Payments designed

for tradespeople

Meet our easy alternative to cards and bank transfers. Get paid instantly after a job, cut fees by up to 50%, and say goodbye to late payments and bad debt.

See our reviews on

How to pay by

QR stand

No more missing payments

Reduce payment fees and get paid on time with Atoa. Let customers pay you directly from their bank app to transform your cash flow.

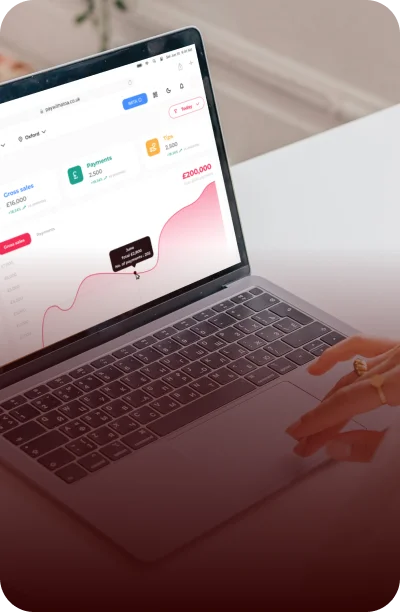

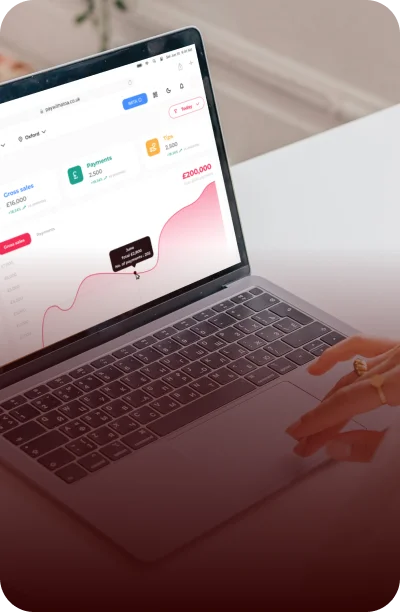

Desktop payments

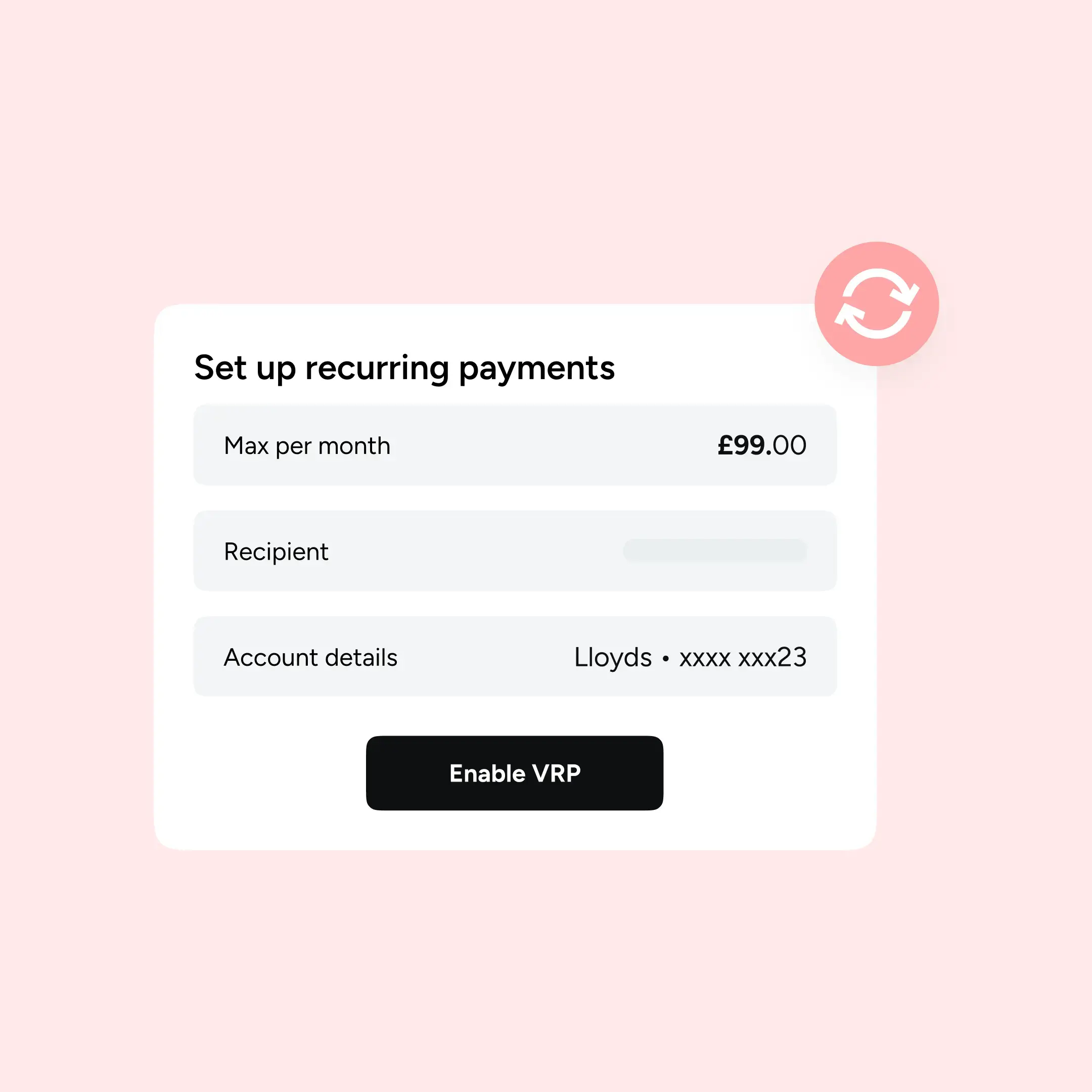

Send bulk payment requests and manage cash flow from your desktop. Great for regular jobs like maintenance or cleaning.

Learn More

Collect payments using SMS

Customers click a link to pay call-out fees and deposits directly from their bank app.

Learn More

Collect payments on the job

Forget unreliable bank transfers and bad debts – customers can pay from their bank app by scanning a QR code.

Learn More

Be a 5-star business

Link your Google Business Profile to collect reviews and improve your rating with each payment.

Learn More

Desktop payments

Send bulk payment requests and manage cash flow from your desktop. Great for regular jobs like maintenance or cleaning.

Learn More

Collect payments using SMS

Customers click a link to pay call-out fees and deposits directly from their bank app.

Learn More

Collect payments on the job

Forget unreliable bank transfers and bad debts – customers can pay from their bank app by scanning a QR code.

Learn More

Be a 5-star business

Link your Google Business Profile to collect reviews and improve your rating with each payment.

