Ready to get started?

Easily integrate next-generation payments and financial data into any app. Build powerful products your customers love.

For years, Payment Service Providers (PSPs) built their infrastructure around card payments. But that model is changing. Across the UK and Europe, more PSPs are now prioritising Pay by Bank (also known as account-to-account payments), a payment method powered by open banking that allows customers to pay directly from their bank app. Many of Europe’s leading PSPs have already integrated it into their offering.

So what’s behind the shift, and why should it matter to larger businesses and multi-chain retailers that rely on PSPs? Here are five key reasons Pay by Bank is climbing to the top of the PSP agenda.

1. Consumers are driving the change

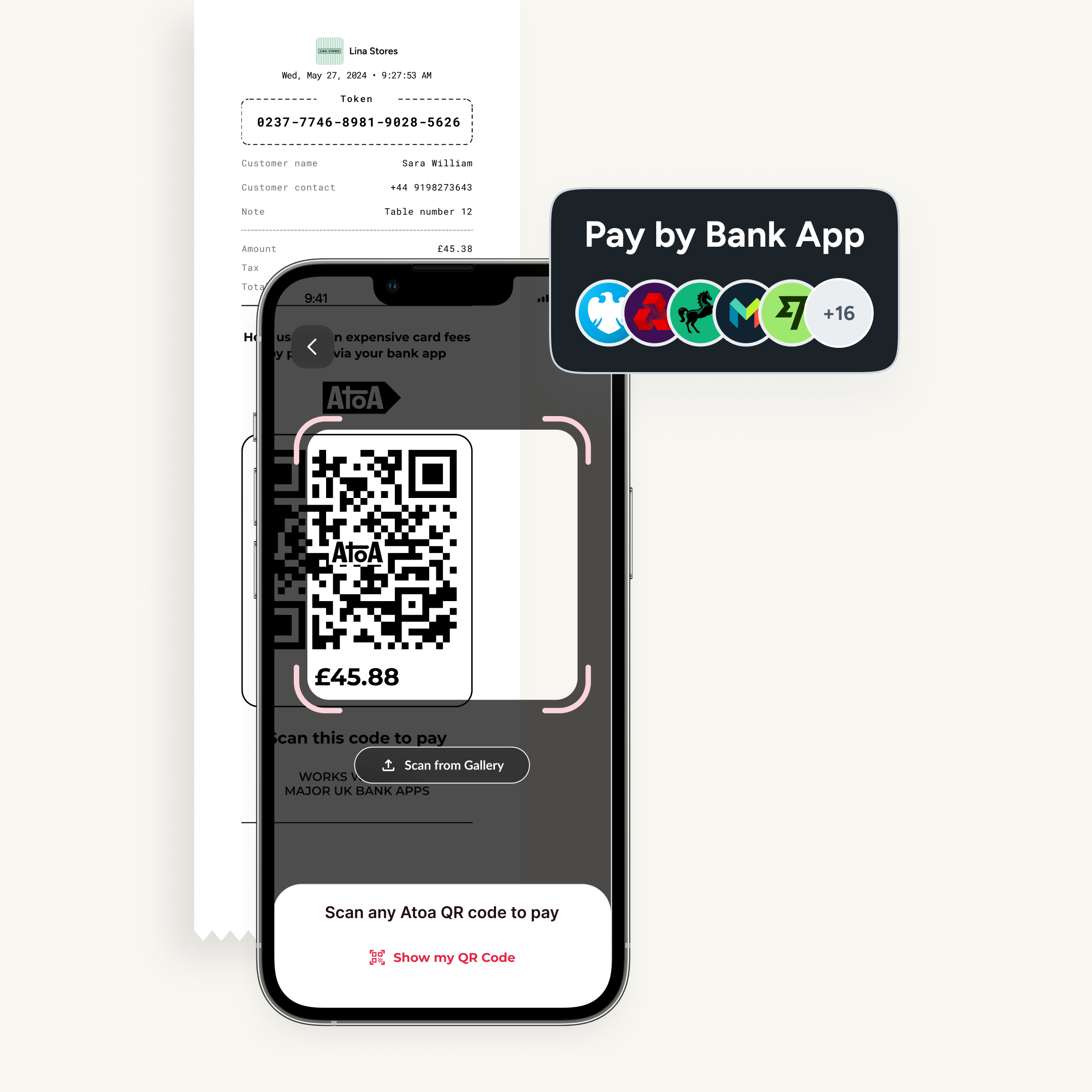

Open banking has moved well beyond the pilot stage. In July 2025 alone, over 15 million UK users made nearly 30 million open banking payments. Customers are comfortable approving payments directly in their banking app with biometrics like Face ID or fingerprints. For PSPs, this means Pay by Bank is clearly more than just a niche method. It is now a mainstream expectation.

2. Regulation is forcing the pace

The regulatory environment is making Pay by Bank harder to ignore. In the EU, the Instant Payments Regulation (IPR) requires PSPs in euro-area member states to be able to receive instant credit transfers and credit accounts within 10 seconds, 24/7, starting in January 2025. PSPs that get ahead of this curve won’t just stay compliant, they’ll strengthen their business proposition at the same time.

3. Businesses want faster cash flow

For large retailers, hospitality groups, or healthcare providers, waiting days for card settlements is more than an inconvenience, it slows down the business. Pay by Bank cuts out intermediaries, meaning funds can land in accounts almost instantly. For PSPs, adding this capability is a direct response to business demand for speed and efficiency.

4. Security and trust are critical

Fraud and chargebacks are costly problems for businesses and PSPs alike. Pay by Bank reduces these risks because every payment is authenticated directly within the customer’s bank environment. Strong Customer Authentication (SCA) built into banking apps makes it harder for fraudsters to succeed and gives customers more confidence in how they pay.

5. Costs can’t keep rising

Card fees remain a sticking point, especially for multi-chain businesses processing thousands of transactions every day. Interchange fees, scheme costs, and additional charges quickly add up. By contrast, Pay by Bank bypasses card networks, offering PSPs and their merchants a leaner, more cost-effective model. For PSPs, providing it is a way to keep merchants from seeking cheaper alternatives elsewhere.

Takeaway

PSPs are prioritising Pay by Bank because it answers the two big questions businesses always ask: how do I reduce costs, and how do I get paid faster? With growing consumer adoption, regulatory support, and business demand, Pay by Bank has shifted from “optional extra” to “essential feature.” For UK businesses, this trend is good news as it gives them more control, lower costs, and faster access to revenue. And with providers like Atoa already delivering Pay by Bank at scale, the infrastructure is here today, not tomorrow.