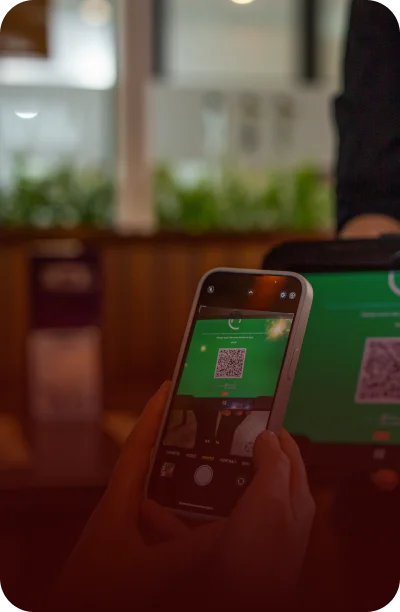

Scan the receipt

to pay by bank

Scan-to-pay means tables turn faster and you can serve more guests. Oh, and did we mention you get paid instantly?

See our reviews on

How to pay by

QR stands

Tap into faster cash flow

Transform how your hospitality business gets paid with faster settlement direct from your customer’s bank app. Plus, collect tips and more 5-star reviews.

Scan to pay

Save staff time by letting guests scan their receipt and pay when they’re ready. More covers, more money.

Learn More

Atoa + your POS

Connect Atoa with your existing point-of-sale system within minutes to offer guests instant bank payments.

Learn More

Collect more tips

Customers can leave tips for your staff as they make payments. This feature may help boost takings by 5-10%.

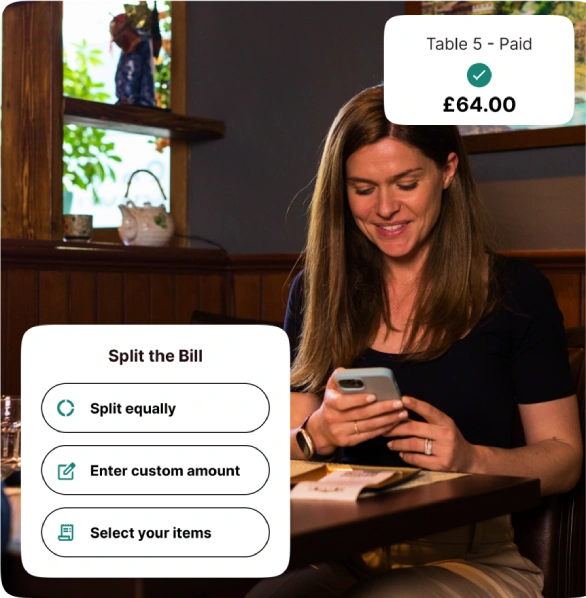

Split the bill fairly

Forget wasting time adding up! Groups can figure out their share before they pay. Your staff will love this!

Be a 5-star business

Link your Google profile and collect reviews during payment to rank higher in search and attract new customers.

Learn More

Scan to pay

Save staff time by letting guests scan their receipt and pay when they’re ready. More covers, more money.

Learn More

Atoa + your POS

Connect Atoa with your existing point-of-sale system within minutes to offer guests instant bank payments.

Learn More

Collect more tips

Customers can leave tips for your staff as they make payments. This feature may help boost takings by 5-10%.

Split the bill fairly

Forget wasting time adding up! Groups can figure out their share before they pay. Your staff will love this!

Be a 5-star business

Link your Google profile and collect reviews during payment to rank higher in search and attract new customers.

