Ready to get started?

Easily integrate next-generation payments and financial data into any app. Build powerful products your customers love.

Xero remains the darling of UK accountants, but the way invoices actually get paid has quietly had a glow-up in 2025–26. The platform has seen a 51% surge in UK revenue and customer growth, driven by digitisation and Making Tax Digital, meaning more businesses than ever are raising invoices through Xero payments. But while Xero adoption has skyrocketed, the payment side has evolved even faster. Instant bank transfers have stormed the party, traditional card fees are losing their appeal, and finance teams now have smarter, faster, and more cost-effective ways to get paid.

So, with Xero powering a growing share of UK businesses, here are the top five ways invoices are actually being paid today, ranked by their impact on speed, cost, and daily workflow satisfaction.

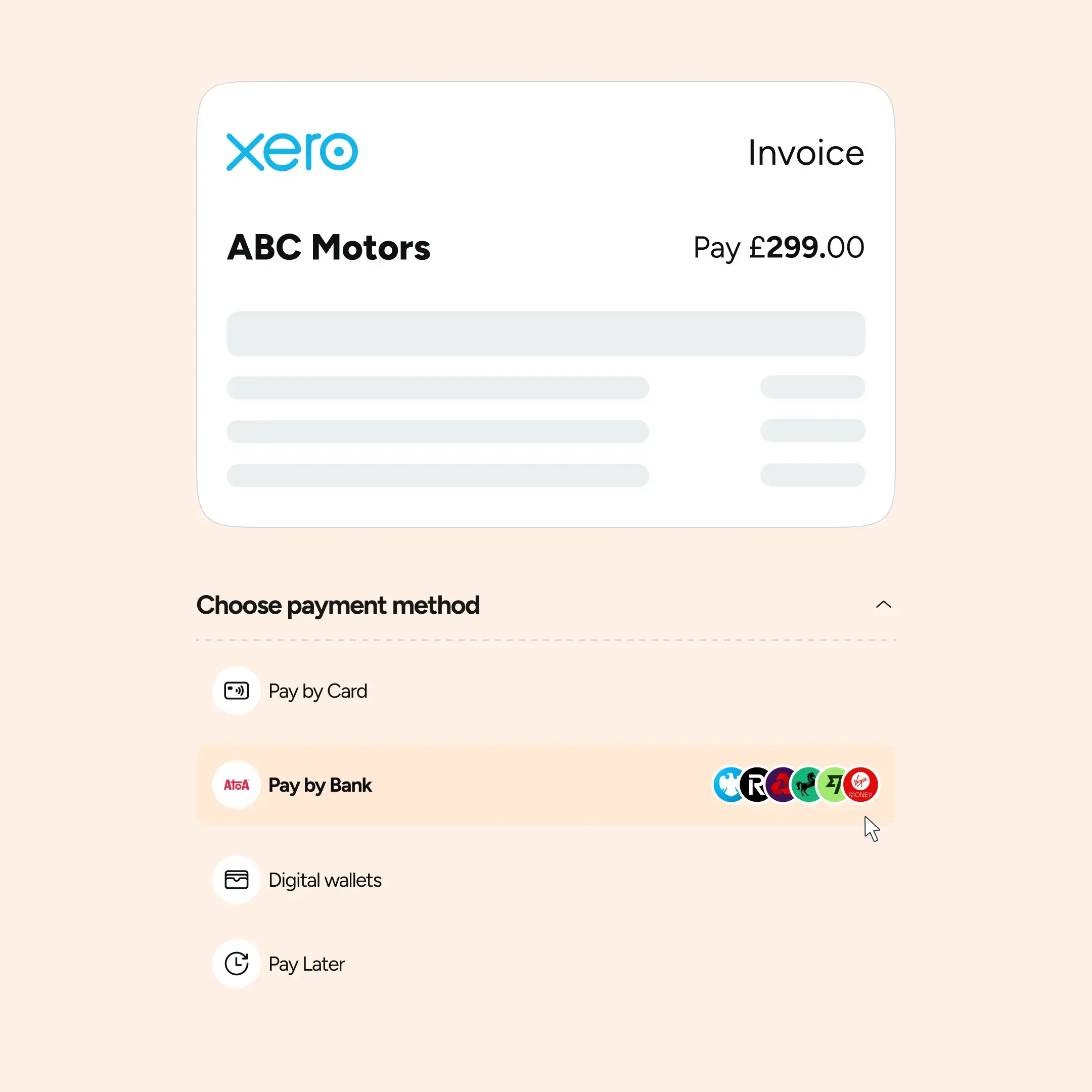

1. Atoa Pay by Bank – The new king

For UK businesses in 2025, Atoa’s Pay by Bank became the go-to choice for invoice payments in Xero and not just because it avoids card fees. Payments are authorised directly through a customer’s bank app which has water-tight security. That means:

