Ready to get started?

Easily integrate next-generation payments and financial data into any app. Build powerful products your customers love.

Think of the last time you made a payment without even realising it. Did you scan a QR code at a café, click a checkout link from your phone, or pay through your banking app in seconds? That effortless moment is no accident. It’s the result of a quiet revolution in the way businesses and customers interact: flexible payments. In the UK, this revolution is well underway. From hospitality and retail to healthcare and professional services, businesses are moving away from slow, card-dependent checkouts and embracing faster, lower-cost, open-banking-enabled options. Flexible payments aren’t just transforming how customers pay, they’re redefining how brands build loyalty.

The rise of flexible payments in the UK

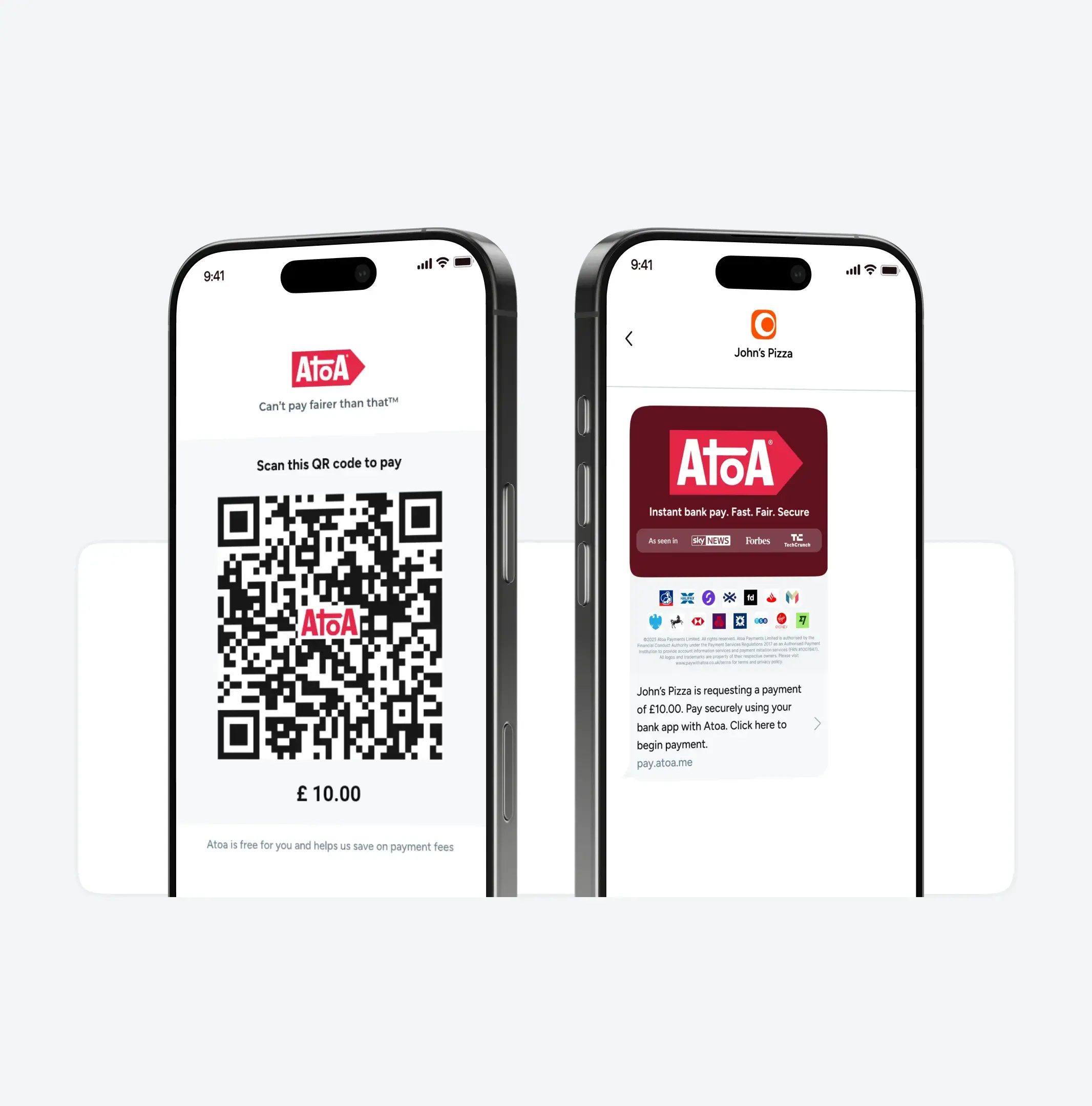

For years, small and mid-sized merchants relied on card terminals, long settlement times, and complex merchant agreements. But with the growth of account-to-account (A2A) payments and Pay by Bank solutions, that landscape is changing. Businesses can now generate QR codes, SMS payment links, or checkout pages instantly, allowing customers to pay directly from their banking app. The result? Lower transaction costs, real-time settlement, and no chargebacks.

According to UK Finance’s 2024 Payment Markets Report, the shift toward digital, mobile-first payments is accelerating. More than half of UK adults (57%) now use mobile wallets, and Faster Payments has become the second most-used payment method, reflecting how consumers increasingly expect speed and simplicity at checkout. This demand for instant, secure transactions is pushing businesses to embrace flexible payment options that fit modern customer expectations.

Why flexible payments improve customer experience

Modern consumers value one thing above all else: control. They want to choose how and where they pay without barriers or delays. Flexible payments deliver exactly that.

- Speed: Instant settlement means customers receive confirmation in seconds.

- Simplicity: No apps to download or card details to type in.

- Security: Every payment is bank-authorised, using fingerprint or Face ID.

- Trust: Fewer errors, clearer confirmation, and no surprise deductions.

When payments happen smoothly, customers remember the service, not the checkout friction.

How UK businesses are using flexible payments

Across sectors, flexible payments are solving everyday challenges:

- Hospitality: Restaurants and cafés use QR-based table payments and instant tipping to improve service flow.

- Professional services: Accountants and law firms send payment links via email or SMS, reducing late payments.

