Ready to get started?

Easily integrate next-generation payments and financial data into any app. Build powerful products your customers love.

Xero payments have come a long way. A few years ago, getting an invoice paid felt like a mixture of admin, luck, and a little pleading with the payout gods. Today, with Xero payments, UK businesses finally have real choice in how money arrives. And when you zoom into the details, the differences between cards, Direct Debit, and Pay by Bank are huge, especially for costs and cash flow.

If your business uses Xero every day, this guide breaks down what each payment method really costs, how fast the money lands, and where UK businesses are saving the most in 2025 and 2026.

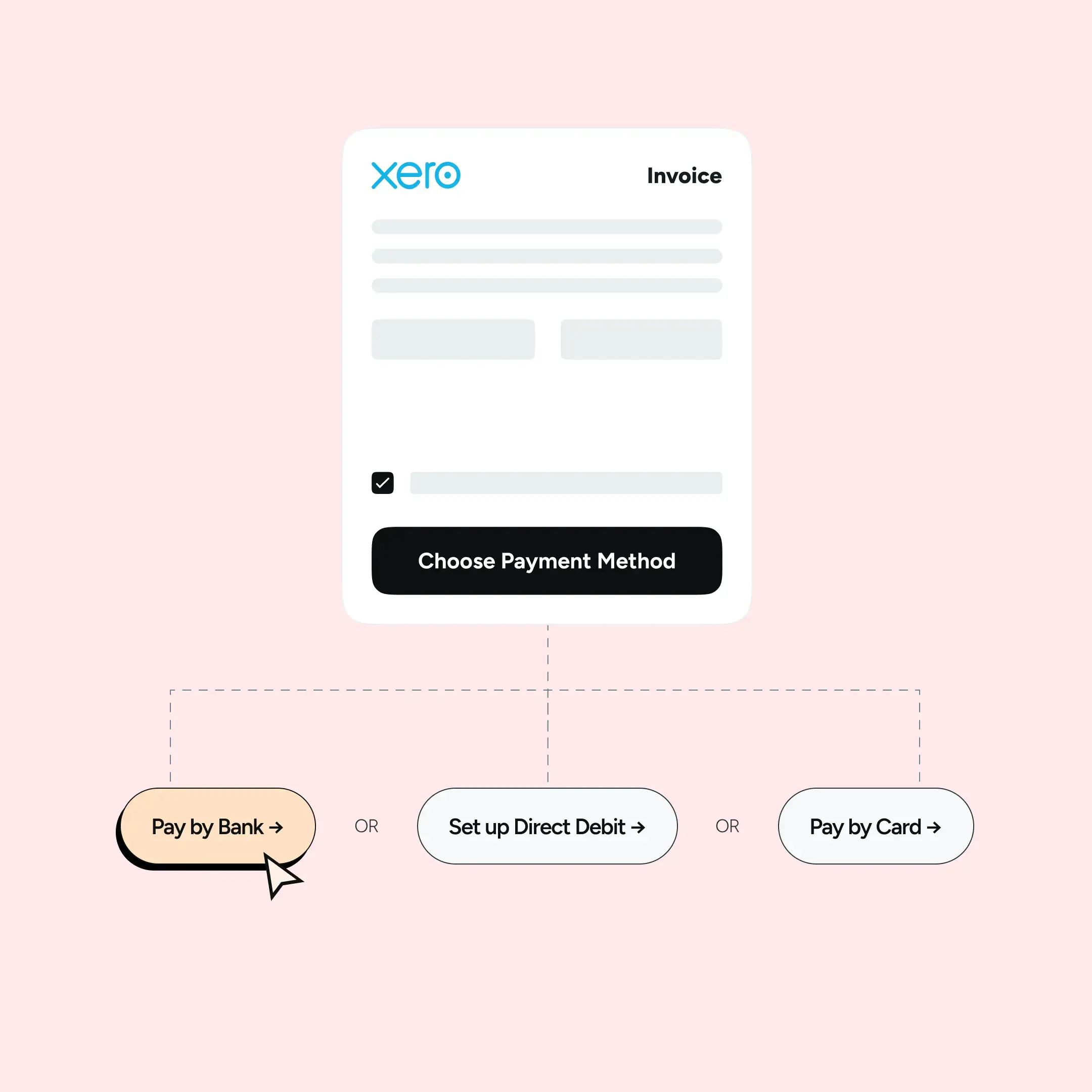

How Xero invoice payments actually work

Xero itself does not process payments. It connects you to providers that handle the actual movement of money. Cards typically run through Stripe or PayPal. Direct Debit usually runs through GoCardless. Pay by Bank uses an open banking provider like Atoa, which lets customers pay directly from their banking app.

