Ready to get started?

Easily integrate next-generation payments and financial data into any app. Build powerful products your customers love.

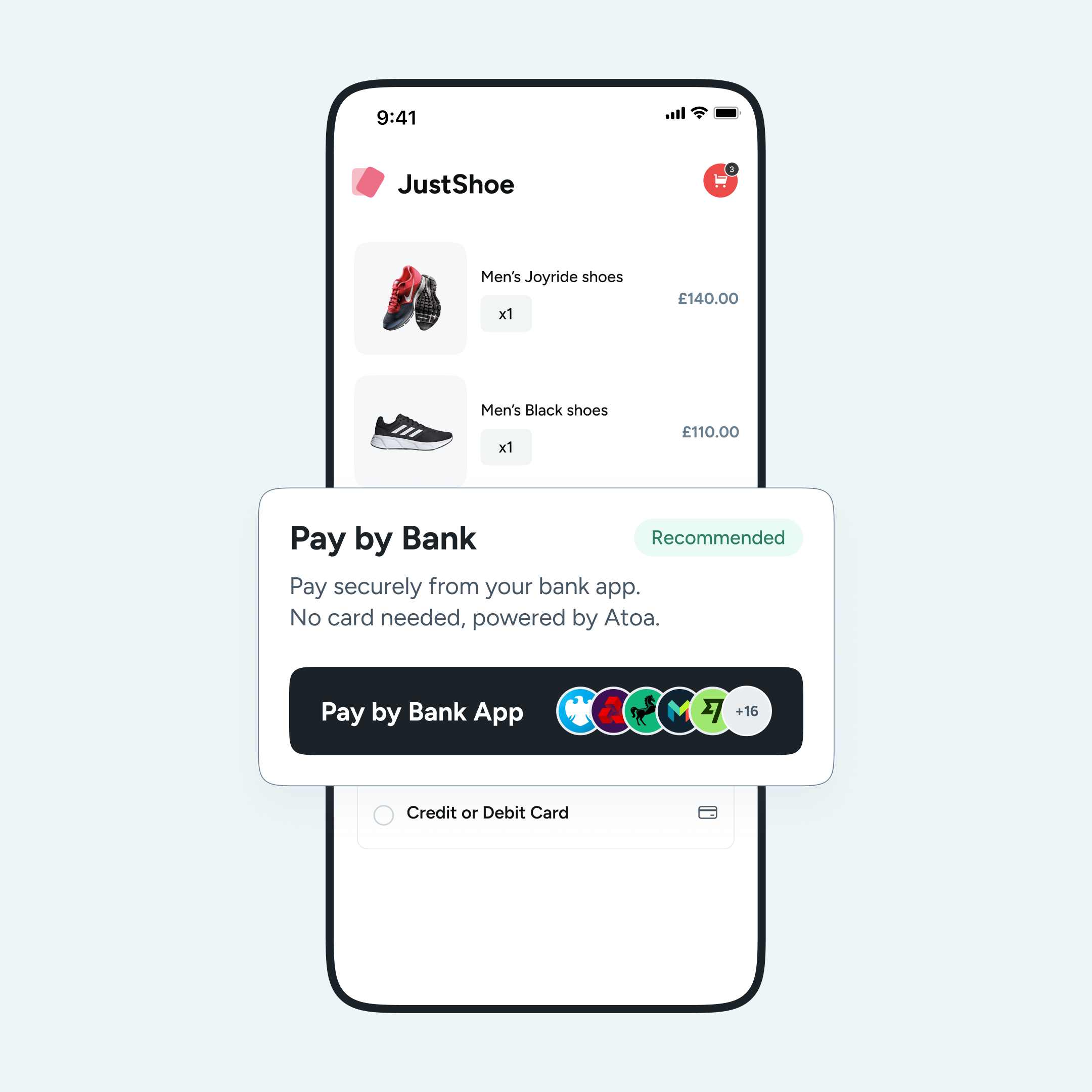

Did you know, in 2023, 45% of all payments made by UK businesses utilised Faster Payments and other remote banking methods? This means, more businesses are saying goodbye to traditional payment methods and choosing to get paid directly through bank accounts instead. It’s called Pay by Bank, and it’s fast becoming the go-to way to take payments. No card machines. No long settlement times. Just quick, secure, bank-to-bank payments that save money and make life easier, for both you and your customers.

So why the switch? Let’s tale a look at five reasons businesses are using Pay by Bank.

1. No card fees = better margins

Every time a customer pays by card, card networks like Visa or Mastercard take a slice. That might not seem like much, but those fees really add up, especially if you’re running on tight margins. Pay by Bank cuts the middlemen out. Payments go straight from your customer’s bank account to yours, meaning lower fees and more money in your pocket.

2. You get your money instantly

With card payments, you often have to wait a day or two to see the funds land in your account. That delay can be frustrating, more so when you’ve got stock to order or wages to cover. Pay by Bank speeds things up. So, the money lands instantly into your bank account. That means better cash flow, less stress, and more control over your business. Plus, getting paid in real time makes a big difference, whether you work in retail, hospitality, or services.

3. It’s safe, really safe

Security is top of mind for both businesses and customers. Pay by Bank is built on open banking, which means:

- Customers never share their card details

- Customers approve payments directly in their banking app

- Every transaction uses Strong Customer Authentication (SCA) like face ID, fingerprint, or passcode protection

And with ISO-certified platforms like Atoa, globally recognised standards for data protection are already baked in. If you’ve ever worried about chargebacks, card fraud, or data breaches, secure bank payments offer peace of mind. Less risk. More trust.

4. Easier for your customers too

People are busy and nobody likes typing out long card numbers at checkout. With Pay by Bank, your customer just:

- Scans a QR code or clicks a payment link

- Chooses their bank

- Approves the payment in their bank app

- Done

There’s no app to download, no logins to remember, and it works just as well on mobile as it does on desktop. In short, it’s as simple as paying with online banking and your customers will thank you for it.

5. Works wherever you do business

Pay by Bank isn’t just for online checkouts. You can also:

- Add a Pay by Bank link to your Xero or QuickBooks invoices

- Let customers pay with their bank account online using a payment link or a QR code

- Use it in-store with a simple printout or tablet display

It’s designed for convenience and needs no complicated integrations, and no special hardware. Whether you’re on the shop floor, sending invoices from your laptop, or taking payments over the phone, it fits right in.

The future is bank-to-bank

As more UK consumers adopt Pay by Bank apps and get used to paying through their banking interface, it’s only natural that businesses follow suit. So, you can expect lower fees, faster payouts, better security, and smoother checkouts.

Try Atoa to skip the card networks and get your money faster. Set it up in just a few minutes. Accept payments the simple, secure way, and directly from your customer’s bank account to yours.

FAQs on Pay by Bank

What is Pay by Bank?

Pay by Bank is a way for customers to pay directly from their bank account using their banking app or online banking. It skips card networks, making payments faster, cheaper, and more secure.

Is Pay by Bank safe to use?

Yes, it’s built on open banking technology and uses your bank’s own secure login and authentication. So, no card details are shared, and all payments are protected by strong customer authentication (SCA).

Do I need special software or hardware to accept Pay by Bank?

No special hardware is needed. With Atoa, you can add Pay by Bank to your invoices, website, or even print a QR code for in-store payments.

How fast will the payment come through?

You get paid instantly. So, no waiting 1–3 days like with traditional card payments. That means better cash flow for your business.