Ready to get started?

Easily integrate next-generation payments and financial data into any app. Build powerful products your customers love.

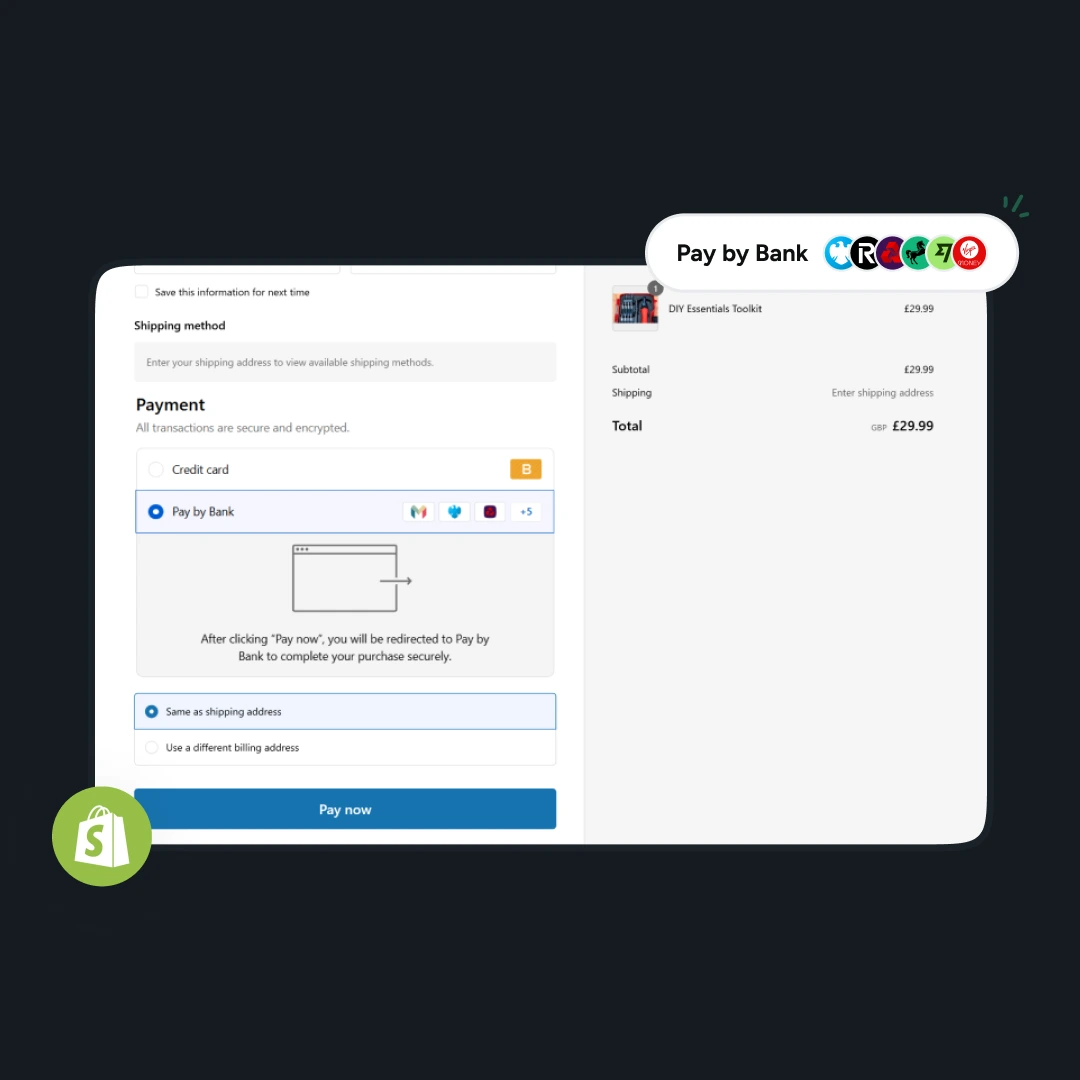

Shopify has become the go-to ecommerce platform for UK businesses looking to sell online quickly and at scale. But one of the biggest pain points for merchants continues to be payments: card processing fees, delays in settlement, and the risk of chargebacks all eat into margins.

That’s where Pay by Bank comes in. By connecting directly to a customer’s banking app, merchants can offer a simpler, lower-cost payment option right inside their Shopify checkout.

How Pay by Bank works in the Shopify checkout

- Customer chooses Pay by Bank at checkout

Alongside card payments and other methods, shoppers see a Pay by Bank button on the checkout page. - Secure bank selection

They pick their bank from a list of major UK banks and are redirected to their mobile banking app or online banking login. - Strong customer authentication

Using biometric security (Face ID, Touch ID), customers approve the payment in just a few quick taps. - Instant settlement

The funds move directly from the customer’s bank account to the merchant’s business account. No card networks, no intermediaries, no waiting days for batch payouts. - Automatic confirmation

Shopify instantly records the payment, marking the order as paid, while the merchant receives the money straight away.

See it in action

Key benefits for Shopify merchants

- Lower costs

Card networks and processors typically charge between 1.5–3% per transaction, plus additional fixed fees for every order. These costs can add up quickly, particularly for Shopify stores with high order volumes or lower-margin products. Pay by Bank removes the card networks entirely, connecting the customer’s bank directly to yours. With fees reduced by up to 50%, merchants retain more of each sale, improving margins without having to raise prices or cut back elsewhere. - Instant cash flow

One of the biggest frustrations with card payments is delayed settlements. This delay slows down your ability to restock, reinvest in ads, or cover operating expenses. With Pay by Bank, settlement is much faster: money arrives in your account within 48 hours. That means merchants can easily convert revenue into working capital, keeping the business moving at the pace of sales. - No chargebacks

Chargebacks are a hidden cost of card acceptance. Every dispute eats up time, resources, and sometimes large sums of money. Since Pay by Bank transactions are authorised directly through the customer’s bank, they cannot be reversed in the same way card payments can. This eliminates the chargeback risk entirely, protecting both your margins and your team’s bandwidth. - Frictionless checkout experience

Shoppers don’t need to find their card, type in numbers, or remember login details. Instead, they approve the payment seamlessly via their bank app, using biometrics like Face ID or fingerprint. This process reduces checkout friction and cart abandonment, while giving customers a secure way to pay that’s already familiar. - Stronger trust signals

Customers are often wary of entering card details into unfamiliar websites. With Pay by Bank, they complete the payment within the bank app they already know and trust. This bank-grade authentication gives customers greater confidence, especially for larger purchases.

Whether you’re looking to cut costs, speed up payouts, or simply give your customers a smoother way to pay, Pay by Bank is worth considering for your Shopify store. With solutions like Atoa, getting set up is quick and you can start saving on fees and boosting cash flow right away.