Ready to get started?

Easily integrate next-generation payments and financial data into any app. Build powerful products your customers love.

Chargebacks were originally designed as a consumer protection measure. But in 2025, they’ve become one of the most pressing financial and operational challenges for businesses.

For UK merchants, chargebacks are no longer just an occasional annoyance. They represent a persistent drain on revenue, time, and resources, with many business leaders now calling for reform. In this article, we explore the current state of chargebacks, their cost to businesses, and how alternative payment methods are helping reduce the risk altogether.

The Growing Scale of Chargebacks

The global volume of chargebacks is projected to grow 24% between 2025 and 2028, reaching more than 324 million disputes annually.

The financial impact is equally significant. Analysts estimate the total global cost of chargebacks will rise from $33.79 billion in 2025 to nearly $41.69 billion by 2028.

For UK businesses, this trend mirrors what many already feel day-to-day: more disputes, greater complexity, and rising costs. Chargebacks are no longer rare events — they are becoming a recurring part of payment operations.

The True Cost to Merchants

Chargebacks cost far more than the disputed transaction itself. While financial institutions report that each dispute costs them $9–10 in processing, merchants often face a much heavier burden.

On average, businesses pay around $20 in chargeback fees per incident, but that’s just the starting point. They also lose the cost of the goods or services sold, shipping, staff time, and unrecoverable payment processing fees.

UK-specific data highlights the hidden toll: confusing billing descriptors alone cost merchants an estimated £128 million per year in unnecessary chargebacks.

In industries with high transaction values, such as travel and hospitality, the cost per chargeback is even more damaging. For a £2,000 holiday booking, one illegitimate dispute could erase profit margins for multiple other sales.

Merchant Success Rates Are Low

Merchants don’t just lose money; they lose most disputes. Surveys suggest that businesses win only 45% of chargebacks on average. Other studies put typical win rates closer to 20–30%, depending on industry and dispute type.

This low success rate reflects the complexity of the system and the perception that it is tilted toward consumers. In fact, nearly two-fifths of UK merchants believe the chargeback process is unfairly skewed in favour of consumers.

The Rise of Friendly Fraud

One of the fastest-growing categories of disputes is so-called friendly fraud, where a legitimate purchase is later disputed by the cardholder. This can happen when:

- A customer forgets a purchase

- A family member makes it without permission, or

- When customers knowingly abuse the system as a “free refund”

Industry research suggests that friendly fraud now accounts for 40–50% of chargebacks globally, and nearly three-quarters of merchants reported a significant increase in friendly fraud over the past three years.

For subscription-based services, where recurring card payments are common, friendly fraud is especially damaging. A consumer disputing a £30 monthly subscription after months of usage can leave the merchant footing both the service cost and the dispute fee.

The Risk Threshold

Beyond the direct costs, chargebacks also create systemic risks for businesses. If a merchant’s chargeback ratio exceeds 1%, they may be flagged by card networks and placed into monitoring programs. This can mean higher fees or, in extreme cases, the loss of card processing privileges altogether.

This threshold is particularly challenging in industries where fraud and disputes are more common, such as travel, digital goods, and online retail. Even one spike in disputes during a busy sales season can trigger additional scrutiny from acquirers.

How Businesses Are Responding

In the face of rising costs, many UK businesses are taking proactive steps:

- AI and machine learning are being adopted for fraud detection and dispute management.

- Clearer billing descriptors are being introduced to reduce consumer confusion and accidental disputes.

