Ready to get started?

Easily integrate next-generation payments and financial data into any app. Build powerful products your customers love.

In bustling cities across Asia, it’s commonplace for individuals to chat with friends, order meals, pay bills, and even book doctor appointments—all within a single application. As Western businesses observe this trend, there’s much to learn from the success of these digital ecosystems.

Could the UK be next in line for a super app revolution? Let’s explore what’s driving the success of these platforms in Asia and what UK businesses can learn from them.

What exactly is a super app?

Unlike regular apps that serve one purpose (like Uber for rides or PayPal for payments), a super app bundles multiple services—such as messaging, payments, e-commerce, and more—into one unified platform. It’s a digital Swiss Army knife—versatile, efficient, and designed to keep users engaged.

Some of the biggest examples include:

- Tata Neu (India) – India’s first super app, launched by Tata Group, brings shopping, travel, finance, and food delivery together in one platform.

- WeChat (China) – Started as a messaging app but now lets users pay bills, shop, book, and flights. Its integration of WeChat Pay allows users to complete transactions effortlessly, making cash nearly obsolete in many Chinese cities.

- Grab (Southeast Asia) – Began as a ride-hailing app and expanded into food delivery, insurance, and even investment services.Its partnerships with major brands and continuous innovation have solidified its position in the market.

These platforms thrive on one thing: integration. By offering everything in one place, they simplify life for users and keep them coming back.

What’s driving their success?