- Fewer failed payments

- Zero chargebacks

- Instant cash flow

- Auto-reconciliation

- Fees that don’t take a bite out of the margin

Atoa integrates neatly with Xero invoices, and because it’s powered by open banking rails, settlement lands in seconds, a breath of fresh air for finance teams waiting endlessly for card payouts.

2. Stripe – Still brilliant, just not instant

The classic. Reliable. Universal. Also… slightly expensive. Stripe remains popular because customers instantly recognise card checkout flows. But payouts still take 1–2 working days and fees hover around 1.5% + 20p for UK cards (plus Xero’s own cut). Stripe is solid, battle-tested, and ideal for organisations selling internationally. But when margins matter, cards start to feel like a premium convenience.

3. PayPal – Familiar face, premium price

PayPal is the “old family friend” of online payments. It’s the big blue button – everyone knows it, everyone’s used it, and it works. But fees are steep (around 2.9%+ for UK businesses), and transfers to a bank can feel sluggish. For micro-transactions or small clients, it’s great. For large invoice amounts? Less so.

4. GoCardless – Direct Debit royalty

Direct Debit is the slow-but-steady option. It’s perfect for recurring invoices like retainers or subscriptions. One-off invoices work too, but settlement is next-day at best and fees start at 1% + 20p. The trade-off:

- Settlement in 3–5 working days

- Potential reversals under the DD Guarantee

- No instant cash flow

Still, for predictable billing cycles, it’s a strong choice. The Xero sync is flawless, just don’t expect weekend magic.

5. Manual bank transfers – The grandad of payments

The “no fee” option but with hidden costs. Manual bank transfers drain operational time, introduce reconciliation headaches, and rely on customers entering details perfectly (spoiler: they don’t). Great for large B2B invoices, but rarely the first choice for modern, high-velocity operations.

Top 5 invoice payment options for Xero in the UK

Below is a qualitative comparison table so executives can see the landscape at a glance.

| Payment method | Cost to merchant | Settlement speed | Chargebacks | Customer experience | Best for |

| Atoa – Pay by Bank | Low, fixed fees (no card networks) | Instant or near-instant | None (bank-verified) | Fast, secure, mobile-friendly | Businesses wanting lower fees & fast liquidity |

| Stripe (Cards) | High (1.4%–2.9% + 20–30p) | 2–7 days | Yes | Familiar, widely used | High-volume e-commerce, international buyers |

| PayPal | Higher fees (2.9%+), FX markup | Instant internally / 1–3 days to bank | Yes | Very familiar, great for small buyers | Freelancers, micro-merchants |

| GoCardless (Direct Debit) | Low %, capped | 3–5 days | Yes (DD Guarantee) | Great for recurring plans | Retainers, subscriptions |

| Bank Transfer (Manual) | Free (or low) | Same-day / manual | None | Poor UX; prone to errors | Organisations handling large B2B invoices |

Final word: What this means for UK finance teams

Xero makes invoice payments flexible, but the real business advantage comes from choosing an option that boosts cash flow, protects margins, and reduces admin drama. That’s why so many UK organisations are moving toward Pay by Bank. This payment method gives you instant settlement, predictable fees, no chargebacks, and no card-network friction. And with brands like Atoa offering one of the simplest, fastest setups for Xero, it’s becoming the natural next step for modern finance teams.

If you’re exploring better ways to get paid in Xero, trying Atoa’s Pay by Bank flow is an easy win. It’s quick to set up, simple for payers, and ideal for businesses that want fewer delays and more money landing now, not later.

If you’d like to get started and need help with it then book a demo with our UK-based team at Atoa today