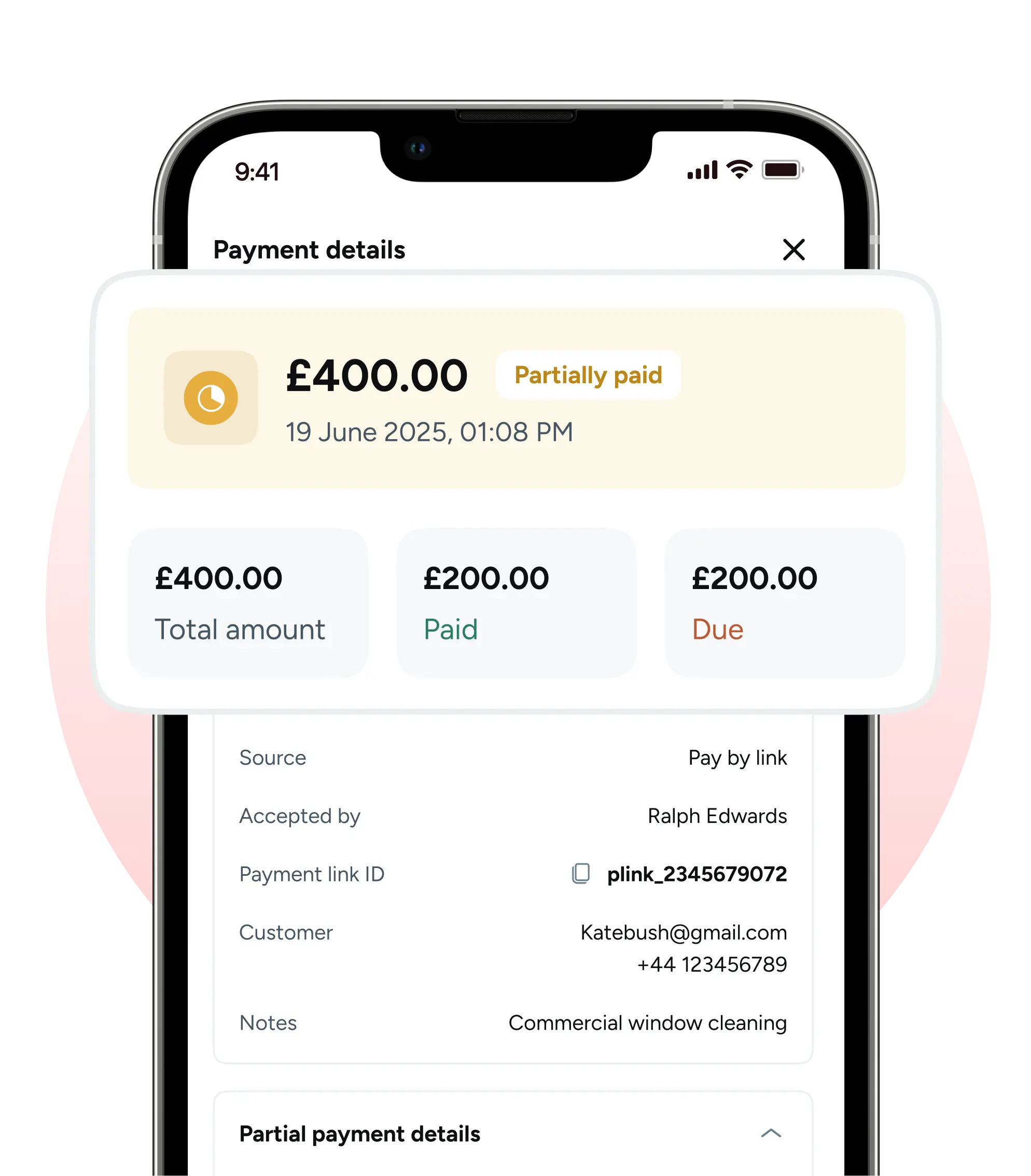

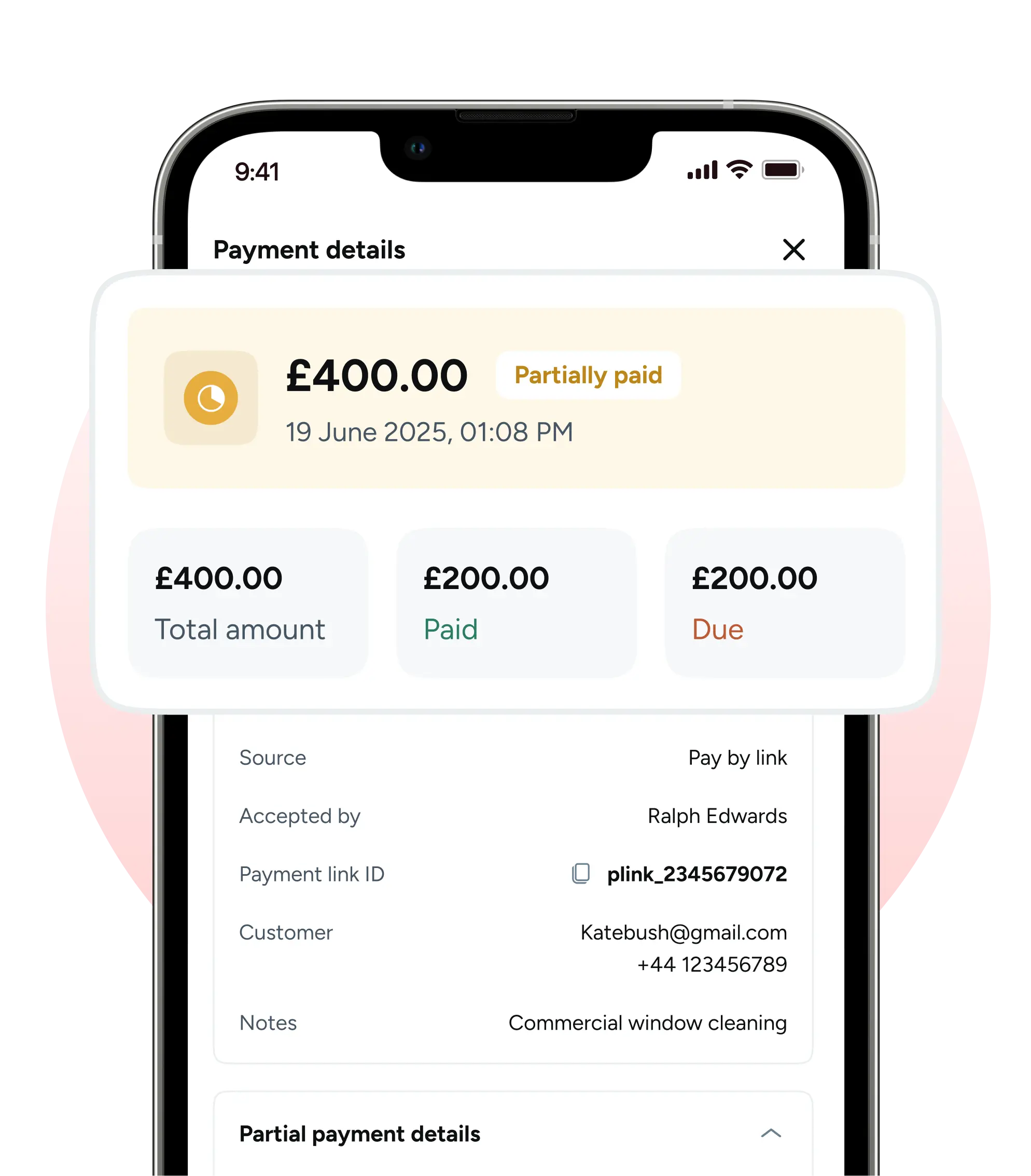

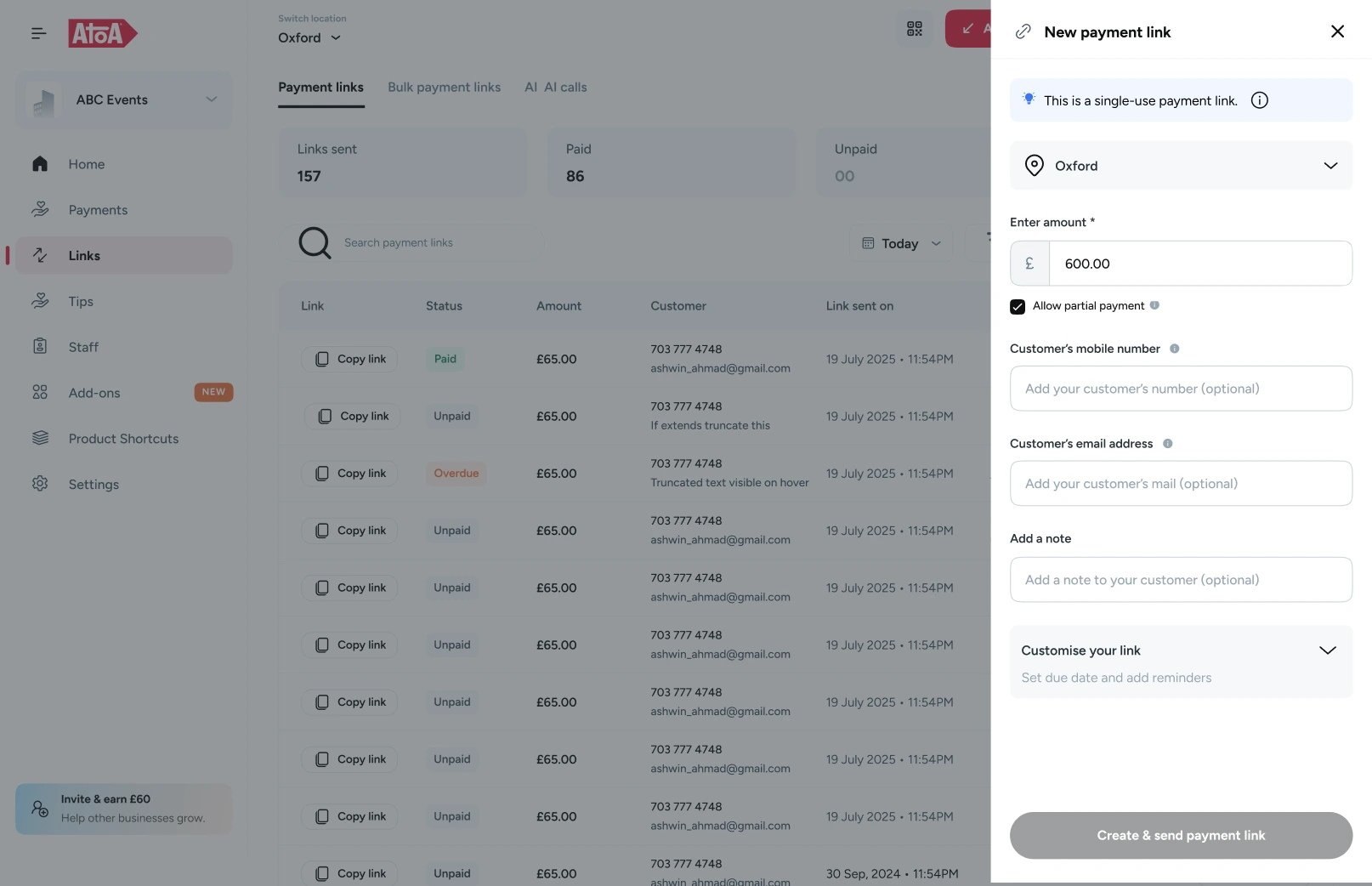

