Ready to get started?

Easily integrate next-generation payments and financial data into any app. Build powerful products your customers love.

For years, UK businesses have been stuck with card payments that come with high fees, delayed settlements, and the constant risk of chargebacks. Pay by Bank is changing that.

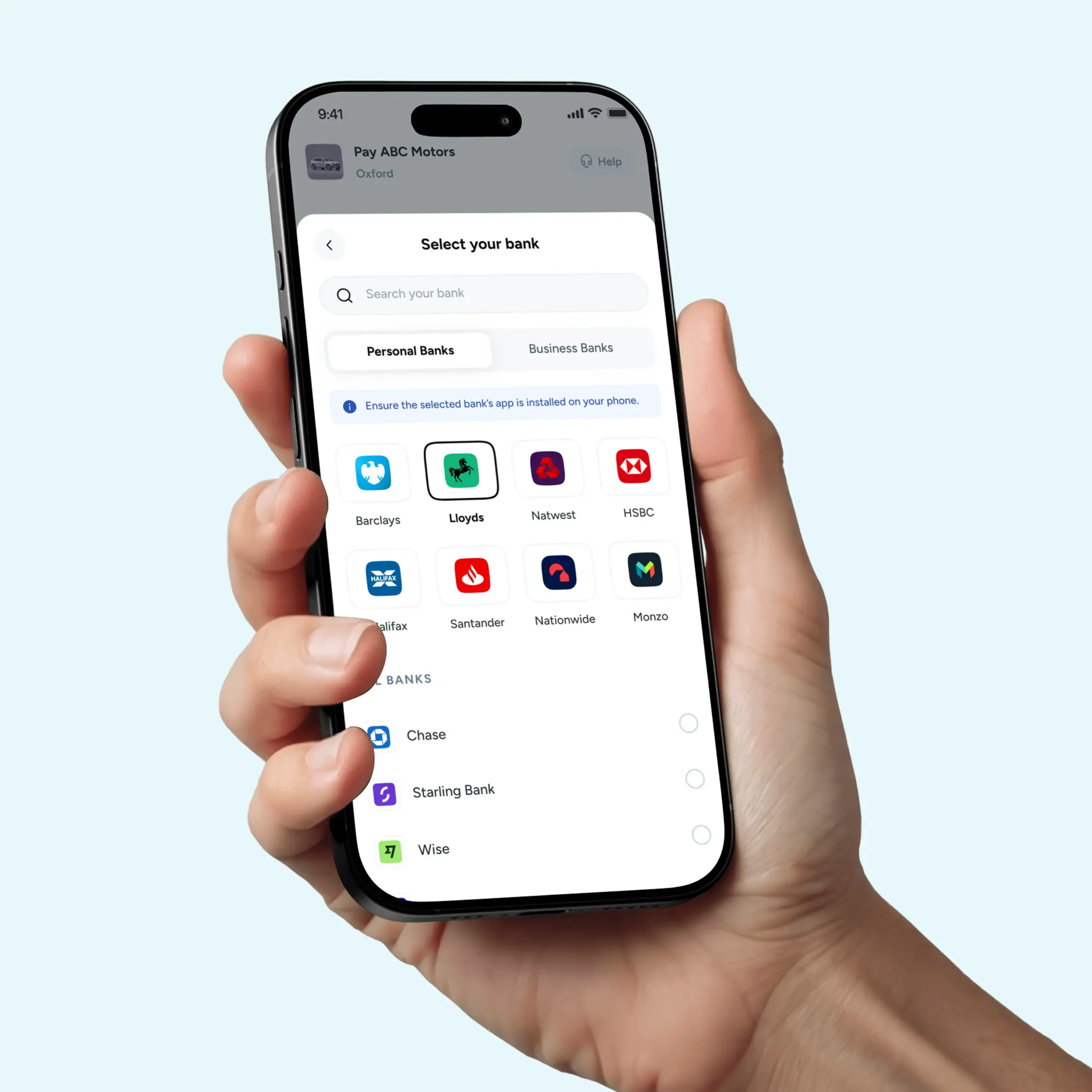

At its core, Pay by Bank is simple: customers pay directly from their bank app to your business account. No cards, no middlemen, no hidden fees. It’s already helping thousands of UK businesses save money and improve cash flow, while giving customers a faster, safer way to pay.

Unlike the card networks, which were designed decades ago, Pay by Bank has been built for businesses in the digital economy. That’s why it’s growing so quickly, and why businesses are adopting it across sectors from retail and travel to healthcare and professional services.

The business reality of Pay by Bank

Where many other sources focus on regulation and payment schemes, we think the bigger story is what Pay by Bank means in practice for businesses. Here’s how it changes day-to-day operations:

- Lower costs = higher margins

Businesses cut payment fees by up to 50% compared to cards. That’s not just “savings”. It’s more cash to reinvest in growth, staff, and better customer experiences. - Faster access to money

Card payments can take days to settle. With Pay by Bank, funds arrive instantly. For businesses, that’s healthier cash flow and fewer sleepless nights. - Zero chargeback risk

Chargebacks aren’t just a nuisance; they’re expensive and time-consuming. Pay by Bank removes this risk completely, while still protecting customers through secure refunds and bank-level guarantees. Want to learn more about how Pay by Bank removes the risk of chargebacks? - Simple to get started

No complex integrations, no need to rewire your checkout. Most Pay by Bank providers are built to work out of the box. With Atoa, businesses can start collecting Pay by Bank payments in minutes via SMS, QR code, invoice, or ecommerce checkouts.

A clearer alternative to cards

One of the most overlooked benefits of Pay by Bank is transparency. Card schemes bury merchants under interchange fees, scheme fees, and FX charges that are nearly impossible to understand.

Pay by Bank brings clarity. The cost is straightforward, predictable, and fair. That’s why small and mid-sized businesses are embracing it as their default payment option.

Building consumer trust without card baggage

There’s been lots of noise in the industry about “recreating chargebacks” for Pay by Bank. We think differently. Instead of copying outdated card processes, the focus should be on smarter, modern protections that give customers confidence without punishing businesses with extra costs.

For example:

- Bank-level security means customers are already protected if a payment goes wrong.

- Fast refunds are built-in and don’t need card networks to work.

- Disputes can be resolved faster with technology-enabled processes, instead of lengthy, manual chargeback claims.

This approach makes Pay by Bank both safe for consumers and sustainable for businesses.

Why this matters now

The New Payment Architecture and other industry schemes will shape how Pay by Bank evolves nationally. But the reality is businesses don’t have to wait. Thousands of businesses are already using this solution to collect payments today, saving them money, improving cash flow, and removing the risks associated with card payments.

That’s what makes Pay by Bank the clear choice for the future of payments and why Atoa is helping make it a reality for UK businesses right now.

Want to find out more? Book a demo with our team!