Ready to get started?

Easily integrate next-generation payments and financial data into any app. Build powerful products your customers love.

In the bustling world of online payments, chargebacks have been a persistent pain for businesses. These payment reversals—when a customer disputes a charge—can lead to lost revenue, endless admin, and major headaches. But thanks to open banking and Payment Initiation Services (PIS), the idea of “zero chargebacks” is quickly becoming more than just wishful thinking.

Let’s break down how this works, what it means for your business, and why it might be time to rethink the way you get paid.

Understanding chargebacks and their impact

A chargeback happens when a customer challenges a payment and asks their bank to reverse it. While this process is designed to protect consumers, it has an adverse effect on businesses—especially when the transaction was legit.

UK merchants lose over £128 million every year just because customers don’t recognise vague billing names on their statements. That’s a lot of money going down the drain over avoidable confusion.

Chargebacks can lead to:

- Financial loss: Not only do you lose the sale, but you’re also hit with chargeback fees.

- Admin overload: Investigating disputes takes up valuable time and resources.

- Reputation damage: Too many chargebacks, and your payment provider might start raising eyebrows—or fees.

How open banking makes payments more secure

Open banking is a regulatory framework that allows regulated third-party providers to connect securely with banks and initiate payments on behalf of customers—safely and with full consent. It’s built on strong security features:

- Secure APIs: Data is shared through encrypted connections, not through outdated systems.

- Customer consent: No action is taken without clear, upfront permission from the user.

- Tight regulation: Everything is overseen by UK regulators under PSD2, with high standards across the board.

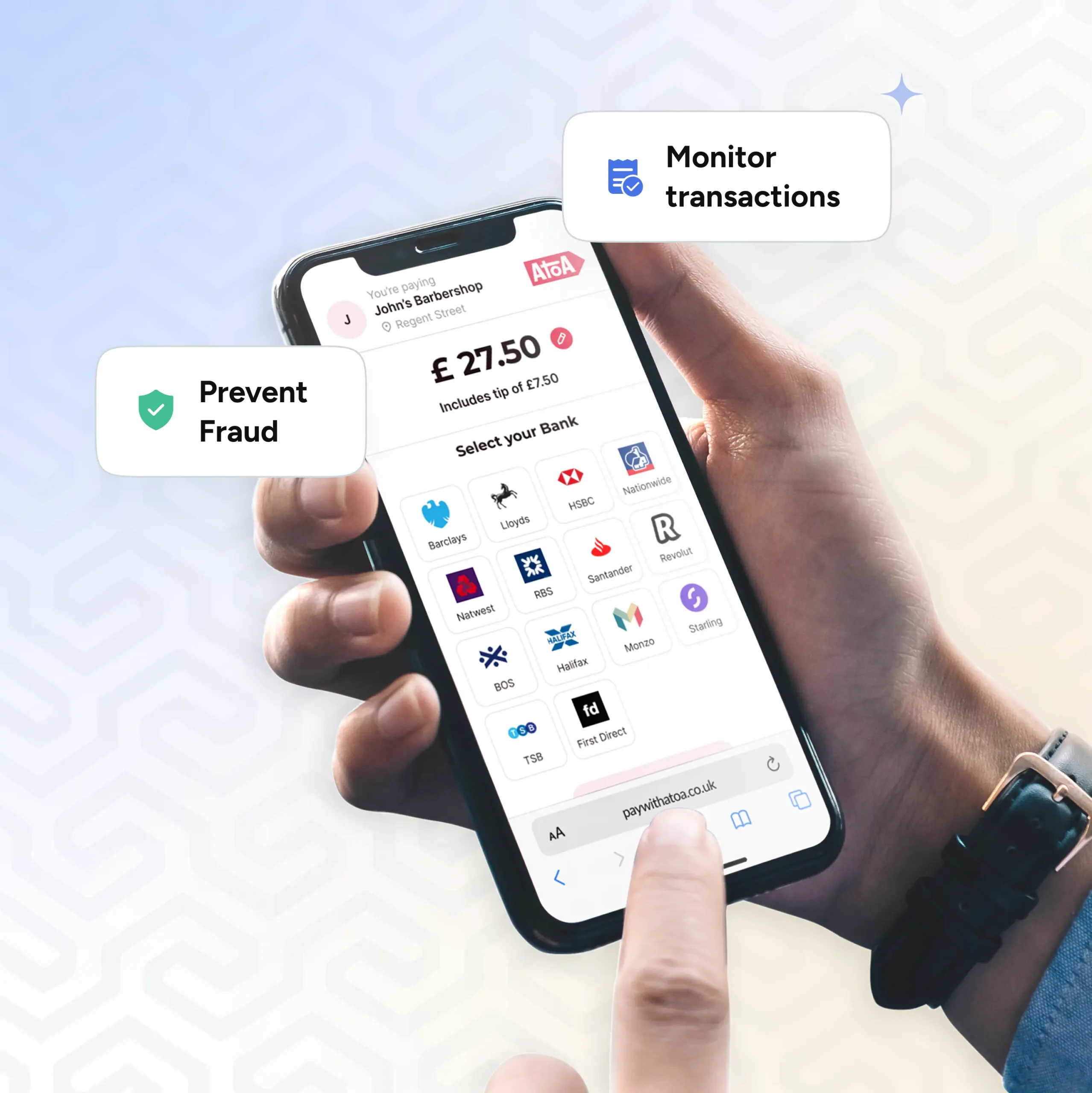

Payment Initiation Services (PIS): Direct and secure payments

Payment Initiation Services (PIS) helps make the checkout process simple and smooth. This direct account-to-account payment model offers several advantages:

- No bank details: Because the customer doesn’t input any bank details, there’s nothing for fraudsters to steal. This drastically reduces the risk of data breaches and payment fraud.