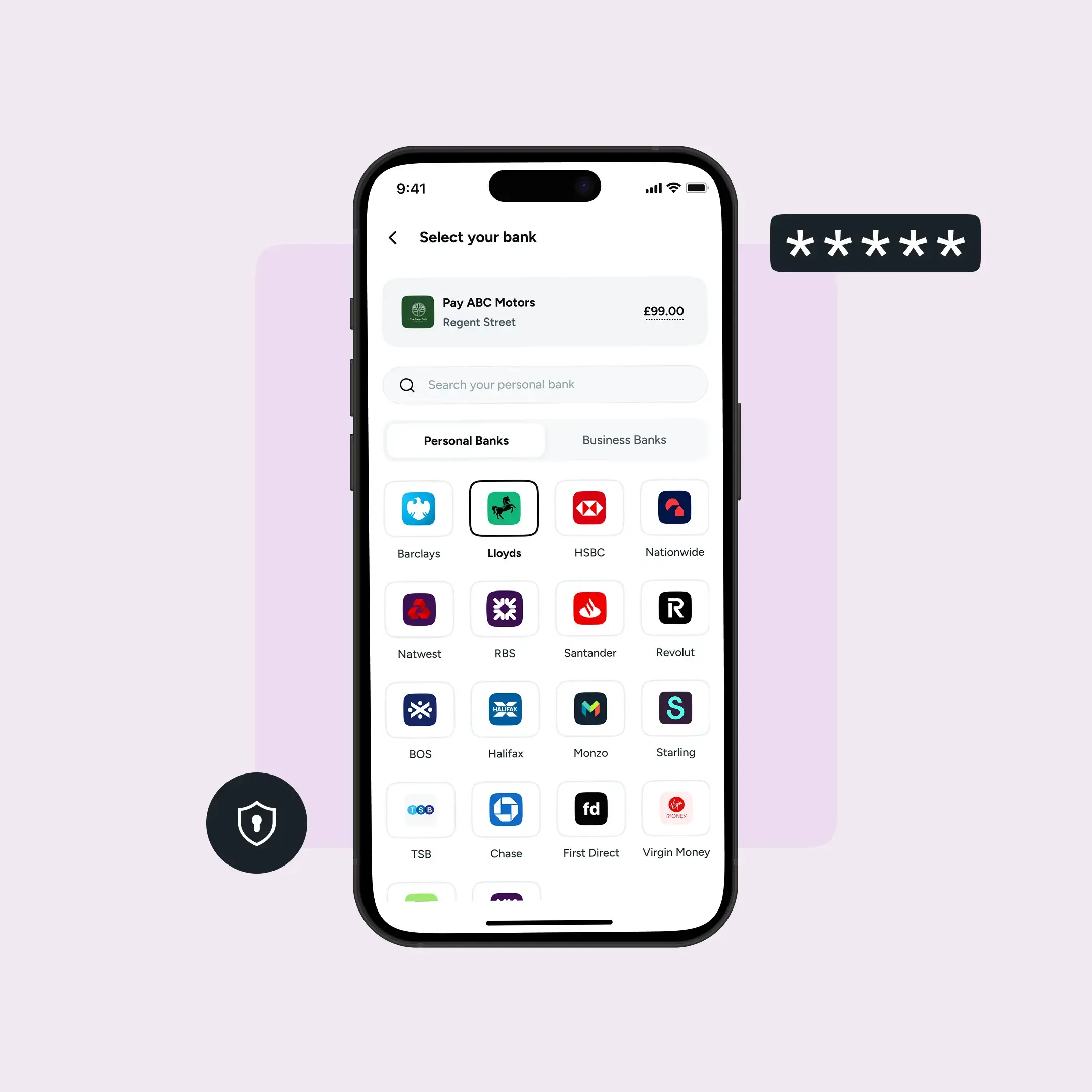

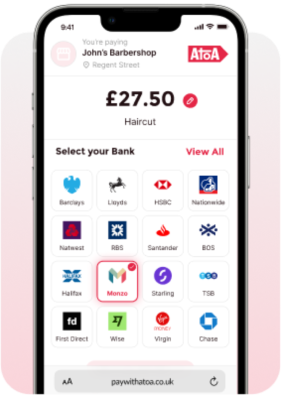

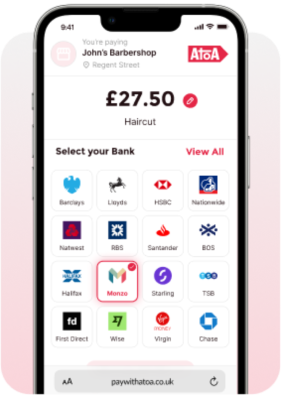

Learn MoreAtoa supports all major UK banks

Pay instantly from your personal or business bank app

TradeHelp members save more

TradeHelp members enjoy exclusive discounts on our instant payment solution, starting at just 0.5% per transaction + VAT. You’ll unlock better rates as your business grows.