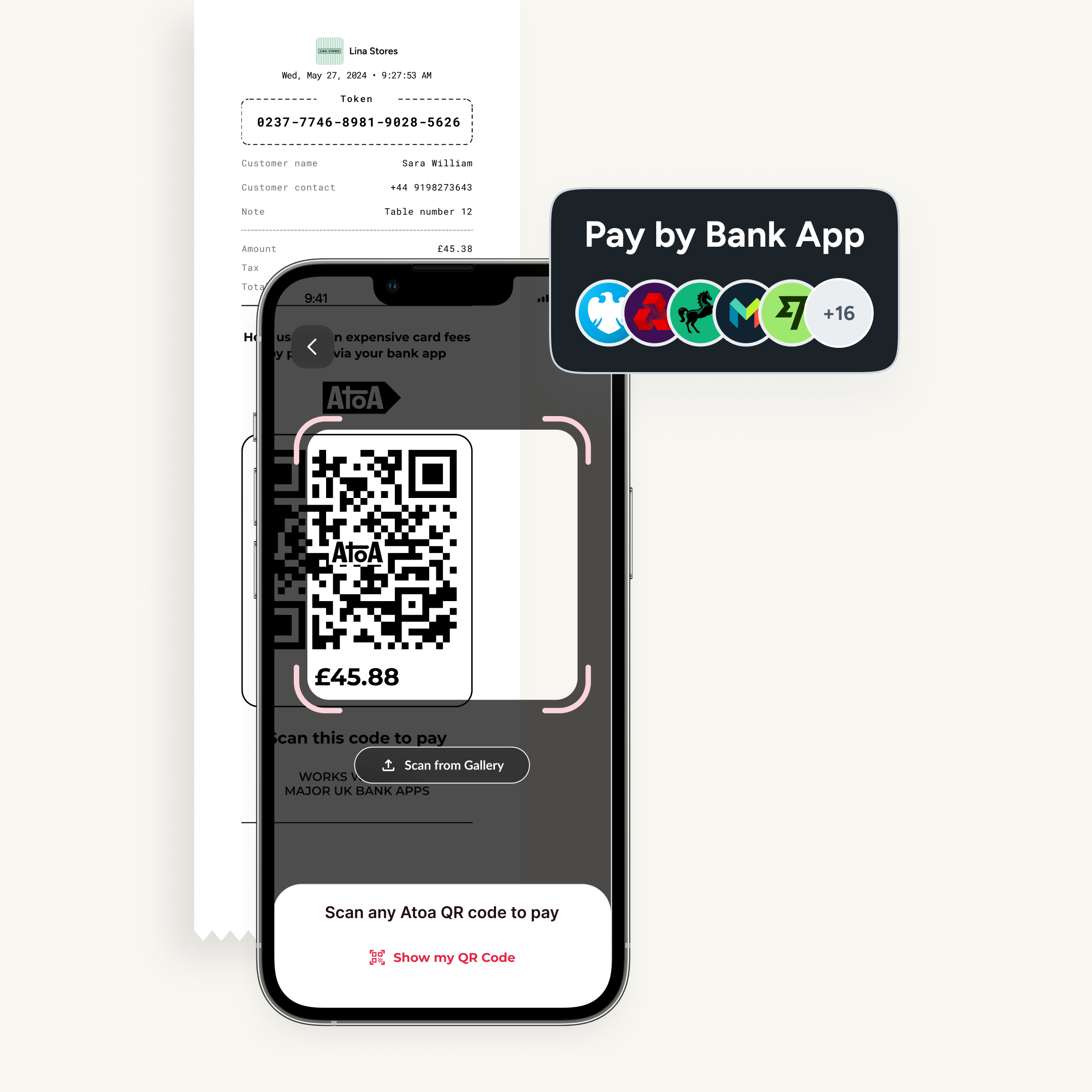

- Alternative payment methods such as Pay by Bank are gaining traction, offering a way to bypass card networks and the chargeback system altogether.

Pay by Bank: A Way Forward

Because Pay by Bank transactions are processed directly from the customer’s bank to the merchant’s bank, they don’t carry traditional chargeback risk.

Instead of dealing with costly disputes and biased processes, merchants get:

- Immediate settlement (no frozen funds)

- Lower transaction costs

- Zero chargeback liability

At Atoa, we’ve seen UK businesses adopt Pay by Bank precisely because of this. It cuts costs while removing one of the biggest headaches in the payments process.

Final Thoughts

Chargebacks were designed to protect consumers. But in 2025, they have become a financial burden for UK merchants, costing millions in fees, lost revenue, and wasted time. With global chargeback volumes forecast to surge over the next three years, businesses face mounting pressure to adapt.

The good news is that solutions are emerging. Smarter fraud prevention, regulatory reform, and alternative payment rails like Pay by Bank are helping merchants reduce exposure and regain control.

For UK businesses, the choice is becoming clearer: keep absorbing the costs of card-based chargebacks, or adopt payment methods built for today’s digital economy.