features that allows you to accept real-time payments.

This makes it ideal for businesses already relying on subscription or invoice-based billing, who want to expand without switching platforms. With integrations across CRMs, accounting tools, and billing platforms, GoCardless streamlines both customer payments and backend reconciliation. It’s particularly popular in sectors like SaaS, education, professional services, and utilities.

Conclusion

The Worldpay acquisition may be the right time to rethink your payment setup, especially if you’re looking for alternatives in the UK with lower fees, faster access to funds, and more flexibility. Whether you need a modern, card-free solution like Atoa, the development power of Stripe, or an all-in-one POS like Square, there are now better, smarter options out there.

Each provider in this list brings something different to the table. So, the best choice will depend on your business type, growth plans, and how you prefer to get paid. Either way, moving away from legacy payment providers could be one of the smartest decisions your business makes this year.