Ready to get started?

Easily integrate next-generation payments and financial data into any app. Build powerful products your customers love.

Running a Shopify store is all about creating a smooth experience for your customers, from browsing to checkout. But behind the scenes, the payment gateway you choose can make or break your margins, cash flow, and customer trust. In 2025, the UK payments landscape looks very different from just a few years ago. While established gateways like Stripe and Shopify Payments remain popular, businesses are now looking at alternatives that reduce fees, speed up settlement, and give them more flexibility. With competition tight and costs rising, the right gateway isn’t just about convenience, it’s about your bottom line.

Here are the five best Shopify payment gateways in 2025, starting with a homegrown UK solution that’s changing the game.

1. Atoa (Pay by Bank)

Best for: UK businesses looking to cut costs and get paid instantly

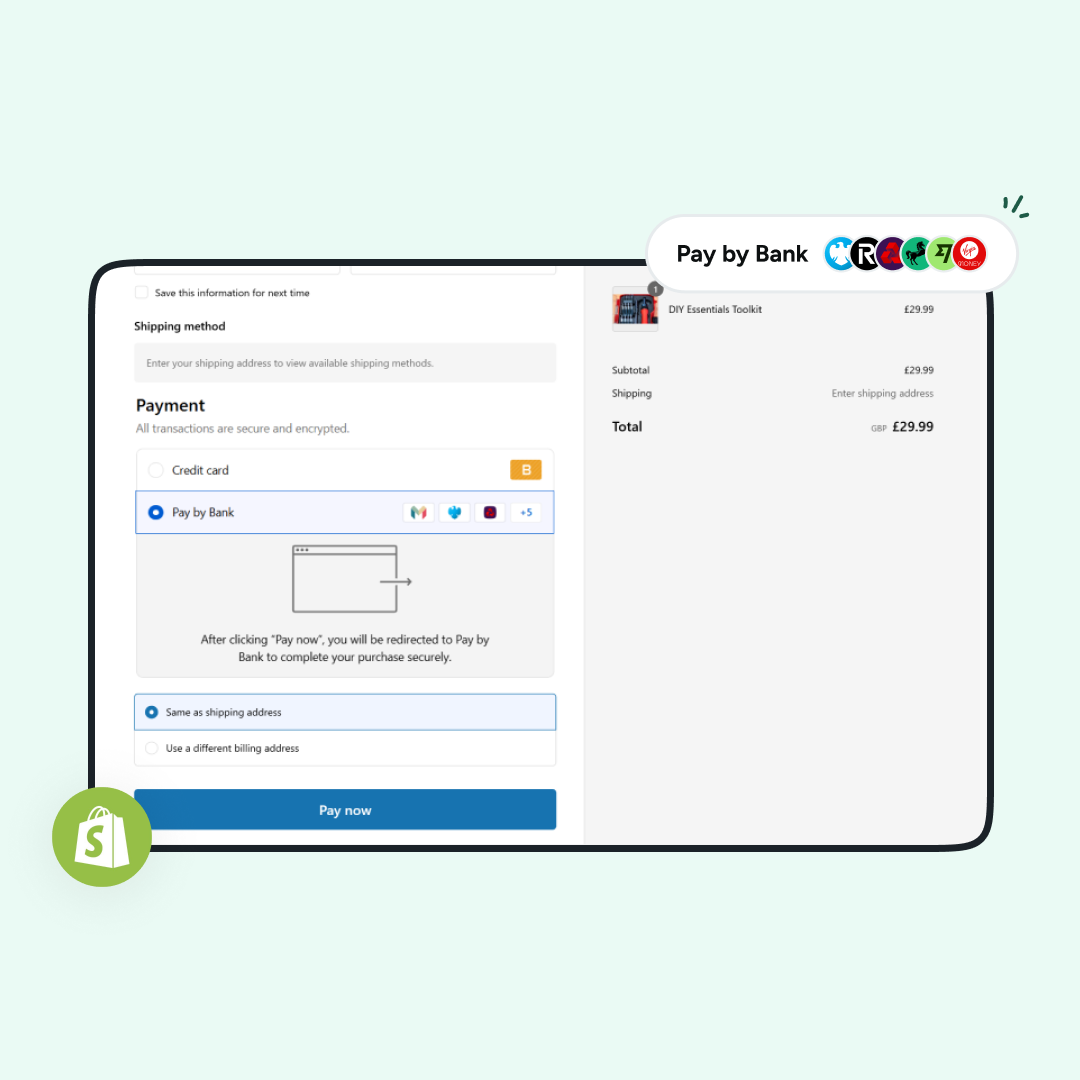

Atoa Payments Limited is a UK-based payment provider built by leveraging open banking technology. Unlike traditional card processors, Atoa allows customers to pay businesses directly from their bank account. As an official Shopify payment partner, it only takes a few clicks to add Pay by Bank to your checkout.

Businesses using Atoa benefit from:

- Lower costs: Businesses save up to 50% compared to card fees.

- Instant settlement: Payments land in your account within seconds.

- No chargebacks: Funds move securely account-to-account with bank-grade authentication.

- Simple checkout: Customers authorise payments in their banking app with fingerprint or face ID.

Atoa is also fully authorised by the UK Financial Conduct Authority (FCA) to operate as an Authorised Payment Institution (API), marking a major milestone in its rapid expansion. On top of that, the company has achieved ISO 27001 certification, the globally recognised standard for information security management, underscoring its commitment to keeping customer data secure and compliant.