- Healthcare and veterinary clinics: Clinics use Pay by Bank links for variable invoices, simplifying billing for clients.

- Retail & multi-chain stores: Chains integrate Pay by Bank checkouts online and in-store, improving speed and consistency.

Platforms like Atoa make this process even simpler, letting UK businesses send payment links or generate QR codes all in one place, with funds landing instantly in their bank account.

The technology behind it

Under the hood, flexible payments rely on a mix of technologies:

- Open banking APIs: enabling instant, secure transfers between banks.

- Dynamic QR codes: linked to invoices or orders in real time.

- Secure checkout links: that sync automatically with accounting tools like Xero, QuickBooks, and Sage.

For businesses, this means fewer manual errors, faster reconciliation, and real-time tracking. This also means no waiting for card settlements or chasing unpaid invoices.

The business advantage

Flexible payments don’t just delight customers, they also strengthen a business’s bottom line.

- Lower fees: By bypassing card networks, businesses can save big on payment costs.

- Better cash flow: Instant settlement means no more waiting two or three days for funds.

- Reduced admin: Payments reconcile automatically with accounting software.

- Increased conversions: A simpler checkout means fewer drop-offs and more completed payments.

For small and multi-chain businesses, the ability to collect payments anywhere, from an email, QR code, or checkout page, is no longer a luxury. It’s a competitive edge.

The future of customer experience

As open banking continues to mature, flexible payments will only become more integrated into everyday life. From instant refunds to automated recurring payments, customers will expect the same friction-free experience everywhere, whether paying a bill, buying lunch, or booking a service. Businesses that adopt these solutions early will gain more than just speed; they’ll gain customer trust. And with FCA-regulated providers like Atoa, UK merchants can offer these experiences today.

Conclusion

The future of customer experience isn’t about adding more payment options, it’s about removing friction. From QR codes to checkout links, flexible payments are giving UK businesses a faster, safer, and more human way to get paid. When customers can scan, click, or tap to pay from anywhere, it sends a message that a business values their time and trust. For UK merchants, especially those navigating tight margins and rising operating costs, the shift toward Pay by Bank, checkout links, and QR codes isn’t just about technology, it’s about creating payment experiences that match the pace of modern life. As open banking continues to power this evolution, flexible payments will define the next phase of customer loyalty.