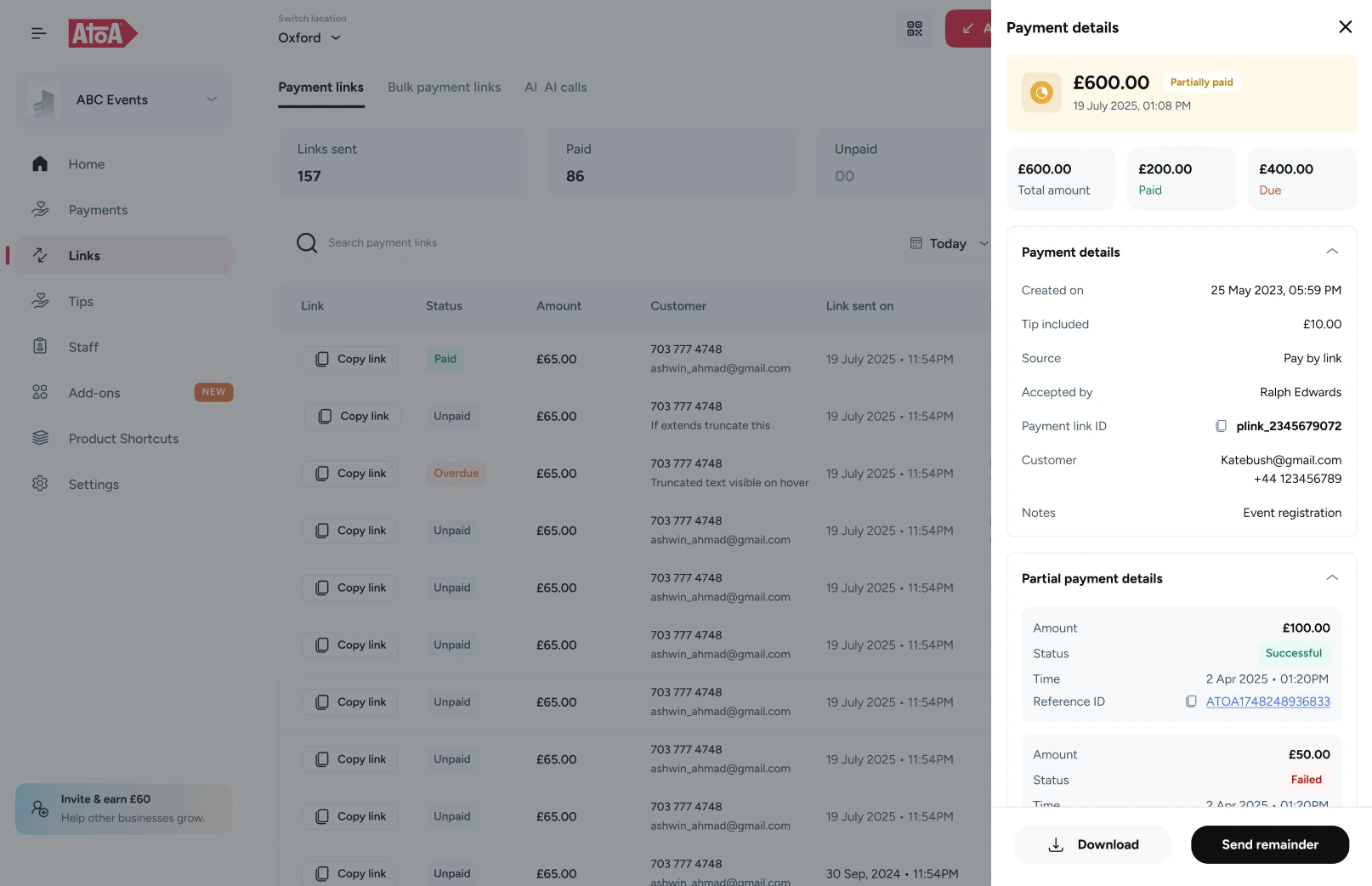

Offer flexibility with Partial Payments

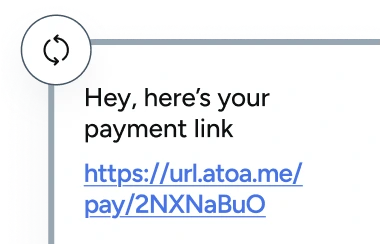

Give customers the flexibility to pay in stages while keeping your cash flow moving. They can pay partially with the same payment link until they have paid the full amount. Easy tracking. No chasing.