- Strong authentication at every step: Payments made via PIS are verified through the bank’s own security systems—usually involving multi-factor authentication (MFA) like a mobile app, a fingerprint, or a unique code. That means it’s extremely difficult for someone to make a payment unless they’re the actual account holder. As a result, disputed payments become rare.

- No middlemen, lower costs: Traditional payments often pass through several intermediaries (think card networks, payment processors, acquirers), each charging a fee and potentially causing delays. With PIS, funds move directly from the customer’s account to the business’s account, often in real time. That means fewer fees, quicker access to your money, and fewer points of failure.

For businesses tired of chasing missing payments or dealing with disputes, PIS a welcome change.

Strong Customer Authentication (SCA): Preventing payment disputes

One of the most important reasons open banking is so secure and reduces chargebacks—is Strong Customer Authentication (SCA).

Under UK and EU regulations (specifically PSD2), most electronic payments now require SCA. Simply put, this means customers have to prove they are who they say they are by providing two out of three types of identification:

- Knowledge: Something the user knows (e.g., a password or PIN)

- Possession: Something the user has (e.g., a mobile device or token)

- Inherence: Something the user is (e.g., biometric identifiers like fingerprints)

So, instead of a payment being authorised with just a card number (which could easily be stolen), the customer now has to actively verify the transaction. It’s like having a double lock on your front door—and only the real homeowner has the keys.

For businesses, this means fewer unauthorised payments and far less risk of customers later saying, “That wasn’t me.” Disputes and fraud are dramatically reduced, and with them, the chargebacks that follow.

Why fewer chargebacks = A happier business

- Healthier cash flow: No more playing the waiting game wondering if a payment will bounce back. With direct payments and instant settlement through open banking solutions, your money arrives quickly and predictably—making it easier to plan, pay suppliers, or invest in growth.

- Lower costs all round: Fewer chargebacks mean no extra admin fees, no nasty fines, and fewer middlemen taking a cut. And with lower transaction fees than traditional card payments, you’ll notice the savings stacking up.

- Better security = fewer worries: With strong customer authentication built in, payments are verified and secure. That means far less fraud to deal with, and much less stress for you and your team.

- Less admin, more time: No one enjoys chasing disputes. Fewer chargebacks mean less paperwork and back-and-forth with banks—so your team can focus on what really matters: running and growing the business.

- More trust, happier customers: When payments are simple and secure, customers feel more confident buying from you again. And when they know their payment details are safe? That’s loyalty in the making.

Real-world applications

Several industries stand to gain immensely from zero chargeback payments:

- E-commerce: Online retailers often grapple with high rates of chargebacks, especially from ‘friendly fraud’—when customers dispute legitimate transactions. Implementing open banking can help mitigate these risks, leading to significant cost savings.

- Travel: The travel sector, with its high-value transactions, is particularly susceptible to chargebacks. Direct account-to-account payments can reduce these incidents, ensuring smoother operations and improved profitability.

- Digital Services: Subscriptions and digital goods providers frequently face disputes over recurring charges. However, by using transparent and secure payment methods, can alleviate such challenges, they can reduce these challenges and, in turn, enhance customer satisfaction.

Challenges and considerations

Sure, it’s not all sunshine and instant success. But here are a few things to consider:

Some customers need a little convincing

Some people might feel unsure about new technology or worry about sharing bank details. A bit of gentle education goes a long way—clear messaging, helpful FAQs, and reassuring them it’s all protected by strict UK regulations can help build trust.

Tech setup might take a bit of work

To get started, your payment system may require some technical integration—and in some cases, developer support or a bit of extra training for your team. The good news is that once it’s up and running, it will operate seamlessly in the background. Also, your business benefits from it every day.

Regulations still matter

You’ll need to make sure everything complies with standards like PSD2 and the UK’s Payment Services Regulations 2017. Keeping up with changes (or working with providers who do) is key.

Fraud isn’t gone—but it’s different

Social engineering—where fraudsters trick customers into approving a payment—still exists. Regular monitoring and customer awareness are important tools in your fraud prevention toolkit.

Final thoughts

Open banking isn’t just about payments—it’s a regulatory framework that gives businesses access to a new world of secure, streamlined financial services. One of the biggest wins? A future with far fewer chargebacks. By tapping into tools like Payment Initiation Services and Strong Customer Authentication, businesses can boost security, lower costs, and build more trust with their customers.The world of payments is changing—and UK businesses have a real opportunity to get ahead. Staying curious, informed, and open to innovation is the best way to make sure you’re not just keeping up, but thriving in the digital economy.