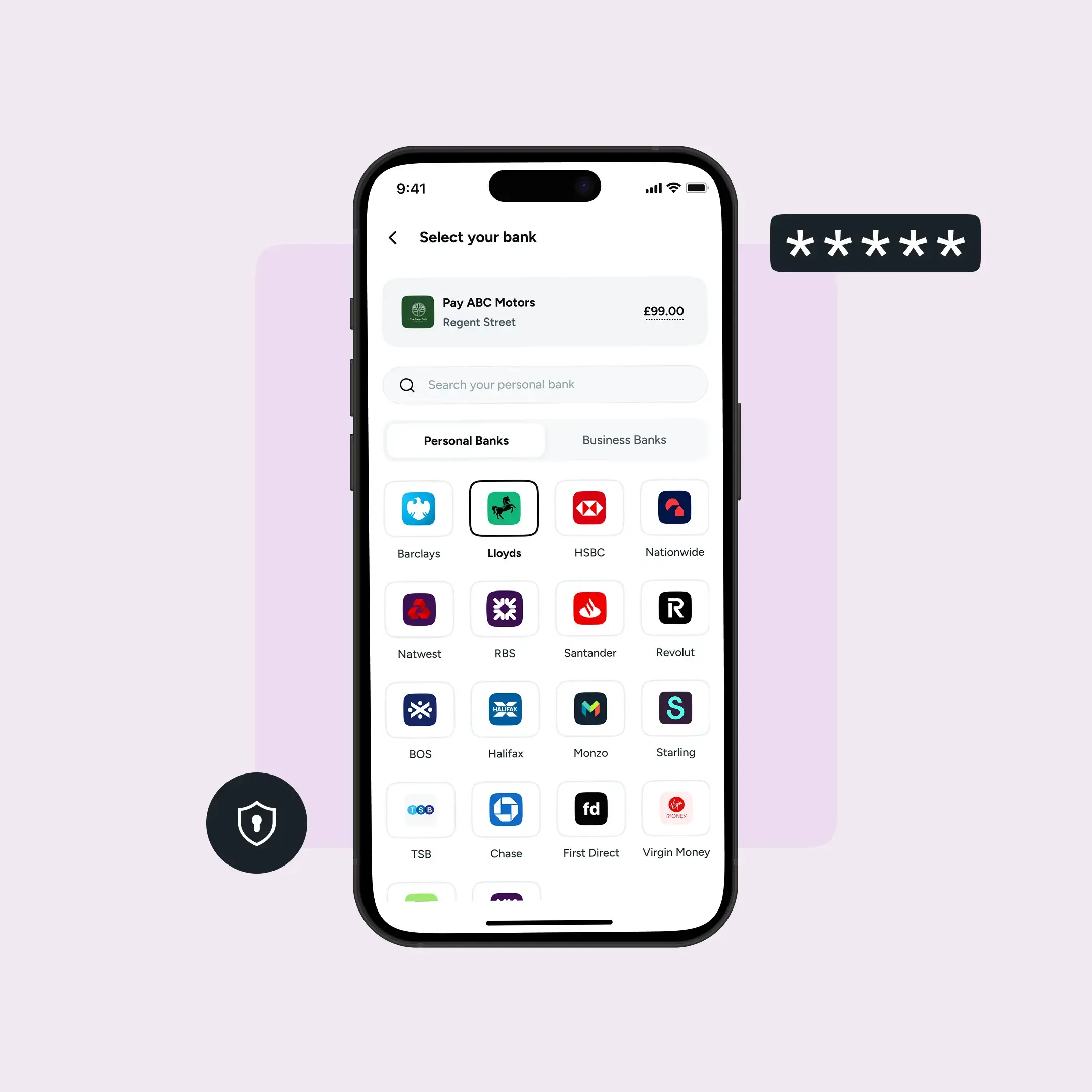

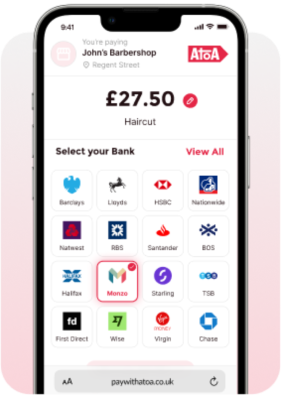

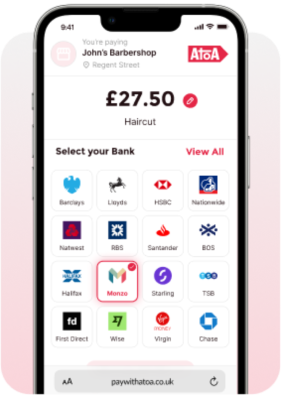

Learn MoreAtoa supports all major UK banks

Pay instantly from your personal or business bank app

““Receipt QR lets each customer pay their bill directly and each magically cashes off on the till. It saves us a lot of time and payment fees!””

