Ready to get started?

Easily integrate next-generation payments and financial data into any app. Build powerful products your customers love.

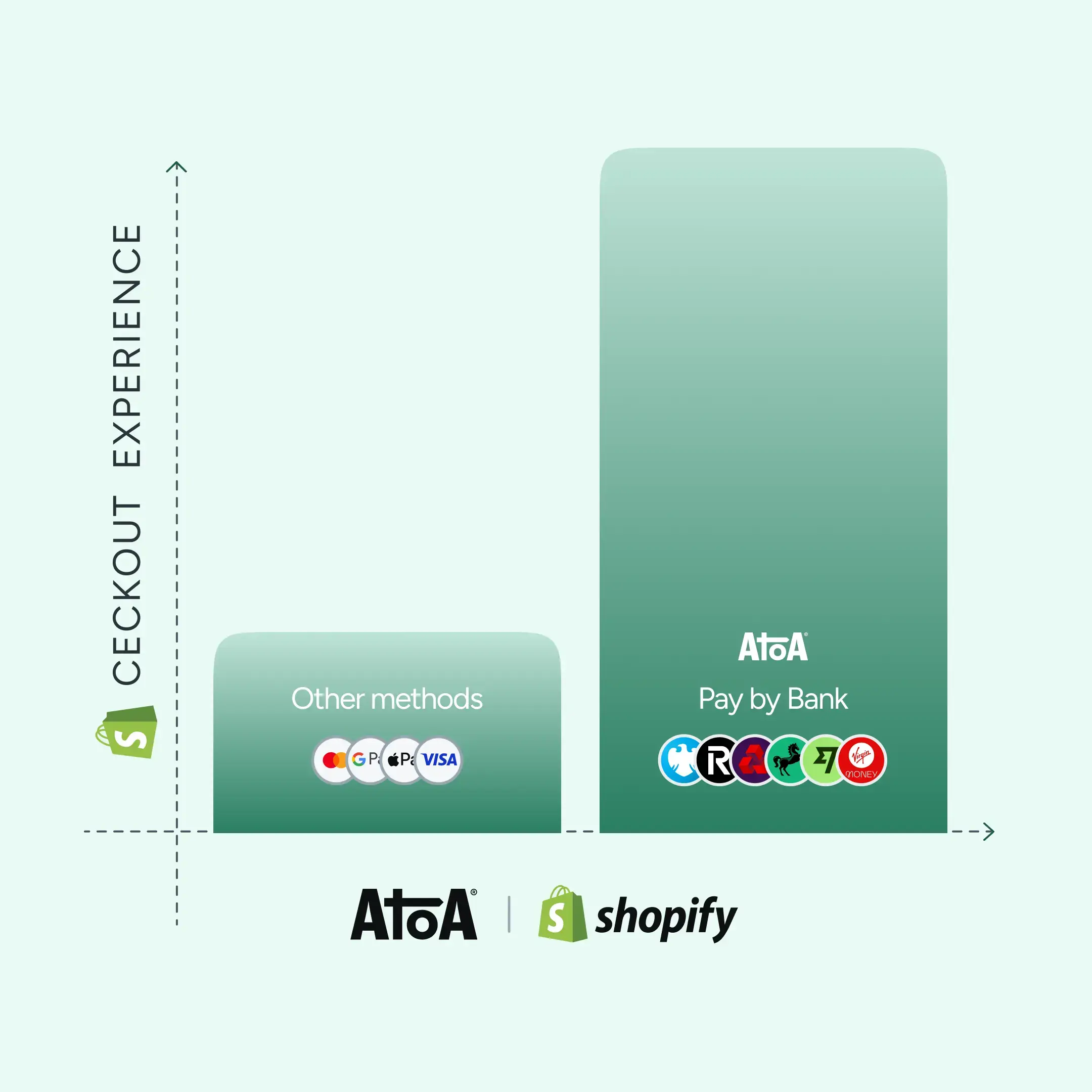

Every checkout tells a story. And it is more than just about a sale. It is also about how smoothly your business runs. When a customer reaches the payment page, it’s your moment of truth: will it be quick, secure, and effortless, or will friction and fees eat into your margins? For UK businesses, open banking payments are quietly rewriting this story. By connecting customers directly to their bank accounts, Pay by Bank payments remove the middlemen, the hidden charges, and the settlement delays that come with cards.

But how is it changing the Shopify checkout experience? Let’s find out.

The checkout friction often overlooked

While cards remain the default payment method, they bring hidden baggage: card-entry fields, failed authorisations, outdated stored cards, chargebacks, and settlement delays. Each little hiccup increases checkout abandonment, drops conversion, or ties up cash flow. On Shopify, where speed and user experience matter, every extra step counts.