With Atoa, your customers can pay you directly from their bank app and funds land in your account instantly. That means no more waiting for bank transfers to clear or chasing bad debts.

We make cash flow problems a thing of the past

Whether you’re managing a large construction site or running a one-person business, Atoa is the perfect payment solution for tradespeople across the board.

Our app and dashboard allows you to request payments anywhere, send reminders, and track who has paid. But Atoa goes beyond payments. We help you build a stronger brand to climb the ranks, secure more clients, and grow your business.

“Excellent service, easy to set up and use. Instant payment to your bank account. Customers find it easy to use, especially if they don’t have a bank card with them.”

S L Simpson, London

Atoa vs. traditional payments

|

Get paid instantly, better cash flow

|

|

Save up to 50% versus cards

|

|

Reduce debt from late payments

|

|

Collect Google Reviews to grow your online reputation

|

|

Zero chargeback risk

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

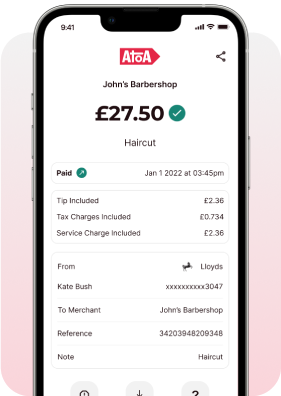

Instant payment confirmation

|

|

No need for bank or card details

|

|