Each rail has its own pricing model, fraud exposure, failure rate, and settlement time. That is why choosing the right payment mix is now part of financial strategy, not just admin setup.

Pay by Bank in Xero payments

Pay by Bank is the fastest-growing payment method in Xero. Built on open banking technology, it lets customers approve payments directly from their bank app, creating a secure, instant, and low-cost way to collect invoices. For high-value invoices or businesses tired of card fees, the savings are particularly significant.

Pros

- Very low fixed cost, usually between 20p and 50p

- No percentage fees, no chargebacks, and no card scheme costs

- Instant settlement any time of day

- Strong security with bank authentication

- Clean, automatic reconciliation with bank-verified details

- Excellent for high-value invoices where percentage fees would otherwise be very expensive

- Lower fraud exposure

Cons

- Requires customers to use mobile or online banking

- Adoption is growing quickly but still newer than cards or DD

- Less suitable when invoicing many international customers

Direct Debit in Xero

Direct Debit is the dependable classic. For recurring payments, retainers, and ongoing service agreements, it’s predictable and smooth. Xero integrates this well, which is why many accountants still consider it a safe choice. But for businesses that rely on speed or handle one-off invoices, Direct Debit often feels slow and rigid.

Pros

- Predictable pricing: around 1% plus 20p, capped at roughly £4

- Familiar for customers who pay subscriptions or services

- Fits well for memberships, retainers, and scheduled billing

- Automated collections reduce manual chasing

Cons

- Slow settlement, typically 3-5 working days

- Extra fees for failed or retried payments

- Direct Debit indemnity scheme places dispute liability on merchants

- Not ideal for one-off or larger invoices

- Cash flow can suffer if mandates are cancelled unexpectedly

Card payments in Xero

Card payments remain a default option inside Xero because they’re familiar, widely accepted, and easy for customers to use. But while they feel convenient, they come with the highest overall cost for UK businesses, especially once percentage fees, international charges, and disputes are factored in.

Pros

- Widely recognised and trusted by customers

- Works for both domestic and international payers

- Good for impulse-driven purchases and B2C flows

- Supported across most devices and checkout methods

Cons

- High transaction fees (typically 1.5 – 2.5 percent plus a fixed fee)

- Higher fees for international cards (often 2.9 – 3.5 percent plus a fixed fee)

- AMEX usually above 3%

- Chargebacks cost around £15-£20 per dispute

- Settlement delays of 1-3 days

- Messy reconciliation due to fragmented card data

- Exposure to fraud and network rules

- Refund timelines controlled by card schemes

Cost comparison table

A qualitative comparison that executives can skim in seconds.

| Method | Cost profile | Settlement | Chargebacks | Best use cases |

|---|---|---|---|---|

Cards | High and variable due to percentage fees and extras | 1–3 days | Yes | General ecommerce and international customers |

Direct Debit | Moderate and predictable but slow | 3–5 days | Yes through the DD indemnity scheme | Subscriptions and recurring billing |

Pay by Bank | Lowest overall with flat fees | Instant | No | High value invoices, professional services, B2B payments |

Scenario comparison

The higher the invoice value, the bigger the gap in fees, here’s the difference in real terms.

Example: £50,000 in monthly invoice volume

- Cards might cost £1,200- £1,600

- Direct Debit around £300- £400

- Pay by Bank between £20- £50

Example: High value invoices of £5,000 or more

- Cards become disproportionately expensive

- Direct Debit delays cash flow

- Pay by Bank remains flat and instant

Operational differences that affect cost

Beyond the fees, each method works very differently in practice. Pay by Bank is the quickest to reconcile because payments settle instantly with clear bank-verified data. Card payments and Direct Debit can fail without notice, creating extra admin and follow-ups. Refunds also vary: open banking refunds are controlled by the merchant, while card refunds must follow scheme timelines. Fraud risk is lowest with bank-authenticated payments, giving Pay by Bank a clear operational advantage.

When each method makes sense

Each option has its strength. Cards are useful when you need broad coverage or expect international customers. Direct Debit fits scheduled billing, from retainers to memberships. Pay by Bank works best for most invoices, especially higher-value ones, because it’s cheaper, faster, and more reliable.

Most UK businesses now use a mix of all three: cards as a backup, Direct Debit for recurring payments, and Pay by Bank for day-to-day invoicing where cost and speed matter most.

Conclusion

The cost of getting paid is no longer fixed. Cards bring convenience but at a high price, Direct Debit is steady but slow, and Pay by Bank offers a faster, cheaper, and cleaner way to collect Xero payments. For finance teams focused on margins and cash flow, shifting more invoices to open banking delivers the quickest gains. And for UK businesses exploring Pay by Bank inside Xero, Atoa offers fast settlement, predictable pricing, and a payment flow customers already trust.