Ready to get started?

Easily integrate next-generation payments and financial data into any app. Build powerful products your customers love.

Your Shopify store might be humming along, sales are steady, customers are happy, the checkout looks polished. Then you glance at your statement and realise that a chunk of your revenue has quietly slipped away in fees. It happens to almost every business. Cards, wallets, “buy now pay later,” each one takes its cut. Over time, those slices add up to a big portion of your profits. But what if your customers could still pay in seconds, and you could keep up to 50% more of your revenue? Here’s how the options stack up, and why one new addition is changing the game for UK businesses.

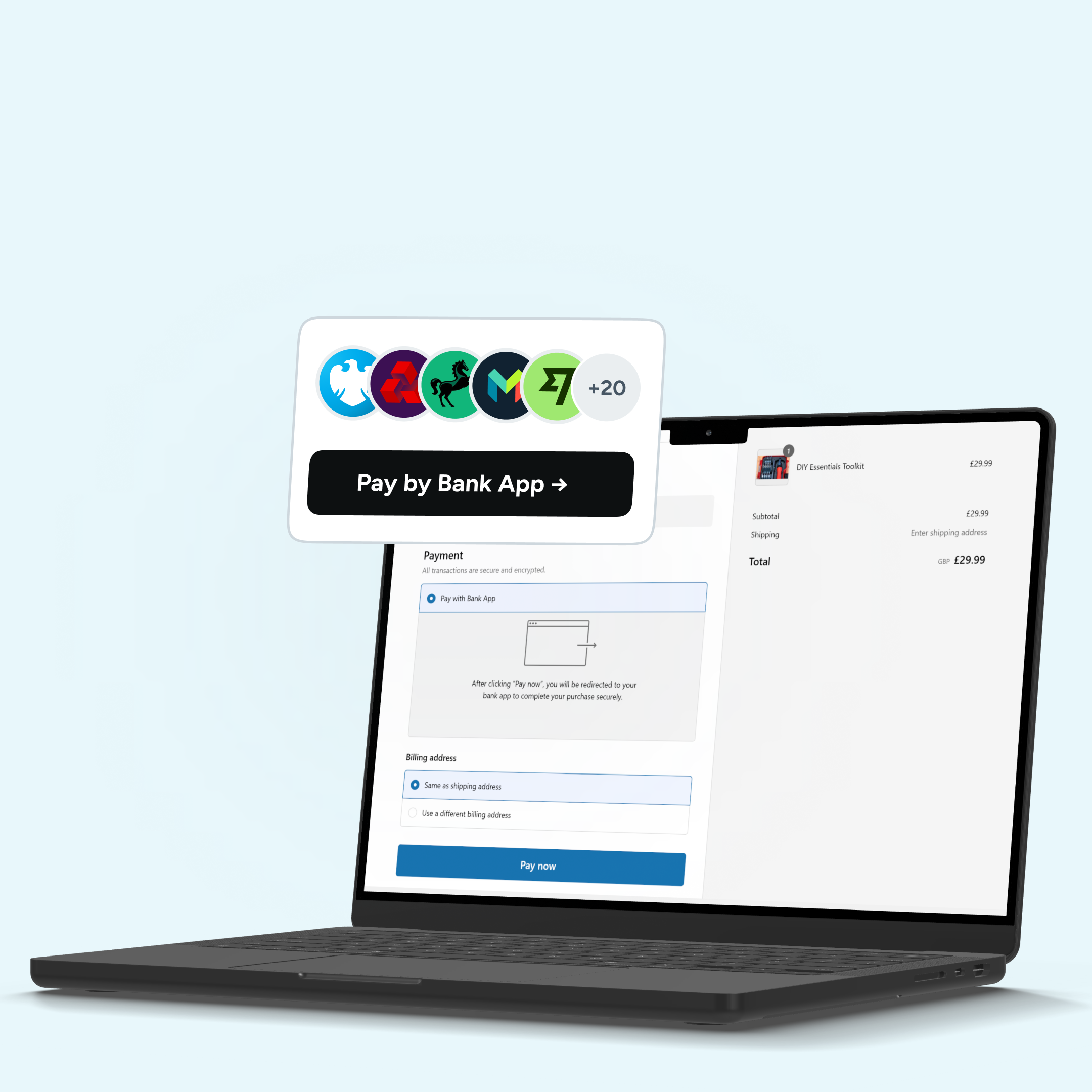

1. Atoa Pay by Bank (Now on Shopify)

The newest and cheapest way to take payments on Shopify is Atoa’s Pay by Bank option. Instead of running through expensive card networks, customers pay directly from their bank account in just a few taps.

That simple change cuts out interchange, scheme fees, and chargebacks entirely. As a result, businesses end up saving up to 50% compared to card payments, while also enjoying instant settlement of funds. For customers, it’s equally smooth. They don’t have to type in card details or even wait for authorisations, just a secure bank login. For UK businesses, Atoa is by far the most cost-effective way to accept payments on Shopify today.

2. Shopify payments (Powered by Stripe)

Shopify Payments is the default choice for most merchants. It’s fully integrated, so you don’t pay the extra 2% fee Shopify charges for third-party gateways. In the UK, fees typically start at around 1.5% + 25p to 2.0% + 25p, varying by plan level and location. That might not sound like much, but if you’re processing large volumes, the numbers quickly add up. It’s convenient and trusted, but not the cheapest option for businesses with significant turnover.

3. PayPal

PayPal remains a popular checkout choice thanks to its brand recognition and buyer protection. Customers like it, and that can help conversion rates. But from a merchant’s perspective, it comes at a price. UK businesses usually pay around 12% – 2.9% + 30p per transaction. Settlement can also take longer, and in disputes, PayPal often sides with the customer. In short, it’s reliable but one of the more expensive payment options to rely on heavily.

3. Buy Now Pay Later (BNPL) providers

Services like Klarna, Clearpay, and Laybuy are also available on Shopify, allowing customers to split payments. These can help boost conversion for high-ticket items, but they’re expensive for businesses. With fees ranging from 3% to 6% per sale, BNPL should be treated as a strategic add-on rather than a primary payment option. Great for customer experience on big purchases, but costly if used across the board.

4. Traditional payment gateways

Some businesses stick with providers such as Worldpay, Opayo (SagePay), or Adyen. Fees here usually sit between 1.5%–2.5% plus a fixed cost per transaction. While these are trusted names, they often come with monthly service charges, setup fees, or minimum usage thresholds that add to the bill.

Which option is cheapest for your business?

The answer depends on your priorities:

- For everyday payments: Atoa’s Pay by Bank offers the lowest fees and fastest settlement. More importantly, it offers consistent savings.

- For international customers: Cards and PayPal may still be needed, though at higher cost.

- For boosting conversion on high-ticket items: BNPL can help, but expect much higher fees so you may not want to make it your main option.

The smartest strategy is often a mix: use Atoa as your primary low-cost payment method, and keep cards or BNPL available as secondary choices for customers who prefer them. That way, you maximise savings without sacrificing flexibility.

The bottom line

There’s no single “best” payment option on Shopify, it depends on your customers, your sales mix, and your margins. Traditional choices like Shopify Payments and PayPal are familiar, but their costs add up. BNPL plays a role for larger purchases, but fees remain high. What’s changing now is the availability of account-to-account payments. With Atoa’s Pay by Bank for Shopify, UK businesses finally have a low-cost alternative that cuts out card network fees, settles instantly, and reduces the risk of chargebacks. For businesses focused on lowering costs without compromising customer experience, it’s an option worth serious consideration.