Mikey T, Barber, Bristol

Atoa vs. traditional payments

|

Get paid instantly, better cash flow

|

|

Save up to 50% versus cards

|

|

Integrates with your POS systems

|

|

Save your staff time during peak service

|

|

Collect and manage Google Reviews

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

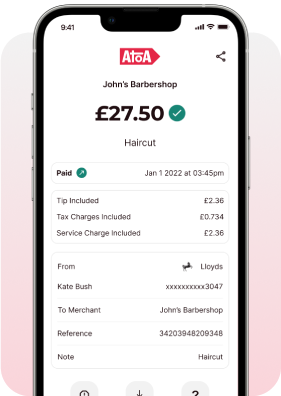

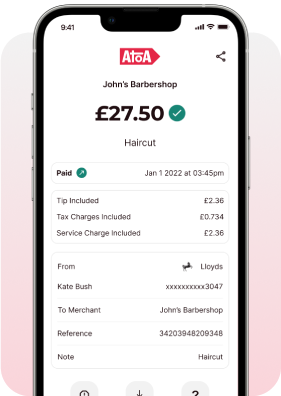

Instant payment confirmation

|

|

No need for bank or card details

|

|

Increase conversion with SMS links

|

|

Add staff with custom access levels

|

|

Collect Google Reviews

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payments for every business

Hair & Beauty

Hair & Beauty

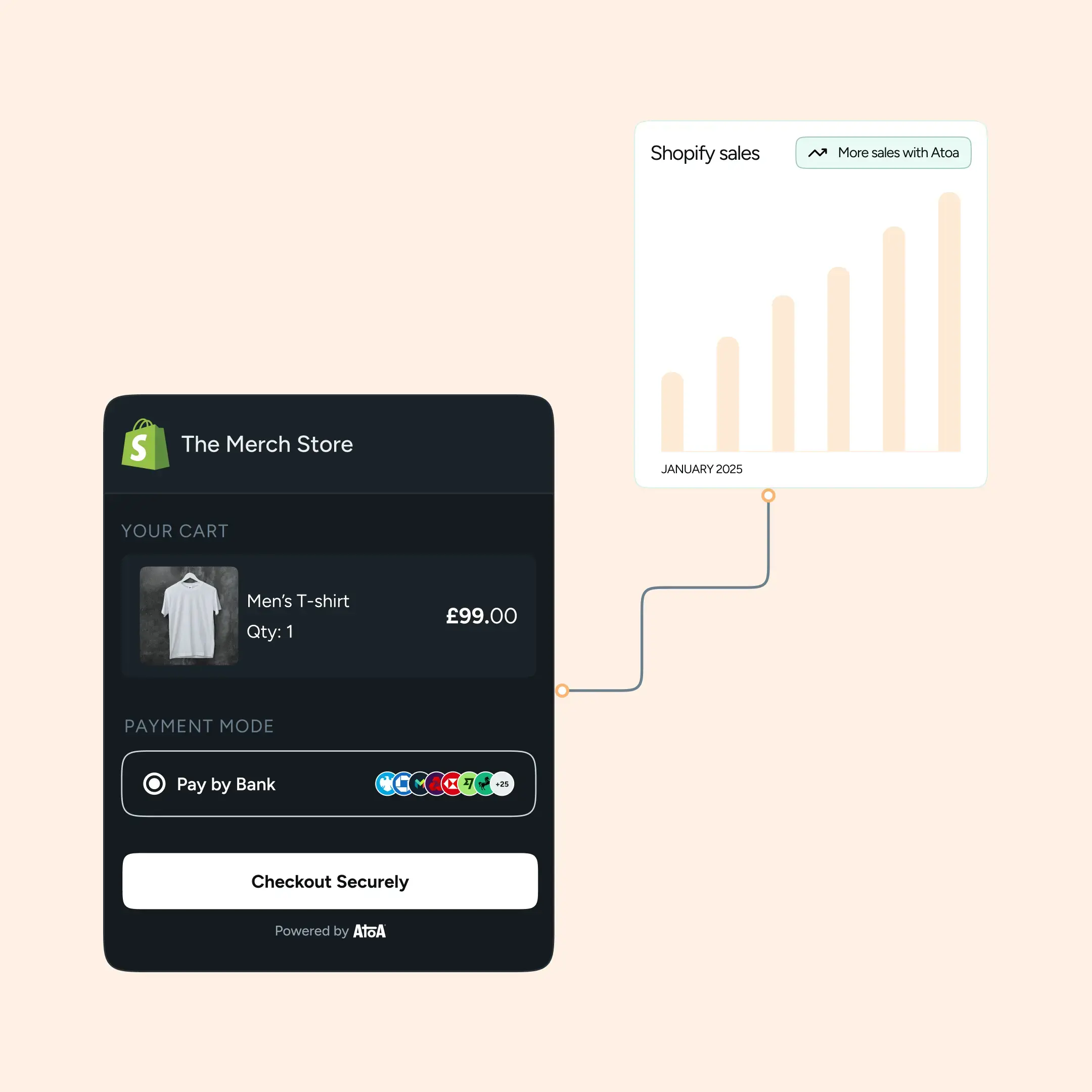

Retail

Retail

Automotive

Automotive

Tradespeople

Tradespeople

Clinics

Clinics

Join thousands of businesses growing with Atoa

Featured stories

Atoa allows customers to pay automotive retailers using their UK bank app. Our name is short for “account-to-account payments”.

Atoa uses the UK Government’s Open Banking network, which lets customers make an instant ‘bank transfer’ to businesses without entering their bank details. Atoa helps local auto businesses save on card fees and get paid faster. We sidestep card networks like Visa and Mastercard, which lowers business owners’ costs and improves cash flow.

Customers enjoy a safe and secure payment experience with Atoa. All they need is a UK bank app on their phone to pay your dealership or garage instantly without signing up or downloading any new apps.

Read our beginner’s guide to open banking to find out more.

