Ready to get started?

Easily integrate next-generation payments and financial data into any app. Build powerful products your customers love.

Late payments are a common frustration for businesses of all sizes. They slow down cash flow, add extra admin, and create awkward conversations with clients. In fact, research shows UK SMEs are owed billions in late invoices every year.

If you’re using Xero to send invoices to your clients, there are some simple steps you can take to cut down on overdue payments and keep money flowing in on time.

1. Set clear payment terms upfront

Vague terms are an open invitation for delays. Make sure every invoice clearly states when payment is due, whether that’s 7, 14, or 30 days. Xero lets you set these defaults so you don’t have to add them manually each time. Clear terms set the right expectation from the start.

2. Use automated invoice reminders

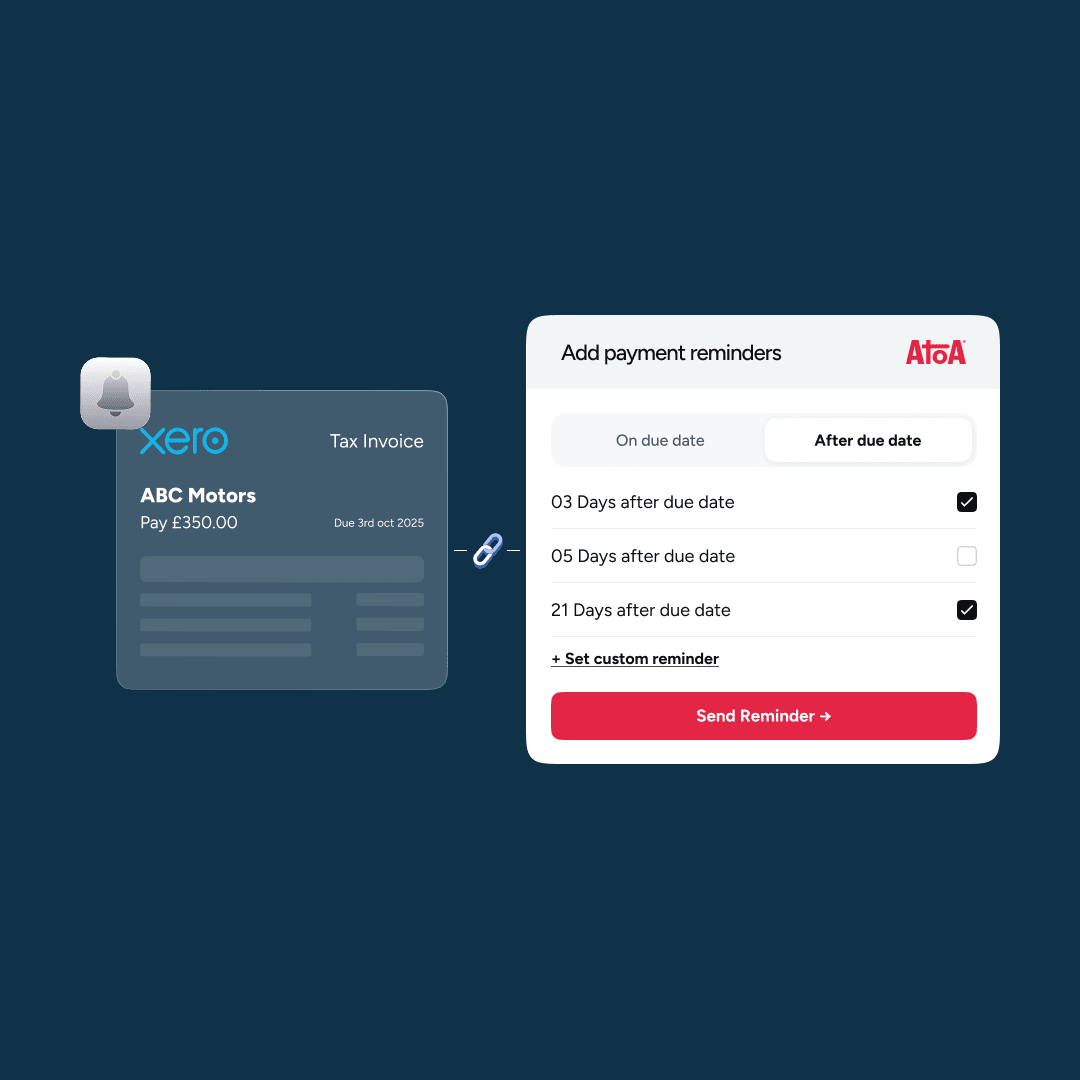

Chasing clients manually isn’t sustainable. Try using tools that provide you with automated reminders. Atoa’s reminder feature does the heavy lifting for you, automatically sending polite nudges after a payment is due. This keeps your cash flow moving and reduces the need for uncomfortable phone calls.

3. Make payments effortless for your clients

The harder it is to pay, the longer customers will put it off. Adding a Pay by Bank option to Xero with Atoa lets clients settle invoices instantly from their banking app. No cards, no manual transfers, no excuses. Just one tap and the invoice is paid. For the businesses using Atoa’s Xero integration, they often see faster payments simply because the process is so frictionless.

4. Reconcile payments quickly

Keeping your books up to date helps you spot late invoices before they become bigger problems. With Atoa’s Xero integration, every payment is automatically matched against its invoice. That means no more wasted hours on manual reconciliation and no risk of missed or misallocated payments.

5. Consider incentives or penalties

Depending on your industry, offering small discounts for early payment, or charging modest late fees, can encourage customers to prioritise your invoices. Whatever you choose, be transparent and consistent so clients know where they stand.

Final thoughts

Reducing late payments doesn’t mean hassling your clients. It’s about setting clear expectations, using automation where possible, and giving customers the easiest possible way to pay.

By combining Xero’s built-in tools with Atoa’s Pay by Bank integration, businesses can:

- Collect more invoices on time

- Save hours of reconciliation and chasing each month

- Maintain healthier, more predictable cash flow

Learn more about how Atoa helps UK businesses get paid faster with Xero or see how it works for yourself in the demo below.