How partial payments work

flexible payments

flexible payments

Atoa supports all major UK banks

Pay instantly from your personal or business bank app

Boost cash flow your way

Our instant payment solution allows customers to pay you in-store or remotely from their bank app. It’s easier than cash and cheaper than cards.

…or on the go

Accept payments anywhere by showing customers a QR code on your phone screen. Ideal for tradespeople, showrooms or events.

Learn More

Manage payments on desktop

Use the Atoa Dashboard to send and track payment links. Ideal for busy office teams and call centers.

Learn More

Get paid in-store…

Display QR code stands in-store for customers to scan and pay from their bank app. No hardware fees, no hassle.

Learn More

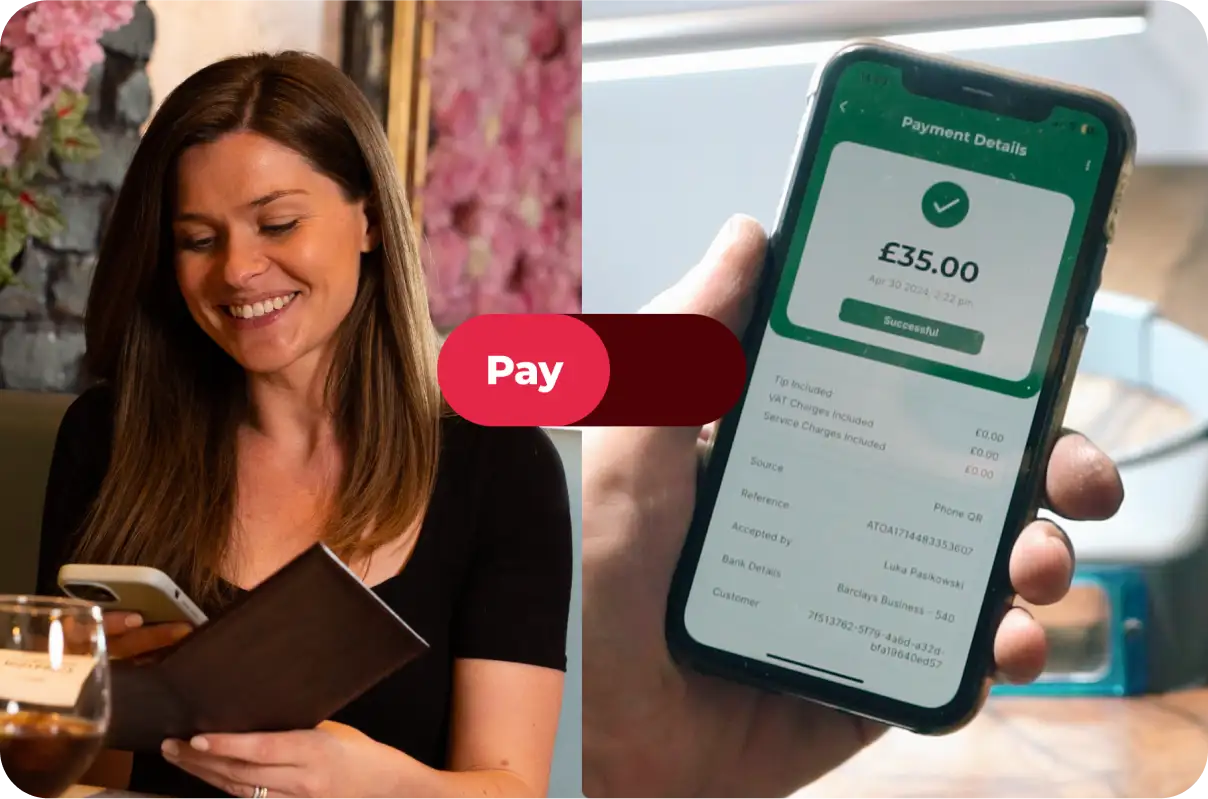

Pay at the table

Integrate Atoa with your hospitality POS so guests scan a QR receipt to pay. Helps reduce waiting times to get more covers (and tips!)

