Ready to get started?

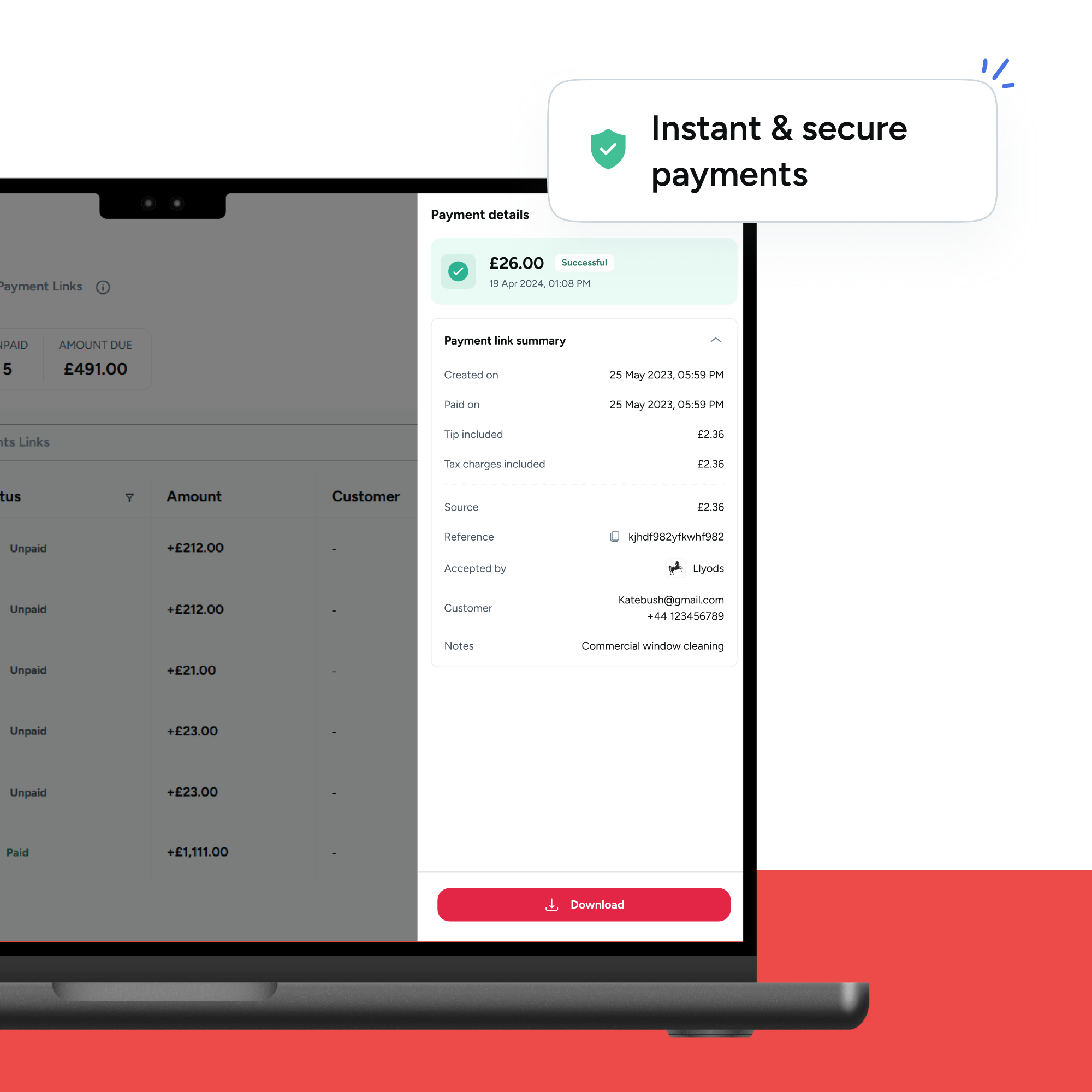

Easily integrate next-generation payments and financial data into any app. Build powerful products your customers love.

Ever wondered how your payment details stay safe when you make online transactions? That’s where tokenisation comes in. It’s not just another security measure—it’s the industry standard that keeps transactions secure, whether you’re tapping your card, paying with your phone, or checking out online.

While it may not be a buzzword, tokenisation is one of the most effective ways to secure payments, reduce compliance headaches, and build customer trust.

But how does it actually work, and why is it so important in payments? Let’s break it down.

What is tokenisation?

Tokenisation is a security technique that replaces sensitive data—such as credit card numbers or personal details—with a unique token. This token acts as a stand-in for the original data, which is securely stored in a separate, protected location.

The same principle applies to tokenisation. Even if hackers get hold of the token, they can’t do anything with it because it has no real value outside of the secure system that links it to the original data.

How does tokenisation work?

When a customer makes a payment, tokenisation kicks in automatically behind the scenes:

- A customer enters their payment details (e.g., credit card number) at checkout.

- A unique token is generated, replacing the actual card number.

- The real card details are securely stored in a token vault—a protected database designed to keep sensitive information safe.

- The token is used for transactions instead of the real payment details, ensuring security without disrupting the payment process.

- If needed, authorised systems can access the original data, but only through a highly secure process called detokenisation.

For customers, nothing changes—they still pay as usual. But for businesses, tokenisation significantly reduces the risk of data breaches.

What role does tokenisation play in your business?

If you process payments, tokenisation isn’t just a nice-to-have—it’s a must. Here’s why:

✔️ Keeps customer data safe: If cybercriminals breach your system, all they’ll find are useless tokens, not actual card numbers. This drastically reduces the risk of fraud and data theft.

✔️ Reduces PCI Compliance Burden: PCI DSS (Payment Card Industry Data Security Standard) requires businesses to protect customer card details. Since tokenised data isn’t considered sensitive, your compliance requirements are much simpler.

✔️ Increases customer trust: Shoppers are becoming more security-conscious. When they know your business takes payment security seriously, they’re more likely to trust you with their transactions.

✔️ Minimises data breach damage: Unlike encryption, where a stolen key could expose all the data, tokenisation eliminates this risk—because there’s nothing valuable to steal.

✔️ Improves system performance – Unlike encryption, which requires complex computations, tokenisation is lightweight and faster. This means smoother transactions, even at high volumes.

Bottom line

Every business wants to keep customer data safe, but not every business realises how easy it can be. Tokenisation is a simple, effective, and future-proof way to secure payments, protect customer trust, and avoid compliance headaches.

As cyber threats continue to rise, businesses that fail to protect customer data risk losing not just money, but also their reputation. The good news? Tokenisation makes payment security effortless.

FAQs

How does tokenisation enhance payment security?

It replaces sensitive payment data with a meaningless token, so even if hackers access your system, they can’t use the stolen data. This drastically reduces fraud risk.

Is tokenisation the same as encryption?

No, they are different. Encryption scrambles data into a code, which can be decrypted with a key. Tokenisation completely removes sensitive data, replacing it with an unbreakable token.

Can it protect data beyond payment information?

Yes! It’s widely used to protect sensitive data like personal identification numbers (PINs), health records, and even email addresses.

Does tokenisation slow down transactions?

Not at all! It’s actually faster than encryption because it doesn’t require complex mathematical transformations.

How does tokenisation help with PCI DSS compliance?

Since tokenised data isn’t considered sensitive, businesses don’t have to meet the same strict PCI requirements—making compliance easier and reducing costs.