Open banking offers a different path: the customer selects “Pay by Bank” as a mode of payment and they’re redirected to their bank’s app to approve the payment, and you get notified immediately. They don’t have to deal with things like putting in their card numbers or card network delays. There are fewer opportunities for error.

What open banking payments adds to Shopify

Let’s break down what this looks like in practice for your Shopify setup in the UK:

- Lower transaction cost potential: Because open banking payments bypass card networks and their associated fees, merchants can often enjoy significantly lower cost per transaction.

- Faster settlement & improved cash flow: Funds can land in your bank account almost instantly, allowing you to fulfil orders, restock or invest earlier.

- Reduced risk of disputes and chargebacks: Unlike cards, where chargebacks can add cost and headaches, Pay by Bank leverages direct bank account authorisation, meaning fewer reversals and less risk for you.

- Stronger customer trust: Shoppers use their trusted bank app, authenticate safely, and pay without entering card details, an experience that elevates confidence at checkout.

- Better for UK-based audiences ready for open banking: In the UK, open banking infrastructure is mature. If your customer base is UK-centric (or UK-EU), this payment method aligns well with local expectations.

Security, compliance and chargebacks

Traditional card solutions, including Shopify Payments and PayPal, rely on card networks and storing card data (or tokens) in some part of the flow. This introduces PCI-DSS obligations, risk of data breaches or fraud, and chargeback exposure. Open banking payments, by contrast, operate under UK Open Banking regulations: no card data is stored, and payments are authorised in the bank’s own secure environment. As a result, the typical cost and operational burden associated with chargebacks and friendly fraud drop significantly. For Shopify merchants particularly scaling in high-volume or higher-value verticals, that reduction in risk can make a material difference.

Choosing the right open banking payments provider

Not all Pay by Bank providers are created equal. When integrating this into your Shopify checkout, consider these key factors:

- UK bank coverage: Ensure the provider supports all major UK banks and has high authentication success rates.

- Shopify integration: Native plugin, checkout button, pay-by-link or QR code flows should work smoothly inside your store without custom dev work.

- Settlement transparency: How quickly will the funds reach your bank account? What are the dashboard/notification tools for reconciliation?

- Accounting stack support: Good providers will integrate with tools like Xero or QuickBooks, allowing you to reconcile payments quickly and efficiently.

- Pricing clarity: Know their per-transaction fee, any fixed monthly fees, refund or dispute costs. Avoid hidden mark‐ups.

Brands like Atoa offers Pay by Bank options with strong reconciliation features and transparent pricing—making it easier for Shopify stores to adopt this method seamlessly.

When to Use Pay by Bank on Shopify UK

Here are some scenarios where Pay by Bank is an especially strong fit:

- You’re looking to reduce transaction fees meaningfully.

- You want faster payouts than card settlement can deliver.

- Your customer base is UK-centric and open-banking-aware.

- You aim to eliminate chargebacks or reduce refund/dispute burden.

- You operate high-volume stores, subscription-box models, or are scaling across UK/EU and want a lean payment stack.

Wrapping Up

Open banking isn’t just a payment option, it’s a strategic upgrade for Shopify merchants in the UK. When set up thoughtfully, it reduces cost, accelerates cash flow and improves the customer experience. While cards and wallets will continue to play key roles, adopting Pay by Bank early lets you stay ahead of checkout evolution. Choose your provider wisely, integrate seamlessly, monitor your numbers, and your payment stack won’t just keep pace with change, it will lead it.

FAQs

Can I replace cards entirely with Pay by Bank on Shopify?

You need not replace cards entirely. Cards still offer global reach and are entrenched in many use-cases. However, using Pay by Bank as your primary method (especially for UK/ high-value flows) while keeping cards as fallback is often a strong balance.

What happens if a customer’s bank isn’t supported?

Provide fallback payment options (like cards or wallet) and clearly communicate “Pay by Bank available for most UK accounts” so customers don’t abandon checkout.

Are refunds more complicated with Pay by Bank?

Refunds are still supported, but the mechanisms vary by provider. Unlike card chargebacks, refund flows tend to be simpler because payment authorisation was direct. Choose a provider that clearly defines their refund/dispute process.

Will integrating Pay by Bank slow down my Shopify checkout?

No—if you pick a provider with a Shopify-ready plugin or pay-by-link flow, the customer journey remains smooth and fast, often faster than cards because of fewer authentication steps.

How do I measure success after adding Pay by Bank?

Track key metrics: checkout conversion rate, cost per transaction, settlement time, reconciliation error rate, and refund/dispute volume. Compare the “before” (cards) with “after” (card + Pay by Bank mix) to quantify uplift.