For businesses, Atoa integrates seamlessly with leading accounting tools like Xero, QuickBooks, and Sage for easier reconciliation. For UK merchants focused on protecting margins and improving cash flow, Atoa offers a modern, regulated, and secure alternative to cards that’s quickly becoming a go-to choice. Check out how Atoa Pay by Bank works in Shopify below.

2. Shopify payments

Best for: Simplicity and built-in Shopify integration

Shopify payments remains the default choice for many merchants because it’s fully integrated into the platform. There are no extra fees for using it (unlike third-party gateways where Shopify charges up to 2% per transaction), and it supports digital wallets like Apple Pay and Google Pay.

UK fees typically sit around 1.4% + 30p for domestic cards and 2.9% + 30p for international cards. While convenient, these fees add up quickly for high-volume businesses. Still, if you want something simple that just works without much setup, Shopify Payments is hard to beat.

3. Stripe

Best for: International stores with technical resources

Stripe is one of the most widely used payment gateways and integrates well with Shopify, but its real strength lies in serving businesses with global ambitions. It offers tools for subscription billing, and gives developers flexibility to customise checkout.

That said, setup can feel technical, support is heavily geared towards developers, and settlement can take 2–7 days depending on the region. Pricing in the UK typically starts at 2.9% + 30p per online card transaction, with extra costs for international cards or currency conversion, which can add up quickly for high-volume merchants. Stripe works best for businesses planning to expand overseas or that need advanced customisation.

4. Checkout.com

Best for: Digital-first enterprises and fast-growing platforms

Checkout.com is a global payment gateway and acquirer that manages the entire payment lifecycle from a unified tech stack. It caters especially well to digital-native businesses, marketplaces, and fintech firms that require international reach and sophisticated fraud protection.

Checkout builds much of its own technology, which gives it tighter control over payment flows, fast authorisation, and flexible payment methods (including wallets and local payment options). Its AI-powered “Intelligent Acceptance” tool, for example, uses real-time data to optimise acceptance rates and reduce declines across complex markets.

Checkout.com carries complexity, both in integration and pricing. Their flat-rate or Interchange++ fees depend heavily on your business’ risk profile, transaction volume, and markets. For UK merchants in 2023, their two UK-registered entities recorded combined losses of about $306 million, reflecting a challenging path to profitability and a business model focused on expansion and investment.

Checkout.com is best for high-growth businesses with international ambitions and in-house technical expertise.

5. Adyen

Best for: Large online businesses with global reach

Adyen is a well-known global payment gateway and designed to scale with large businesses. It offers strong omnichannel support, meaning you can take payments online, in-app, or in-store through a single integration. Key strengths include a wide range of supported payment methods, recurring payment options for subscriptions, AI-powered fraud detection, and detailed reporting dashboards.

However, Adyen is less suited to smaller businesses. Its pricing model is more complex than other providers, with costs depending on the customer’s issuing bank (ranging from around 3% to 12% plus 13p). Customisation options can also feel limited compared to developer-heavy gateways like Stripe.

Comparison: 5 Best Shopify Payment Gateways in 2025

| Provider | Best for | Key strengths | Considerations |

|---|---|---|---|

Atoa (Pay by Bank) | UK businesses looking to cut costs and get paid instantly | – Save up to 50% vs. card fees – Instant settlement to your bank – No chargebacks, bank-grade security – Smooth checkout in banking app – Integrates with Xero, QuickBooks, Sage | UK-only focus (not global), but designed specifically to maximise savings and security for UK merchants |

Shopify Payments | Simplicity and built-in Shopify integration | – Fully integrated with Shopify – Supports wallets (Apple Pay, Google Pay) – Avoids Shopify’s 2% third-party fee | Fees add up quickly (1.4% + 30p UK / 2.9% + 30p international), not the cheapest for high-volume merchants |

Stripe | International stores with technical resources | – Subscription billing tools – Highly customisable for developers – Strong fraud protection | Setup can be technical Settlement takes 2–7 days UK pricing ~2.9% + 30p, plus extras for international/ currency conversion |

Checkout.com | Digital-first enterprises and fast-growing platforms | – Full-stack platform (gateway + processor + acquirer) – AI-powered fraud prevention – Supports wallets and local methods | Pricing complex (flat rate or Interchange++) Best for enterprise scale, not smaller UK merchants |

Adyen | Large online businesses with global reach | – Omnichannel support (online, app, in-store) – Wide range of local & global methods – Subscription & recurring billing – AI fraud detection + advanced reporting | Pricing complex, 3–12% + 13p depending on issuer Better suited to enterprises |

Final thoughts

Choosing a payment gateway for Shopify isn’t just about ticking a setup box, it directly impacts your margins, cash flow, and customer experience. Enterprise players like Stripe, Checkout.com, and Adyen bring powerful features for global operations, while Shopify Payments offers simplicity for smaller stores. But for UK merchants who want to reduce fees, avoid chargebacks, and get paid instantly, Atoa’s Pay by Bank stands out as the most cost-effective and future-ready choice.

The key is to match the gateway to your business goals. If cutting costs and speeding up payments is a priority, Pay by Bank could be the change that makes the biggest difference to your bottom line in 2025.