Ready to get started?

Easily integrate next-generation payments and financial data into any app. Build powerful products your customers love.

Business doesn’t always happen in one place anymore. Your team might be on the move, your customers could be miles away, and payments still need to happen quickly, smoothly, and without extra steps. That’s where payment links come in. They make it easy to collect money without needing a card machine, a face-to-face visit, or a lengthy phone call. Just send a link, get paid, and get on with the day. For businesses that want to simplify how they collect payments without changing how they work, this might be the easiest upgrade you make this year.

The case for remote payments

There’s a reason more businesses are moving away from asking customers to “come in and pay” or read out card details over the phone. Remote payments simplify the process, not just for customers, but for your finance and ops teams too. They reduce delays, cut down on manual errors, and get the money where it needs to be, faster.

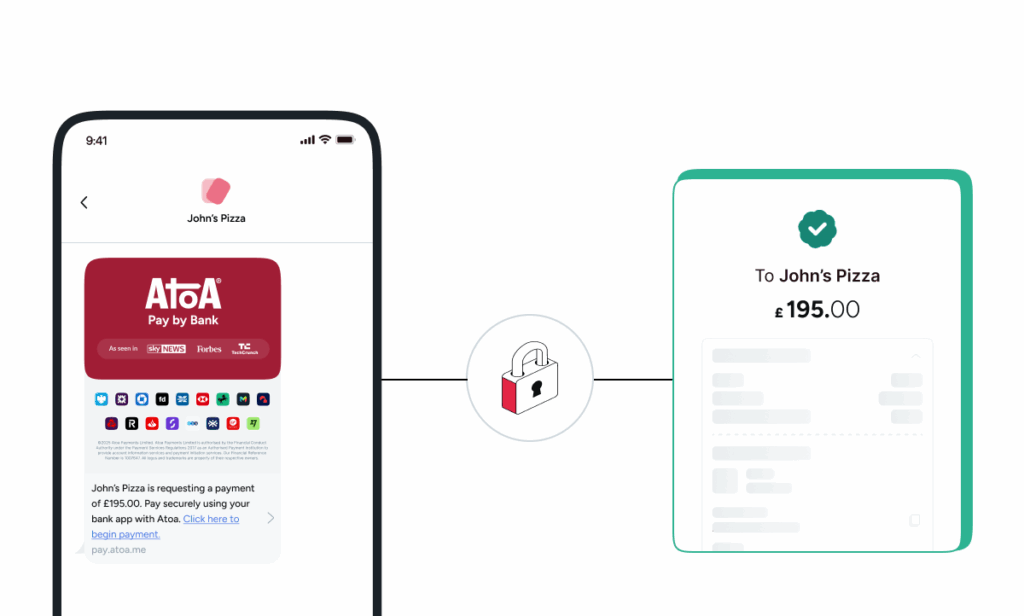

Unlike cash or card payments, payment links facilitate direct account-to-account transfers, moving money straight from your customer’s bank to yours. This not only improves settlement times but also removes the need for middlemen like card networks. It’s a system the UK government is backing too, in its National Payments Vision report (Nov 2024), it called the development of seamless A2A payments “crucial” to the future of UK payments.

With payment links, you can send a deposit link before starting a job, collecting consultation fees post-appointment, or requesting balance payments from clients on the go. It gives you all the flexibility of remote payments, without losing the speed or security of bank-level infrastructure.

What exactly is a payment link?