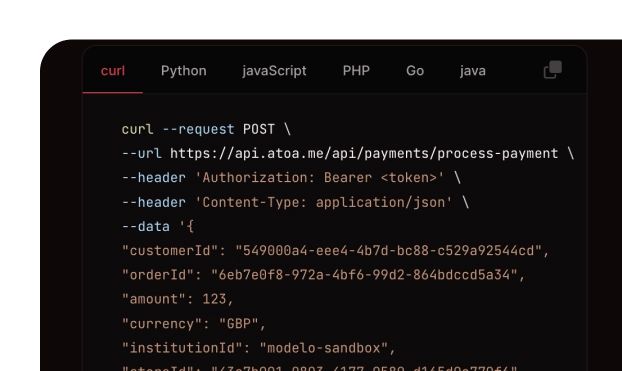

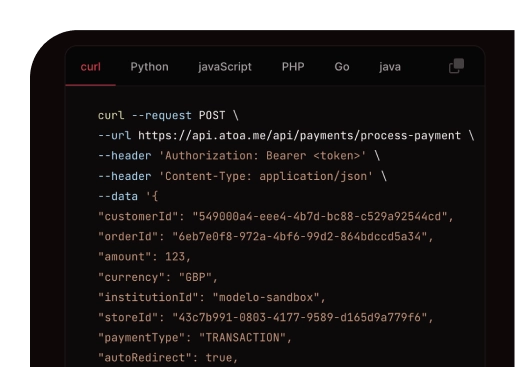

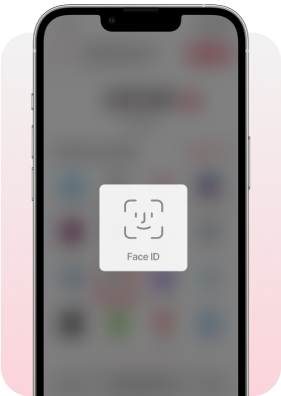

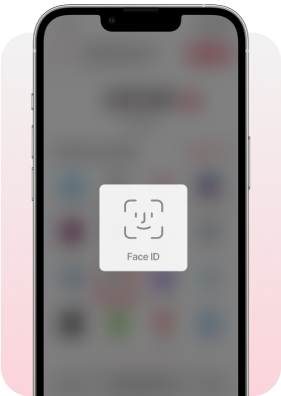

When customers are ready to pay, they scan a QR code stand or receipt in-store, which starts an account-to-account (A2A) payment in their smartphone browser. The customer enters the amount they wish to pay and selects their bank. They are then automatically redirected to their bank app to securely confirm the payment using their face ID or fingerprint scan. Once the payment is approved, funds are released to the business instantly.

If you want to take a deposit or remotely payment our links can be shared with customers over SMS, WhatsApp, social media or email. When the customer clicks on the link, they’ll see the amount due and an optional reference or note from the business. The customer selects their bank from the list provided and securely approves the payment in their bank app using their face ID or fingerprint scan.

No. Atoa uses the open banking network for payments. To use Atoa, the customer needs a UK bank account and banking app on their smartphone.

The customer scans an Atoa QR code or clicks a payment link, which takes them straight to their bank app to approve the payment. Once confirmed, funds are transferred to the business bank account in seconds. This offers instant cash flow and up to 50% savings compared to traditional card payments. We call this technology “Instant Bank Pay” but it’s also known as an account-to-account (A2A) payment or “pay by bank”.

Atoa is safer than card payments. Unlike cards that can be lost or stolen, Atoa transactions are made from the customer’s bank app. Every payment is approved by the consumer’s bank and confirmed using a face ID or a fingerprint scan, removing the chances of chargeback fraud.

Atoa skips Visa and Mastercard’s card rails and instead taps directly into the UK government’s secure Faster Payments and Open Banking networks. The UK Financial Conduct Authority monitors every transaction, and banks handle all funds directly, meaning Atoa never touches your money. We’re rated “Excellent” on Trustpilot and trusted by thousands of UK businesses.

Atoa is cheaper as it cuts out card processing fees. Instead, it takes payment directly from the customer’s bank app and deposits it straight into the business’s linked bank account. No card networks means no sneaky service charges, compliance fees, or hardware costs.

Atoa helps hospitality operators break free from the high costs and slow settlement of card payments with an easy and convenient solution.

- Lower payment fees -Atoa offers unbeatable pricing for hospitality businesses, with fees up to 50% lower than leading card providers – and custom rates for larger chains. Anyone with a UK bank app can pay using Atoa. Customers don’t need to download any new apps.

- Instant cash flow – Say goodbye to waiting up to 7 days to get paid by your card provider. Atoa deposits funds in your bank account within seconds to give you instant cash flow.

- Easy deposits – Atoa allows you to collect deposits by sending an SMS payment link to guests to secure bookings. You can track payments in real time using our app and web dashboard.

- Collect Google Reviews – Atoa helps you collect 4 and 5-star Google Reviews to help more clients find your business.

- Customer tips supported – Atoa asks guests whether they would like to leave a tip before they pay.

- Better customer experience – Atoa provides an “on-brand” payment experience, showing your business name and logo when making a payment.

We’re trusted by hundreds of bars and restaurants in the UK who rate us “Excellent” on Trustpilot.

You can sign up by clicking the “Start 7-day free trial” button on the top of our website. You can also download our mobile app by searching for “Atoa Business” in the App Store or Play Store.

Registration takes about five minutes and is quick and easy. When you sign up, we offer 7 days of free transactions to get you started.