Ready to get started?

Easily integrate next-generation payments and financial data into any app. Build powerful products your customers love.

Running a car dealership in the UK isn’t just about selling cars—it’s about keeping the business running smoothly without burning through cash. And one of the biggest expenses eating into profits? Staffing costs. With rising employer National Insurance contributions and higher minimum wages, keeping a well-oiled team on board is getting pricier. In fact, according to the British Retail Consortium (BRC), these changes are set to drive up retailers’ labour costs by a staggering £5 billion in 2025. That’s a hefty bill no dealership can ignore.

For UK car dealerships, staffing costs have become a primary concern. A survey by Startline Motor Finance revealed that 40% of used car dealers identified rising staff costs as their biggest worry heading into 2025. This concern underscores the need for dealerships to explore strategies that can mitigate these expenses without compromising operational efficiency.

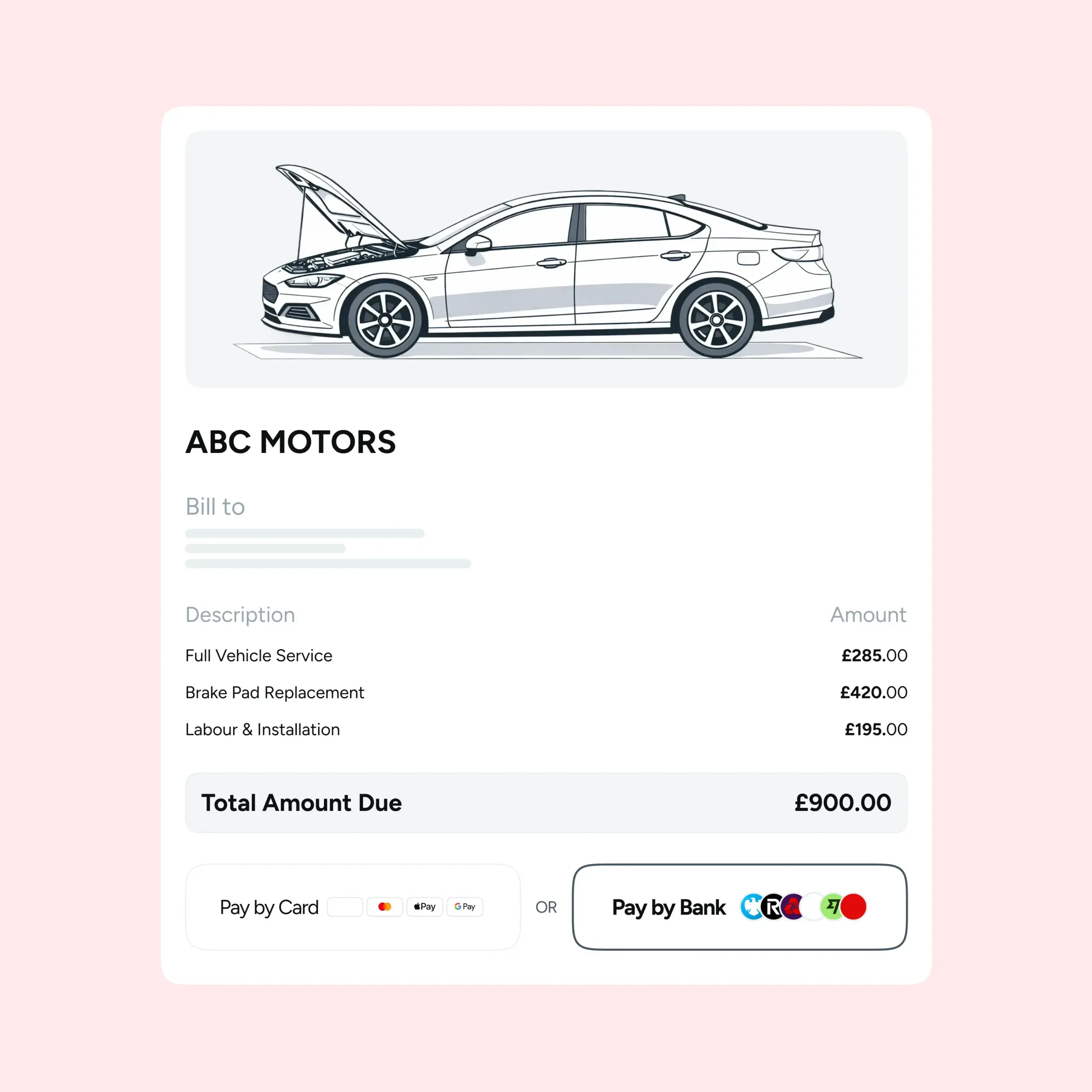

The impact of traditional payments on staffing costs

Traditional payment methods, such as credit and debit card transactions, often involve manual administrative tasks that can inflate staffing costs. These tasks include:

- Manual data entry: Processing card payments often means manually entering transaction details, increasing the risk of errors and adding extra time for corrections. Small mistakes can lead to big headaches for staff and customers alike.

- Time-consuming reconciliation: Matching payment records with bank statements isn’t always straightforward. The process can be labour-intensive, requiring meticulous attention to detail from finance teams to avoid discrepancies.

- Fraud management: Traditional payment systems can be vulnerable to fraud, meaning businesses need dedicated staff to track transactions, detect suspicious activity, and resolve potential issues.

- Payment disputes and chargebacks: Credit card transactions are prone to disputes and chargebacks, requiring staff to investigate and resolve cases. Frequent chargebacks not only increase labour costs but can also impact customer relationships and business reputation.

- Compliance and regulatory requirements: Businesses must adhere to industry standards like PCI DSS when handling payments, which means ongoing staff training and system audits—adding to operational expenses.

- Delayed payments & cash flow impact: Traditional payment methods often involve processing delays before funds become available. This can create cash flow challenges, requiring additional time and resources to manage accounts payable and receivable efficiently.

These manual processes not only consume valuable employee time but also divert attention from core business activities, ultimately leading to higher labour expenses.

Benefits of adopting instant bank payments

Embracing instant bank payments presents a viable solution for car dealerships aiming to reduce staffing costs. The advantages include:

- Less manual work: Instant bank payments move money directly between customers and dealerships, cutting out the need for manual entry. That means fewer errors, less admin, and more time to focus on sales.

- Faster access to funds: With payments clearing instantly, dealerships don’t have to wait days for their money. Better cash flow means less reliance on short-term credit and more control over finances.

- Stronger security: Instant payments come with built-in authentication features that help prevent fraud. With fewer security risks, dealerships can save time and money on fraud prevention and monitoring.

- Better customer experience: No one likes waiting around for payments to go through. Instant transactions make the process smooth and hassle-free, keeping customers happy and more likely to return.

- Smarter cash flow management: When money is available immediately, dealerships can reinvest in inventory, marketing, and other business needs without delays. That kind of flexibility helps drive growth.

- Staying ahead of the competition: Offering instant payments shows customers that a dealership is forward-thinking and easy to do business with. It’s a simple way to stand out from competitors still using slow, outdated payment methods.

Collectively, these benefits can lead to a significant reduction in staffing costs associated with payment processing.

Implementing instant bank payment systems in dealerships

To successfully use instant bank payment systems, dealerships should consider the following steps:

- Assess current payment processes: Identify inefficiencies in existing payment workflows to understand where improvements can be made.

- Select a suitable payment platform: Choose a provider that offers secure, user-friendly instant bank payment solutions compatible with the dealership’s operational needs.

- Integrate with existing systems: Make sure the new payment system seamlessly integrates with current accounting and Customer Relationship Management (CRM) software to maintain operational continuity.

- Train staff: Give comprehensive training to employees on the new system to allow a smooth transition and encourage adoption.

- Communicate with customers: Inform customers about the new payment options, highlighting the benefits such as security and convenience to encourage uptake.

Case Study: Ponko Car Dealership

Ponko, a leading car dealership in Cambridge with over 300 vehicles, sought to streamline its payment processes and reduce associated staffing costs. By partnering with Atoa Instant Bank Pay, Ponko shifted 96% of its transactions to instant bank payments. This shift resulted in savings exceeding £6,000 in card fees each month, significantly enhancing their cash flow.

Conclusion

Rising staffing costs are a real challenge for UK car dealerships. Switching to instant bank payments can make a big difference. It’s a smart way to stay efficient and keep operations running smoothly. Now is the time for dealerships to explore instant bank payments and stay ahead in an ever-changing market.