Ready to get started?

Easily integrate next-generation payments and financial data into any app. Build powerful products your customers love.

For as long as there have been shops, one thing has never changed: the customer is king. Every innovation in commerce, from catalogues to online stores, has been about making life easier for the buyer. Payments are no exception. With the rise of flexible payments, customers now expect the freedom to pay however they like, whether that’s tapping their bank app, scanning a QR code, or clicking a link in an SMS.

But here’s the twist: with new technology, it’s not just customers who benefit. Businesses do too. Flexible payments don’t just remove friction at checkout, they cut costs, improve cash flow, and give merchants more ways to connect with their customers. Payments are no longer just the final step of a transaction; they’ve become a powerful tool for growth.

What do we mean by flexible payments?

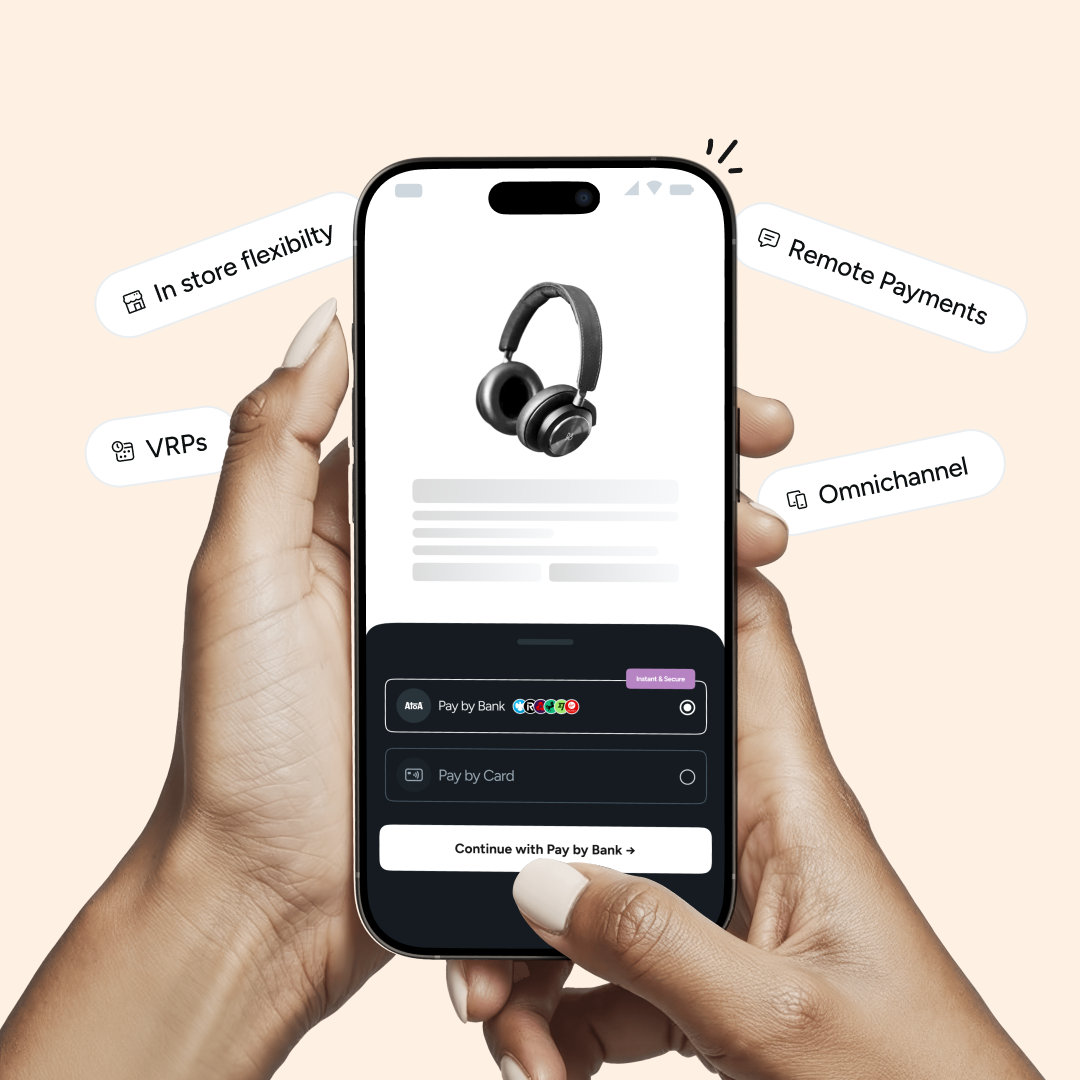

“Flexible payments” isn’t about offering a dozen random methods. It’s about giving customers the right option at the right time, wherever they are. That could mean:

- In-store flexibility: Tap to pay, Pay by Bank, QR codes, or even instant refunds.

- Remote payments: SMS Pay, payment links, or branded payment pages.

- Recurring models: Subscriptions or Variable Recurring Payments (VRPs) that allow amounts to change within agreed limits.

- Omnichannel options: Keeping the payment experience consistent whether a customer is on their phone, laptop, or standing at a till.

The goal is simple: remove barriers. If paying feels easy, customers are far more likely to complete a purchase.

Why flexible payments matter to businesses

The benefits go well beyond customer satisfaction:

- Higher conversions: A smooth checkout with the right options reduces abandoned sales.

- Stronger cash flow: Instant bank-to-bank transfers mean money arrives in seconds, not days.

- Lower costs: Pay by Bank avoids card network fees, saving up to 50% in processing charges.

- Increased trust: Customers feel safer when they can pay in ways they already trust, especially in their own bank app.

In other words, flexible payments don’t just please your customers, they directly improve your bottom line.

What kind of businesses benefit from flexible payments?

Flexible payments aren’t only for eCommerce giants. They’re becoming essential across industries:

- Retail and hospitality: Quick, secure in-store checkouts and QR-based ordering.

- Professional services: Law firms, accountants, and consultants can send payment links through SMS or email to get paid faster without chasing invoices.

