Ready to get started?

Easily integrate next-generation payments and financial data into any app. Build powerful products your customers love.

The checkout counter is changing and fast. In just a few years, UK shoppers have gone from chip-and-PIN to tapping phones, scanning QR codes, and even paying directly through their bank apps. Businesses are taking this tech upgrade in their stride. It’s a total reshaping of how customers want to pay, and how merchants get paid.

So what’s driving this shift, and what payment methods will dominate the UK checkout in 2025–26? Let’s break down the trends reshaping payments and what they mean for businesses.

1. Cards still dominate but the mix is changing

Cards remain the backbone of UK payments, accounting for around 64% of all transactions in 2024 according to UK Finance. Debit cards led the pack, with 26.1 billion payments made, and nearly 19 billion contactless card taps, representing more than 60% of all card payments. But this dominance comes with a caveat. As transaction volumes rise, so do merchant costs and that’s why more businesses are exploring alternatives that reduce reliance on card networks.

2. Mobile and digital wallets take centre stage

In 2025, over half of UK adults (57%) used mobile wallets, marking one of the fastest adoptions of any payment technology. Tap-to-Pay on iOs and Android systems has turned every smartphone into a potential checkout terminal, letting merchants accept payments anywhere — from cafés to car forecourts. For customers, it’s about convenience and security. Biometric authentication (Face ID, fingerprint) removes friction at checkout, while stored loyalty cards and tickets make wallets multifunctional. For merchants, shorter queues and faster throughput mean smoother operations.