Increase conversion with SMS links

|

|

Add staff with custom access levels

|

|

Collect Google Reviews

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payments for every business

Hair & Beauty

Hair & Beauty

Restaurants

Restaurants

Retail

Retail

Automotive

Automotive

Clinics

Clinics

Join thousands of businesses growing with Atoa

Featured stories

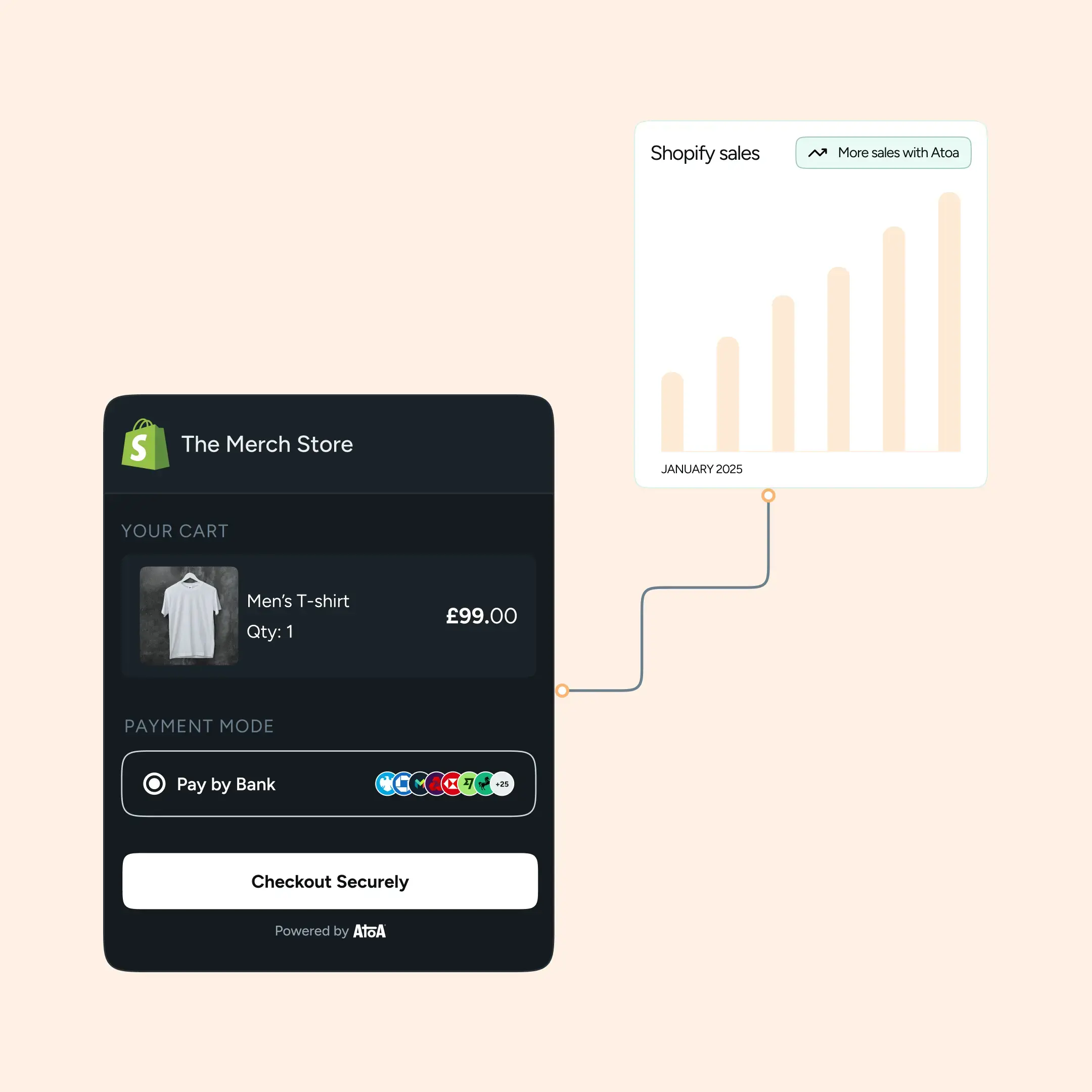

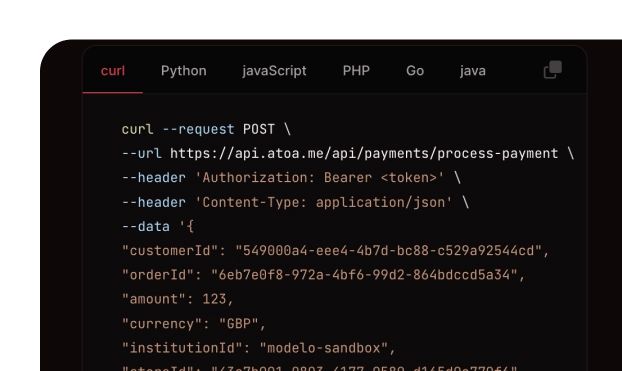

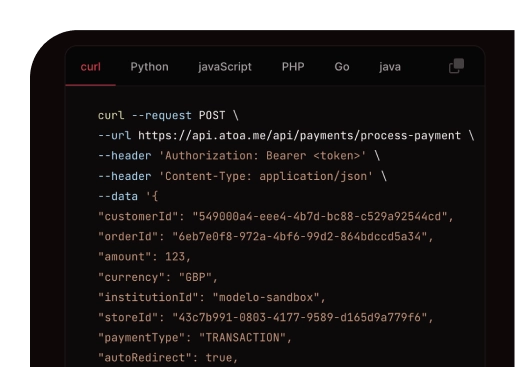

Atoa allows customers to pay automotive retailers using their UK bank app. Our name is short for “account-to-account payments”.

Atoa uses the UK Government’s Open Banking network, which lets customers make an instant ‘bank transfer’ to businesses without entering their bank details. Atoa helps local auto businesses save on card fees and get paid faster. We sidestep card networks like Visa and Mastercard, which lowers business owners’ costs and improves cash flow.

Customers enjoy a safe and secure payment experience with Atoa. All they need is a UK bank app on their phone to pay your dealership or garage instantly without signing up or downloading any new apps.

Read our beginner’s guide to open banking to find out more.