1. Payments that keep you hooked

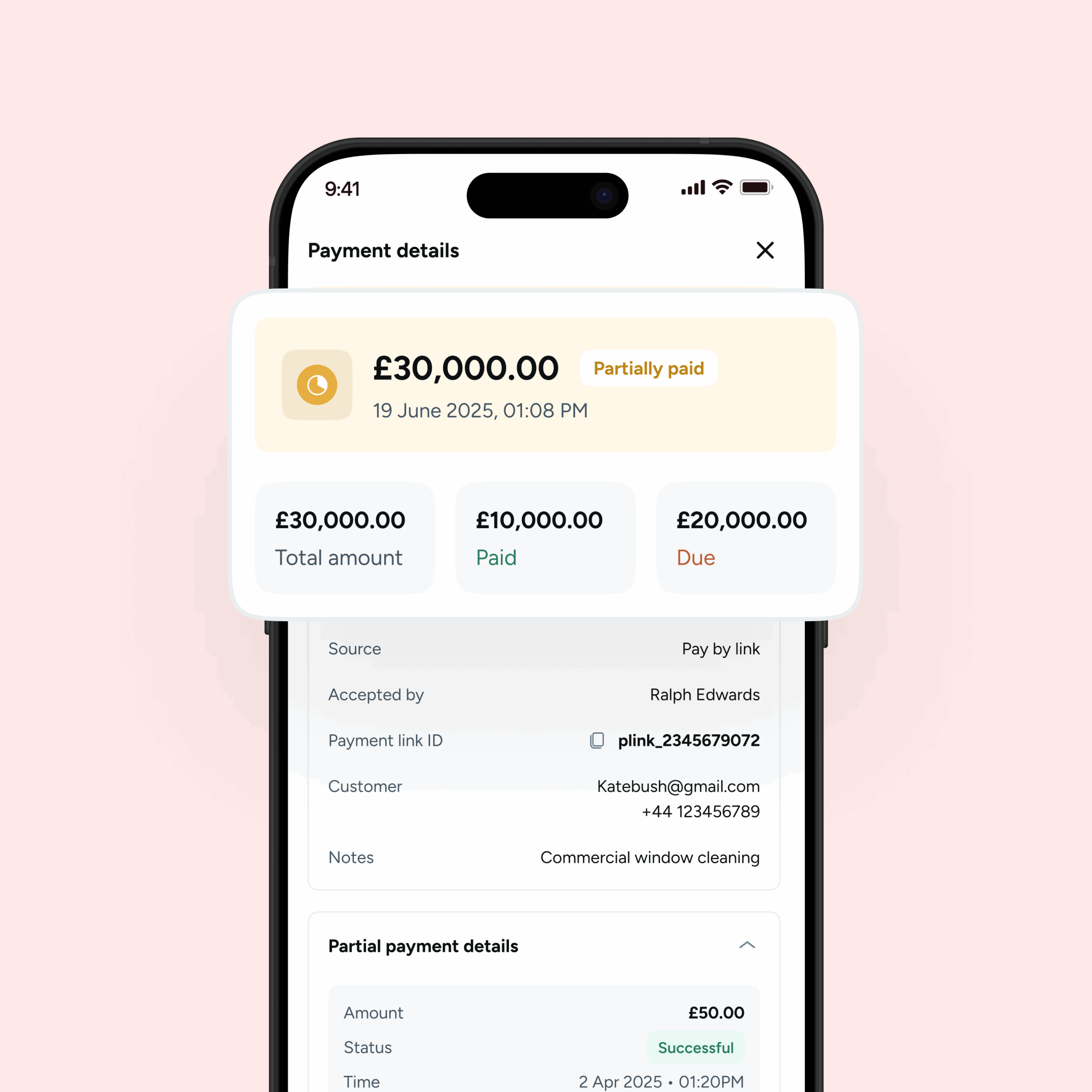

Super apps aren’t just about convenience—they’re powered by integrated payment systems. WeChat Pay and GrabPay allow users to make instant transactions within the app, making it effortless to shop, split bills, or even donate to charity.

For UK businesses, this highlights the importance of frictionless payments. Open banking is already laying the groundwork, allowing businesses to offer seamless, direct-from-bank transactions without the need for cards.

2. Loyalty programs that work like magic

One reason super apps keep users engaged is their rewards and loyalty schemes. For example, Tata Neu offers “NeuCoins,” which can be used across multiple Tata services, from grocery shopping to booking flights. By rewarding users for staying within the app, they create a cycle where people keep returning to earn and spend points.

In the UK, businesses can replicate this by linking loyalty programs with digital payments—offering discounts or cashback for using direct payment methods instead of cards.

3. Convenience beyond just payments

Super apps remove friction from everyday activities. Instead of switching between multiple apps, users can do everything in one place.

For example:

- WeChat users can message a friend, then instantly send them money within the same chat.

- Grab customers can book a ride, then order their dinner while en route.

- Tata Neu users can browse electronics, then apply for a loan to finance their purchase—without leaving the app.

UK businesses don’t need to build full-scale super apps, but they can offer smoother experiences by integrating payments, services, and rewards into a unified platform.

What UK businesses can learn

While the western market differs from Asia’s, there are valuable insights UK businesses can adopt:

- Embrace integration: Combining services can enhance user experience. For instance, integrating payment solutions with loyalty programs can streamline processes for customers.

- Leverage open banking: The UK’s open banking initiative allows businesses to access financial data (with consent), enabling the creation of integrated services akin to super apps. This can lead to personalised offerings and improved customer satisfaction.

- Focus on user experience: Simplifying interfaces and reducing friction in transactions can significantly boost user engagement and loyalty.

- Collaborate for expansion: Partnerships can facilitate service diversification. For example, collaborating with fintech brands like Atoa can introduce new financial services to your platform.

In conclusion

Super apps succeed by integrating payments, shopping, and services into one seamless experience, and while the UK isn’t quite there yet, businesses can still adopt key elements to stay ahead. Features like integrated payments via open banking, loyalty programs that reward engagement, and bundled services that simplify customer experiences can drive long-term success.

Western companies like Revolut and Uber are already moving in this direction. Revolut has expanded beyond banking to offer crypto trading, insurance, and stock investments, inching closer to becoming a financial super app. Uber is exploring travel bookings and financial services to turn its app into more than just a ride-hailing service. Retailers like Tesco and Sainsbury’s already integrate banking, grocery delivery, and loyalty rewards in their apps—but there’s room for more innovation. The takeaway? Customers love convenience. Businesses that offer bundled services, easy payments, and a seamless user experience will win long-term loyalty.

Although the UK is moving more cautiously in this space compared to Asia, businesses that prioritise frictionless experiences and multi-service integration will be the ones shaping the next evolution of consumer engagement.