Ready to get started?

Easily integrate next-generation payments and financial data into any app. Build powerful products your customers love.

Millions already use open banking to make secure payments, manage their finances, or connect apps to their bank accounts. In fact, over 13.3 million open banking payments were made in March 2025 alone, according to Open Banking Limited. But while adoption is growing, it’s not exploding. And for a system that’s been called the future of finance by industry experts and regulators alike, many are asking: why hasn’t it taken off faster?

Here are five key reasons and how we can turn the tide.

1. Lack of awareness and understanding

Many consumers and even some businesses still don’t fully understand what open banking is or how it can benefit them. It’s often confused with data sharing or viewed as risky.

How to fix it: More consumer education is needed, especially from trusted providers and institutions. When people understand that open banking powers services like Pay by Bank, budgeting tools, and instant verification, without sharing login details, they’re more likely to trust and use it.

2. Limited use cases at checkout

While open-banking-powered payments are ideal for many purchases, not every merchant offers them at checkout. And when card payments dominate the experience, open banking can feel like an afterthought.

How to fix it: Make Pay by Bank a clear, visible option, especially for high-ticket items where lower fees and instant settlement make a difference. The more familiar it becomes, the faster adoption will grow.

3. User experience isn’t always smooth

Depending on the bank, open banking journeys can vary. Some users face extra friction like outdated interfaces, multiple logins, or unclear consent screens.

How to fix it: Banks and fintechs need to continue improving their open banking APIs and UI. Brands like Atoa Instant Bank Pay are already leading the way with smoother, app-free checkout journeys that connect users to their bank in seconds, without redirects or confusion. The more seamless the flow, the more likely users are to return.

4. Security concerns and mistrust

Despite payment platforms being built with strong regulations and consent-driven APIs, some users worry about security.

How to fix it: Clear, consistent messaging is key. The more providers reinforce how open banking works and why it’s safer than traditional alternatives, the more trust it will gain.

But is it actually secure?

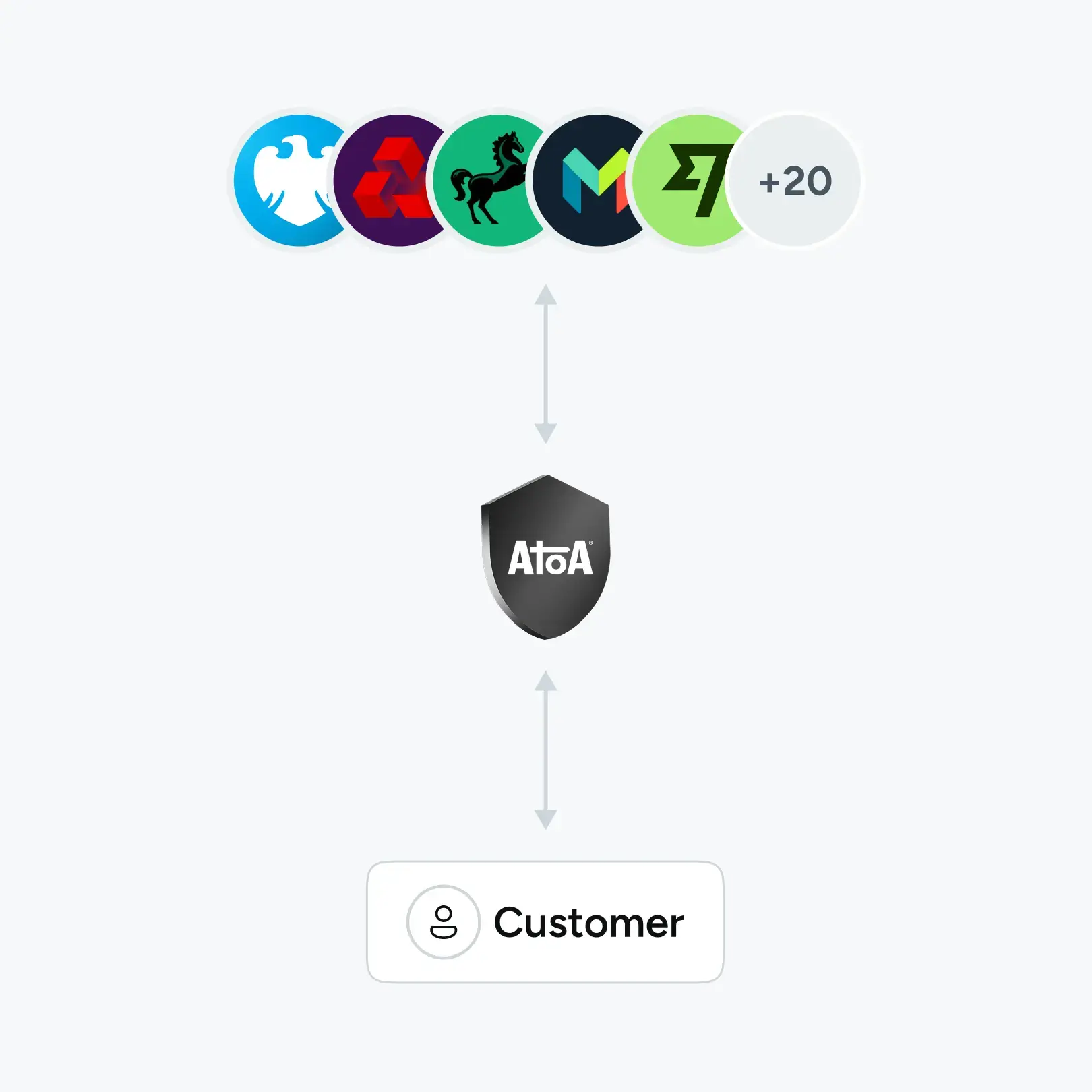

Yes. Open banking powered payment platforms use encrypted APIs, strong customer authentication (SCA), and never share credentials with third parties. They’re regulated by the FCA and designed to be safer than card-on-file or screen scraping.

5. Integration friction for businesses

For larger organisations, introducing a new payment method can feel disruptive, even if it isn’t. Teams worry about process changes, tech requirements, or confusing customers.

How to fix it: Modern providers (like Atoa and others) offer plug-and-play integrations with accounting tools like Xero, QuickBooks, and Sage. So, there’s often no hardware or major overhaul needed. Just a few clicks to start accepting faster, cheaper payments.

Takeaway

Open banking isn’t stuck, it’s simply waiting for its tipping point. But with better education, smoother UX, and visible value at checkout, adoption will accelerate. The infrastructure is maturing, the regulations are tightening, and the use cases are expanding. So, businesses that move early stand to gain the most, from lower transaction fees, real-time settlements, and smoother cash flow. It’s not just a future trend, it’s a practical, competitive advantage available today.