- Healthcare and wellness: Clinics, gyms, and studios can combine fixed subscriptions with flexible add-ons.

- Automotive: Car dealerships can take deposits or staged payments remotely, speeding up the sales cycle.

- Marketplaces and platforms: Multiple payment methods help cater to different audiences globally.

If your customers want more than one way to pay, your business can benefit from flexibility.

The technology behind flexible payments

The shift toward flexible payments is being driven by a combination of technology and changing customer behaviour. Open banking has been one of the biggest enablers, making secure account-to-account payments possible and unlocking innovations like Pay by Bank and Variable Recurring Payments (VRPs).

At the same time, the rise of mobile-first behaviour has transformed how customers interact with businesses. Whether scanning a QR code in a café, clicking an SMS link from a service provider, or approving a payment in their banking app, customers now expect to manage payments directly from their phones.

Equally important are the integrations happening behind the scenes. Payment solutions that connect seamlessly with platforms such as Shopify, Xero, or Sage make life easier for businesses by reducing manual reconciliation and cutting down on admin. Instead of treating payments as an isolated step, these integrations ensure transactions flow smoothly into accounting, reporting, and customer management systems. Together, these advancements are redefining what businesses and customers see as “normal” when it comes to paying and getting paid.

The Pay by Bank moment

Lately, many providers have been making noise about Pay by Bank and treating it like the hot new feature in their arsenal. But for Atoa, this isn’t a new headline. It’s something we’ve been delivering to UK businesses for years. This means businesses can meet customers wherever they are, whether that’s paying a bill on their phone, splitting a cost with friends, or settling an invoice instantly. The result? Lower fees, faster payments, no chargebacks, and a checkout experience customers actually enjoy.

The future outlook

The direction is clear: payments will continue to shift towards being faster, cheaper, and more convenient, with customers holding the power to choose how they want to pay. Businesses that adapt will see higher conversions, smoother cash flow, and stronger loyalty.With Atoa, UK merchants don’t have to wait for the future of payments. Flexible, secure, and instant account-to-account payments are already here and helping businesses of all sizes thrive and scale.