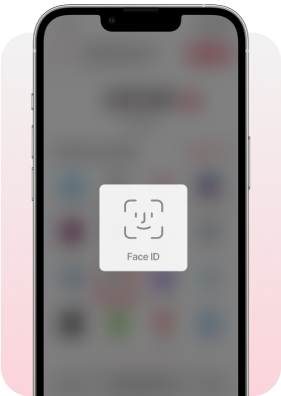

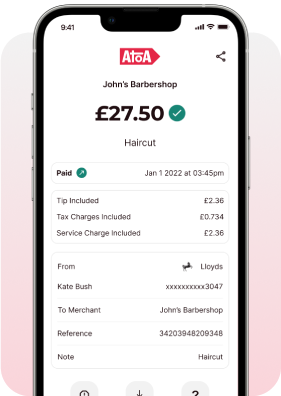

When customers are ready to pay, they scan a QR code stand or receipt in-store, which starts an account-to-account (A2A) payment in their smartphone browser. The customer enters the amount they wish to pay and selects their bank. They are then automatically redirected to their bank app to securely confirm the payment using their face ID or fingerprint scan. Once the payment is approved, funds are released to the business instantly.

Our payment links are great for collecting deposits and can be shared with clients over SMS, WhatsApp, social media or email. When the client clicks the link, they’ll see the amount due and an optional reference or note from the business. The client selects their bank from the list provided and securely approves the payment in their bank app using their face ID or fingerprint scan.

No. Atoa uses the open banking network for payments. To use Atoa, the customer needs a UK bank account and banking app on their smartphone.

The customer scans an Atoa QR code or clicks a payment link, which takes them straight to their bank app to approve the payment. Once confirmed, funds are transferred to the business bank account in seconds. This offers instant cash flow and up to 50% savings compared to traditional card payments. We call this technology “Instant Bank Pay” but it’s also known as an account-to-account (A2A) payment or “pay by bank”.

Atoa is safer than card payments. Unlike cards that can be lost or stolen, Atoa transactions are made from the customer’s bank app. Every payment is approved by the consumer’s bank and confirmed using a face ID or a fingerprint scan, removing the chances of chargeback fraud.

Atoa skips Visa and Mastercard’s card rails and instead taps directly into the UK government’s secure Faster Payments and Open Banking networks. The UK Financial Conduct Authority monitors every transaction, and banks handle all funds directly, meaning Atoa never touches your money. We’re rated “Excellent” on Trustpilot and trusted by thousands of UK businesses.

Atoa is cheaper as it cuts out card processing fees. Instead, it takes payment directly from the customer’s bank app and deposits it straight into the business’s linked bank account. No card networks means no sneaky service charges, compliance fees, or hardware costs.

Atoa helps tradespeople get paid on time with an efficient, low-cost alternative to card payments and bank transfers.

- Lower payment fees – Atoa offers unbeatable pricing for tradespeople, with fees up to 50% lower than leading card providers – and custom rates for larger businesses. Anyone with a UK bank app can pay using Atoa. Customers don’t need to download any new apps.

- Instant cash flow – Say goodbye to waiting up to 7 days to get paid by your card provider. Atoa deposits funds in your bank account within seconds to give you instant cash flow.

- Easy in-store and remote payments – Atoa allows you to accept payments on the job using QR codes or remotely with payment links. Plus, boost sales by sending payment links for call-out fees or deposits.

- Collect Google Reviews – Atoa helps you collect more 4 and 5-star Google Reviews to help more clients find your business.

- Better customer experience – Atoa provides an “on-brand” payment experience, showing your business name and logo when making a payment.

We’re trusted by 1000s of businesses in the UK who rate us “Excellent” on Trustpilot.

You can sign up by clicking the “Start 7-day free trial” button on the top of our website. You can also download our mobile app by searching for “Atoa Business” in the App Store or Play Store.

Registration takes about five minutes and is quick and easy. When you sign up, we offer 7 days of free transactions to get you started.