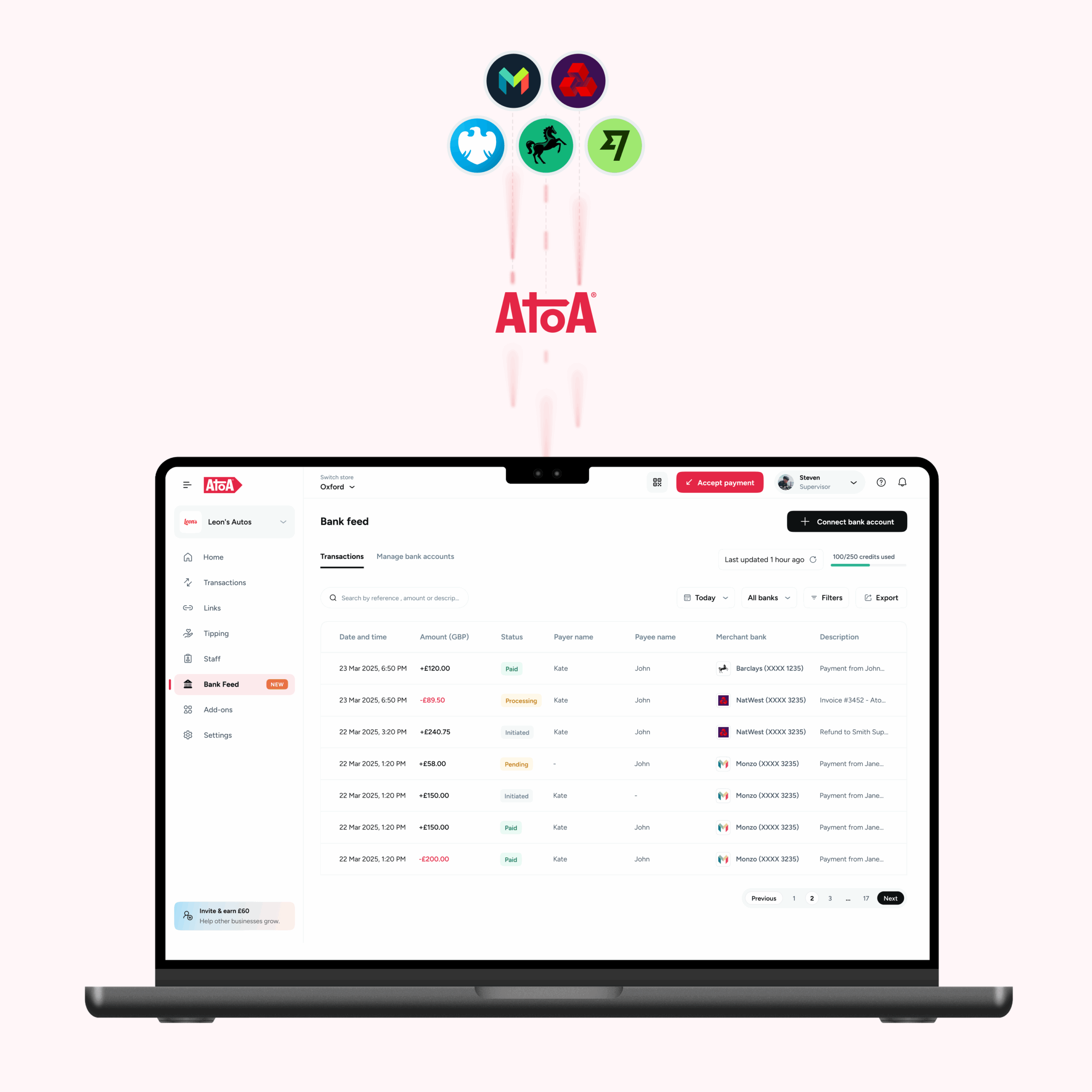

3. The rise of Pay by Bank and open banking payments

If 2024 was the year of contactless maturity, 2025 is the year Pay by Bank goes mainstream. Thanks to open banking, customers can now pay directly from their banking app. No cards, no middlemen, and no waiting days for settlement.

For businesses, the benefits are tangible:

- Lower fees (often saving up to 50% versus card payments)

- Instant settlement and improved cash flow

- No chargebacks or hidden scheme costs

- Bank-level security via face or fingerprint ID

Platforms like Atoa have been at the forefront of this shift, giving UK merchants simple “Pay by Bank” buttons, QR-code checkouts, and smart links that sync seamlessly with tools like Xero and QuickBooks.

Learn more about this growing trend in our article The Real Cost of Open Banking Payments.

4. BNPL matures but use it wisely

Buy Now, Pay Later has moved beyond impulse spending into structured, regulated territory. Use of BNPL among UK adults rose from 14% to 25% in just one year. For merchants, it remains a powerful conversion booster, basket sizes typically increase by 30–50%. But rising regulation means providers and merchants alike must prioritise transparency and affordability.

5. Cash continues its decline

Cash use has dropped below 10% of all UK payments for the first time. While it remains important for certain demographics and rural areas, cash is now more a fallback than a preference. For most consumers, “fast” now means digital, contactless, and app-based.

6. Why this matters for businesses

The shift in the UK payment mix isn’t about replacing one method with another, it’s about choice, speed, and cost-efficiency. Today’s customers expect a checkout that mirrors their lifestyle: frictionless, mobile-first, and secure.

Merchants that adapt early gain an edge in three ways:

- Higher conversion: Customers complete checkout faster when their preferred methods are available.

- Lower costs: Bank-to-bank options like Atoa reduce card fees and settlement delays.

- Better cash flow: Instant settlement means money hits accounts in seconds, not days.

In short, offering flexible payment methods isn’t a nice-to-have anymore, it’s a business necessity.

7. Looking ahead to 2026

Capgemini’s World Payments Report 2026 notes that PayTechs are reshaping merchant services through smarter, faster, and more integrated systems. Yet, 66% of merchants still trust traditional banks most. The opportunity lies in collaboration, where banks, PayTechs, and open-banking platforms work together to redefine checkout. By 2026, two-thirds of UK and European e-commerce transactions are expected to use alternative payment methods (APMs) such as bank transfers, wallets, or BNPL, with cards no longer holding the monopoly.

Conclusion

The UK’s payment mix is evolving faster than ever, from cards and wallets to instant bank payments and embedded Pay by Bank links. For merchants, it’s not about chasing every trend but choosing the methods that make payments faster, cheaper, and more aligned with how customers want to pay. Those who adapt early will find that a modern checkout is more than just about convenience, it’s a competitive advantage.