Learn More

…or on the go

Accept payments anywhere by showing customers a QR code on your phone screen. Ideal for tradespeople, showrooms or events.

Learn More

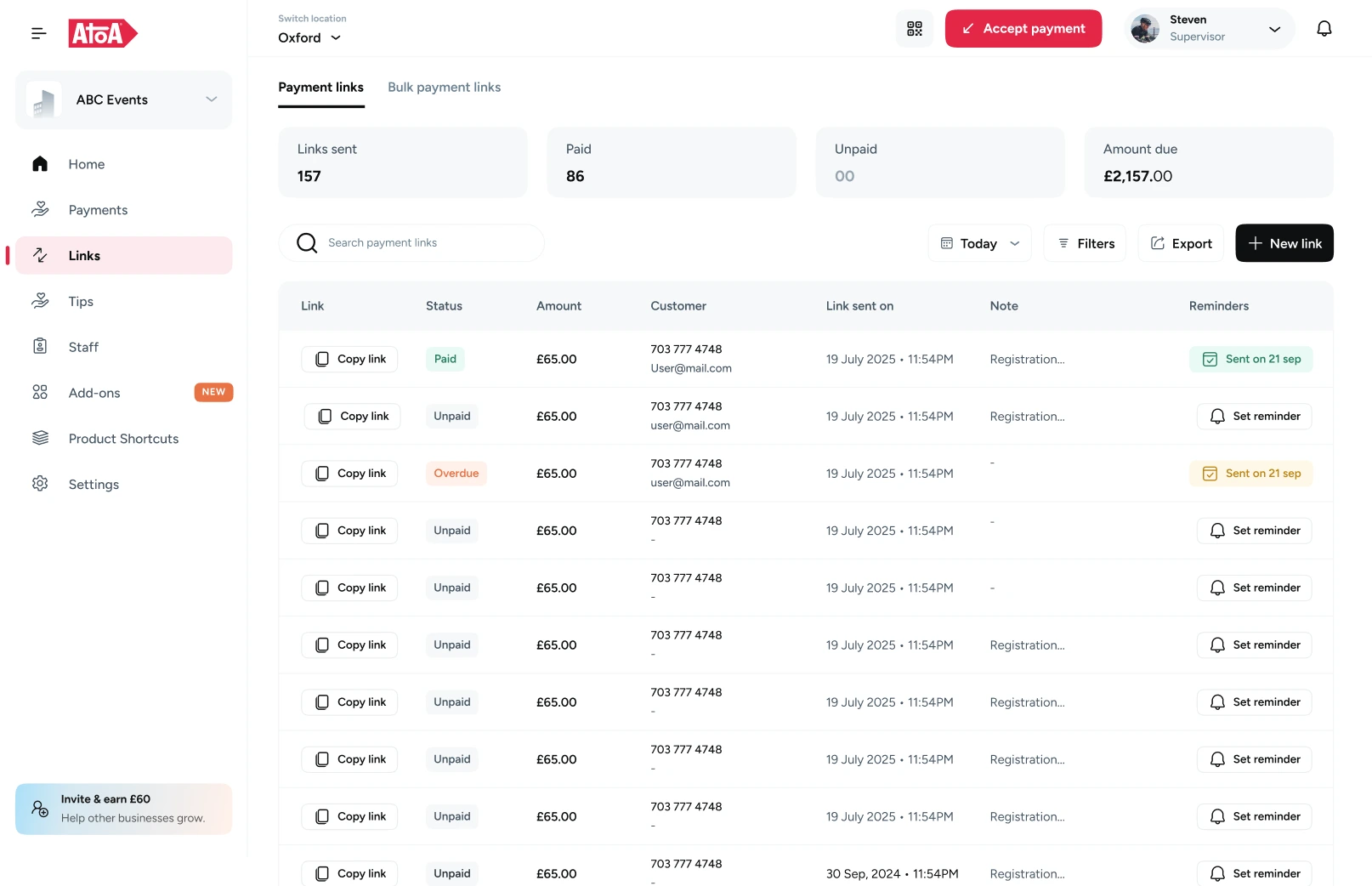

Manage payments on desktop

Use the Atoa Dashboard to send and track payment links. Ideal for busy office teams and call centers.