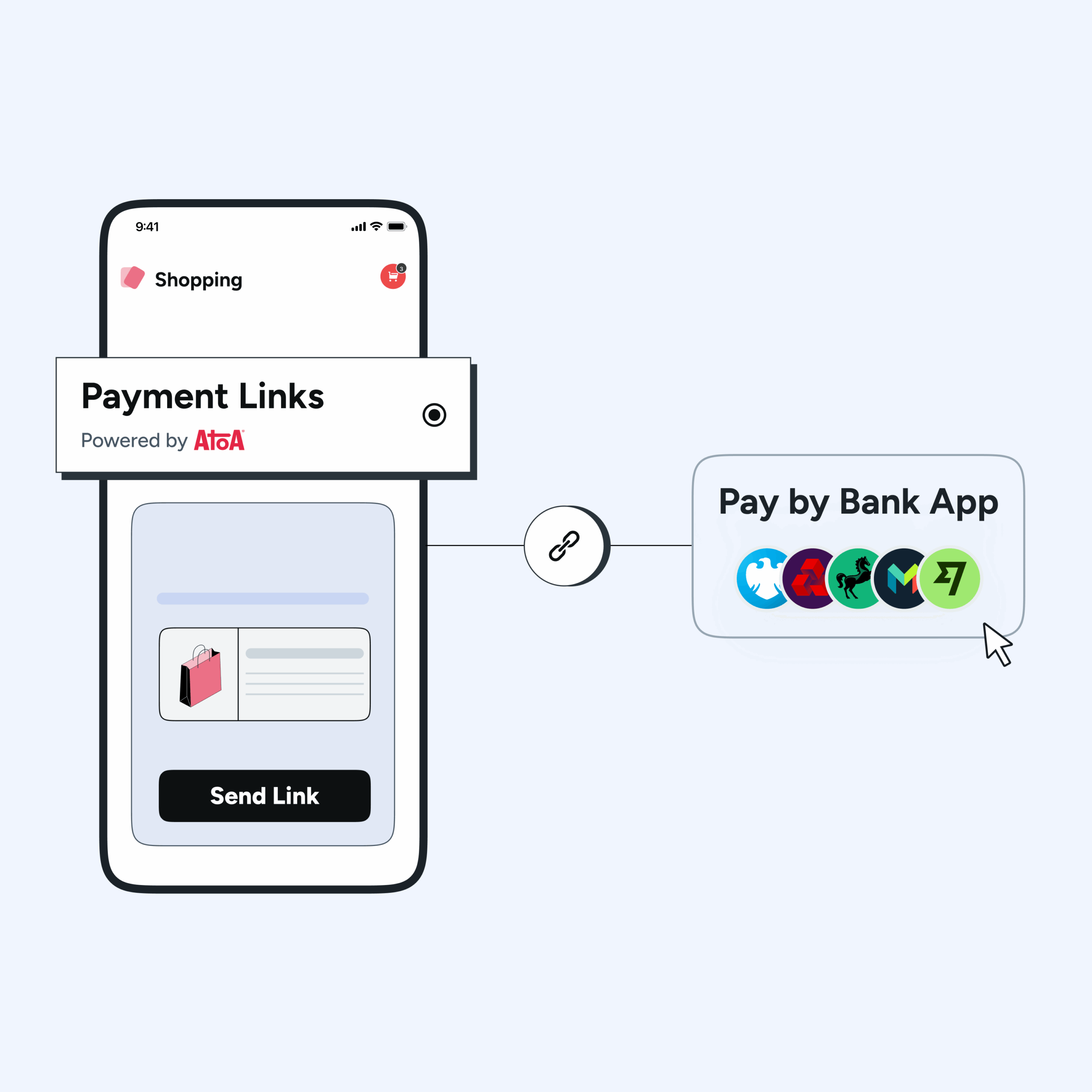

A payment link is a unique URL you can send to customers through text, email, or WhatsApp. When they click it, they’re taken to a secure checkout page where they approve the payment directly from their bank app. That’s it. Unlike clunky hardware or old-school bank transfers, payment links work wherever your customer happens to be. And they’re quick to set up and send out.

Why they work so well

Payment links offer more than just convenience, they make the entire payment process feel effortless for both your business and your customers. Here’s a quick look at why they work so well.

- No terminals, no in-person friction. The link goes out, the payment comes in.

- Reduces chasing. When it’s that easy to pay, you won’t need to follow up as often.

- Fast settlement. Some providers let you receive funds instantly, improving your cash flow.

- Great for customer experience. Mobile-friendly, no app to install, and payments are confirmed in real time.

- Works with your existing tools. Add them to invoices, booking confirmations, emails, whatever you already use.

Types of payment links

Payment links can be tailored to fit one-off jobs, repeat services, or even walk-in transactions, no matter where your customers are or how they prefer to pay. Here’s a breakdown to help you find what fits best.

One-time links: A single-use link for a particular job, quote, or invoice. Perfect for made-to-order services or ad hoc jobs.

Reusable links: A standard link used for fixed-price items or services. Great for things like classes, consultations, or repeatable offers.

Invoice-embedded links: Auto-generated when you send an invoice via tools like Xero, QuickBooks, or similar platforms.

QR-based links: Perfect for printed receipts, countertop displays, or physical spaces where customers can scan and pay on their own.

How businesses are using them

Here’s how different sectors are putting them to work, without changing how they already operate.

- Health and wellness: Send links after an appointment or let patients pay ahead.

- Legal services: Collect retainers without back-and-forths or cheques.

- Home services: Collect deposits before dispatching a technician or starting work.

- B2B and wholesale: Send links for balance payments or regular orders without the need for typing in bank details.

Getting started is easy

You don’t need to replace your systems. Start by setting up an account with a provider that supports online payment links. From there, generate your first link and share it through your usual customer channels like email, text, or even in a PDF. Some teams start by using links for late payments or off-site jobs. Others go all in and make them part of their standard checkout experience. However you choose to begin, the flexibility is there.

Final thoughts

In a world where fewer people carry cards or cash, and even fewer want to wait around to pay, payment links meet your customers where they are. They help you get paid faster, reduce admin headaches, and modernise how you run your business. Remote payments aren’t just for online stores anymore. With payment links, any business can offer a faster, simpler way to get paid.