Ready to get started?

Easily integrate next-generation payments and financial data into any app. Build powerful products your customers love.

How do you get paid when you don’t want to pay high card fees? What happens when customers want to pay remotely? And which pay by link solutions in the UK give you the best value for money?

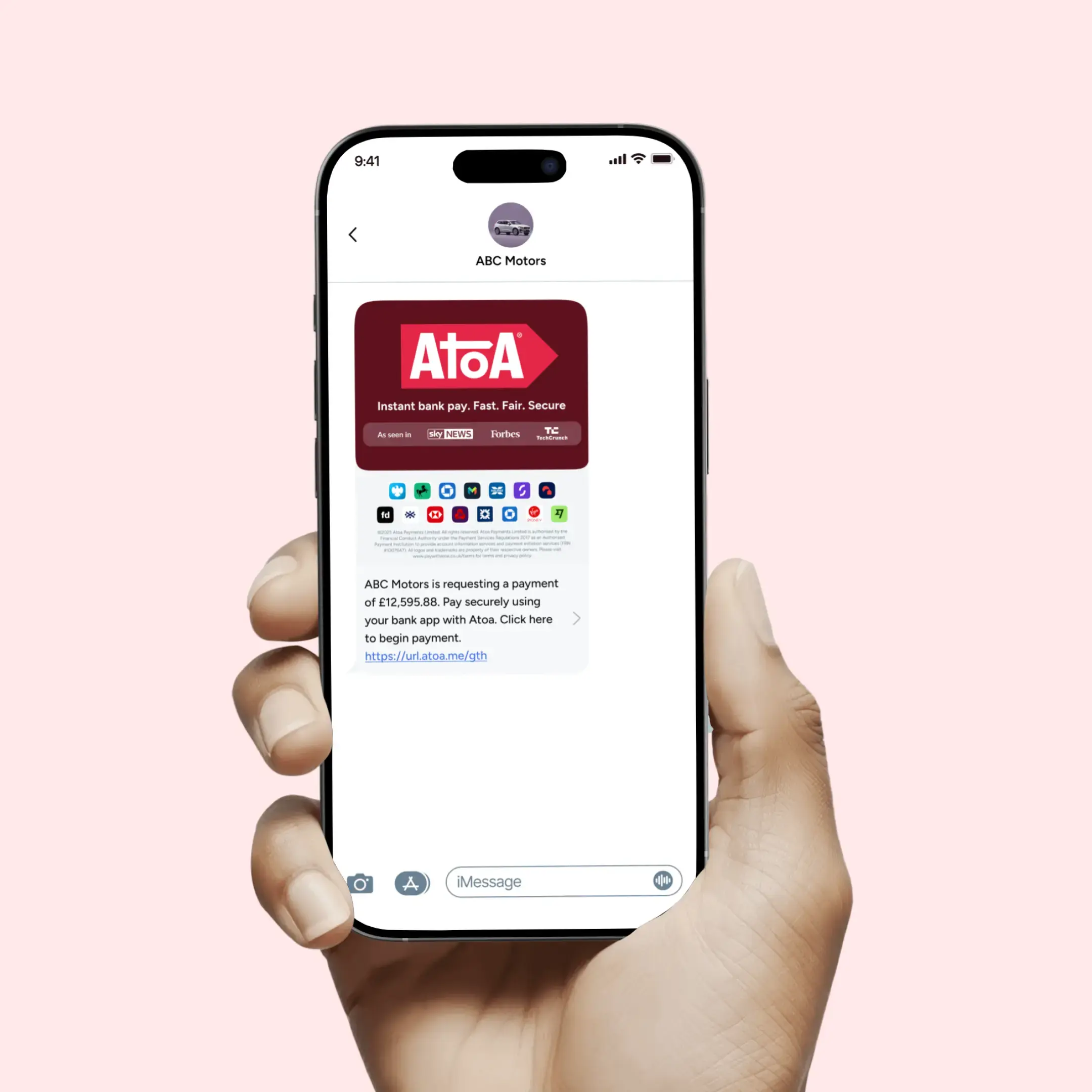

These are questions many UK businesses are asking right now. As payments become more digital and customers expect convenience everywhere, pay by link (or SMS Pay) has emerged as one of the simplest and most flexible ways to accept payments. A link can be shared via email, SMS, WhatsApp, or even social media, and with a single click, your customer completes the transaction securely. But not all providers are equal. Some come with steep fees, others are built for enterprises rather than SMEs, and a few are introducing new ways to cut costs altogether. Let’s break down the leading options for UK businesses and see which one makes the most sense for you.

What makes a good Pay by Link solution?

The best solutions balance three things: simplicity, cost, and trust. From a business perspective, a pay by link service should be easy for staff to generate and simple for customers to use. Pricing should be transparent, with no unexpected extras creeping into the bill. And, crucially, funds should settle quickly, waiting several days to access your own money is a major drawback. Add in security features like Strong Customer Authentication (SCA), plus the ability to integrate with tools you already use (e.g. Shopify or Xero), and you’ve got the right foundations for a solution that saves time and money.

The top Pay by Link options in the UK

Here’s how some of the best-known providers compare:

| Provider | Typical fees | Settlement speed | Pros | Cons |

|---|---|---|---|---|

Atoa | Up to 50% cheaper than cards fees | Instant settlement | Transparent pricing, no chargebacks, open banking APIs, partial payments | UK-only |

Square | 1.4% + 25p per transaction | Next day | No monthly fee, easy to use | Fees add up at higher volumes |

PayPal | 2.9% + 30p per transaction | 1–2 days | Familiar to customers, global reach | Expensive, disputes often favour buyers |

Stripe | 1.2% – 5% + 20p | 2–7 days | Developer-friendly, flexible | Complex setup, similar to card fees |

TrueLayer | Monthly fee + per-use charges, custom for high volume businesses | Instant / same day | Strong open banking APIs, reliable | Better fit for tech-savvy businesses |

Where Atoa stands out

While traditional pay by link solutions run through card networks, Atoa Pay by Bank works differently. It’s powered by open banking technology, which allows customers to pay directly from their bank account. That means:

- Lower costs: Businesses save up to 50% compared to card fees, with no hidden extras.

- Faster cash flow: Payments settle instantly, not in days.

- More flexibility: Atoa links can even support partial payments, so a customer who can’t pay in full right away doesn’t slip away as a lost sale.

And beyond pay by link, Atoa also offers Payment Pages: reusable links or QR code links where multiple customers can pay at once. Every transaction updates in real time, making it easier to track income without manual reconciliation. Try out the demo below to see how payment links from Atoa work.

Which Pay by Link solution is right for you?

There isn’t a single answer for every business. A small retailer may find Square or PayPal appealing for their familiarity and ease of setup, though higher fees can eat into margins. Stripe and TrueLayer are well-suited to more technical businesses that need flexibility and integration. But for UK merchants focused squarely on reducing costs and improving cash flow, Atoa’s Pay by Link solutions are emerging as the strongest alternative, combining the convenience of link-based payments with the savings of open banking.

Takeaway

Pay by link has gone from a nice-to-have to an essential tool for UK businesses. It gives customers the convenience they want and helps businesses get paid faster. But while the big names still dominate, their fees often eat into revenue more than necessary. That’s why newer solutions like Atoa’s Pay by Bank are worth serious consideration. By combining cost savings, instant settlement, and features like partial payments and payment pages, Atoa makes it easier for businesses to stay on top of their cash flow without overpaying on fees.

The bottom line: whichever provider you choose, the cheapest pay by link solution is the one that works for your customers, protects your margins, and keeps your cash flow moving.