Ready to get started?

Easily integrate next-generation payments and financial data into any app. Build powerful products your customers love.

Chargebacks are one of the most frustrating parts of running a business that takes card payments. They can eat into profits, disrupt cash flow, and damage trust with payment providers. Fortunately, there are practical ways to reduce them, even eliminate them entirely with newer payment methods.

1. What is a chargeback?

A chargeback happens when a customer disputes a card payment through their bank or card issuer. The bank reverses the payment, pulling funds back from the merchant’s account.

Common reasons include:

- The customer doesn’t recognise the transaction

- The product didn’t arrive or wasn’t as described

- A genuine case of card fraud

- Refunds that weren’t processed fast enough

Each chargeback usually costs the business the transaction amount plus an admin fee, and can damage your reputation with acquirers.

2. How to reduce chargebacks

While you can’t always control customer behaviour, you can reduce your exposure significantly by tightening key areas of your payment flow.

Be transparent before and after purchase

- Use clear product descriptions, delivery timelines, and refund policies.

- Send automated receipts and shipping updates so customers know what to expect.

Make billing descriptors easy to recognise

Customers often dispute payments they don’t remember. Use a recognisable business name on statements (for example, “London Dental” instead of “LD12345”).

Handle refunds quickly

Most chargebacks start because a customer couldn’t get a fast refund.

Process refunds within 24–48 hours of approval.

Keep clear records

Maintain order logs, delivery confirmation, and communications.

This helps you win disputes when they do occur.

Use strong authentication

Implement 3D Secure (3DS) for card payments. It shifts fraud liability back to the card issuer in many cases.

3. The only way to fully avoid chargebacks: remove cards from the equation

Chargebacks are a card-network issue. They only exist because the card issuer controls the refund mechanism. If a customer pays directly from their bank, there’s no intermediary to reverse the payment.

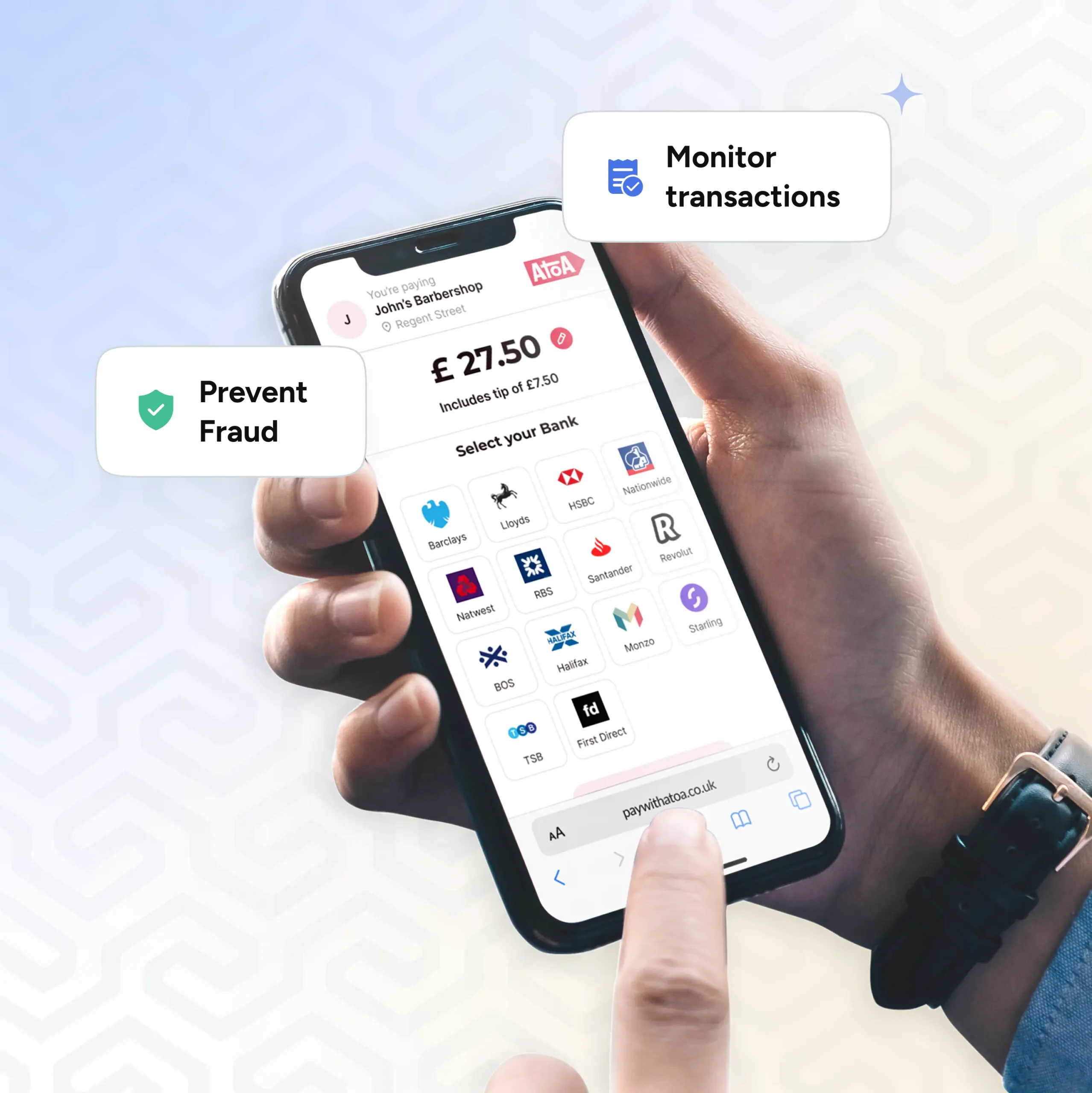

That’s why Pay by Bank has emerged as a safer, chargeback-free alternative.

With Pay by Bank:

- The customer authorises the payment securely in their own banking app

- Funds move instantly via the UK’s Faster Payments network

- The transaction is final. No card numbers and no chargeback risk

4. How UK businesses are cutting chargebacks entirely

Forward-thinking retailers, travel operators, and service firms are already adding Pay by Bank at checkout or in their invoices. This gives customers a trusted way to pay while removing the risk of disputes entirely.

Platforms like Atoa make this easy. Businesses can:

- Accept Pay by Bank and card payments side by side

- Enjoy zero chargebacks on Pay by Bank transactions

- Still provide refunds directly if needed, keeping full control

For many, this isn’t just about saving on fees, it’s about peace of mind.

5. A smarter way to get paid

| Method | Chargeback Risk | Average fee | Settlement speed |

|---|---|---|---|

Credit/Debit cards | High | 1.4–2.9% + 20–30p | 1–3 business days |

PayPal | Medium | 2.9–4% | 1–3 business days |

Pay by Bank | None | 0.7% (avg) | Instant |

Next steps

If you’re tired of losing revenue to disputes, it might be time to rework your payment mix. Explore how your business could cut chargebacks and payment fees with Pay by Bank. Request a short demo today to see it in action.