Learn More

Get paid in-store…

Display QR code stands in-store for customers to scan and pay from their bank app. No hardware fees, no hassle.

Learn More

Pay at the table

Integrate Atoa with your hospitality POS so guests scan a QR receipt to pay. Helps reduce waiting times to get more covers (and tips!)

Learn More

Don’t lose a sale over price

Make paying easier

for both sides

Take deposits up front

Keep the same link open

Reduce admin and chasing

Take deposits up front

Keep the same link open

Reduce admin and chasing

Why business owners trust Atoa

“Atoa is a game changer for low fees, instant payouts, and amazing customer service!”

Dora, Holimed Beauty, Surrey

“Atoa is far easier for deposits. Customers don’t need to log in to their bank account or transfer money to companies they don’t know.”

Remo, SCC, Leeds

“Money lands in our account instantly and processing fees went down straight away.”

Luka, Goldsmith, London

“If you’re starting a business and wondering how to accept payments, try Atoa. I downloaded the app and got set up in about two minutes.”

Damian, Carter Creative, Manchester

“Since moving to Atoa, we have saved about £6,000 a month in transaction fees. 96% of our payments are now taken via Atoa.”

Jason Drury, Ponko, Cambridge

“Atoa is a game changer for low fees, instant payouts, and amazing customer service!”

Dora, Holimed Beauty, Surrey

“Atoa is far easier for deposits. Customers don’t need to log in to their bank account or transfer money to companies they don’t know.”

Remo, SCC, Leeds

“Money lands in our account instantly and processing fees went down straight away.”

Luka, Goldsmith, London

“Since moving to Atoa, we have saved about £6,000 a month in transaction fees. 96% of our payments are now taken via Atoa.”

Jason Drury, Ponko, Cambridge

“If you’re starting a business and wondering how to accept payments, try Atoa. I downloaded the app and got set up in about two minutes.”

Damian, Carter Creative, Manchester

Join thousands of businesses growing with Atoa

Frequently asked questions

Email us at hello@paywithatoa.co.uk to get in touch

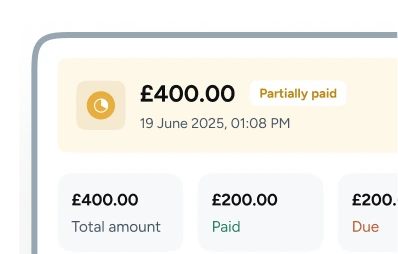

In the Links tab, check the Status column for each payment. If a payment has been partially completed, it will show as ‘Partially paid’ and show you the amount left due. Once the full amount is received, the status will automatically update to ‘Paid’.

Yes. When partial payments are enabled, the customer can enter any amount up to the total balance. They’ll see the remaining balance each time they open the link.

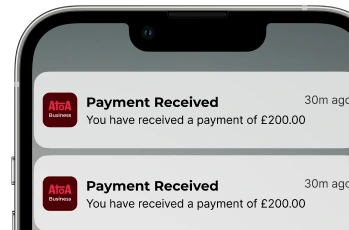

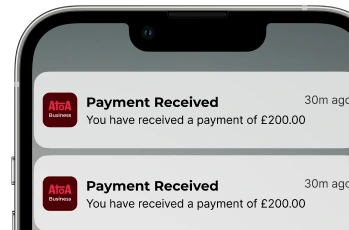

Yes. You’ll receive a notification each time the customer makes a payment—whether it’s partial or full—so you can keep track of progress without checking manually.

No. Once a link is sent with partial payments enabled, that setting can’t be changed. If you no longer want to accept partial payments, you’ll need to create a new link with the full amount required.

No, partial payments are available with the Advanced Add-on. You can explore more features included in this plan on our pricing page.