Ready to get started?

Easily integrate next-generation payments and financial data into any app. Build powerful products your customers love.

Running a business often means juggling payments from different places like card terminals, bank transfers, online links, and more. And when those payments hit different bank accounts, keeping track can turn into a spreadsheet nightmare. The daily reconciliation process can quickly become a time sink. Bank feed is designed to fix that.

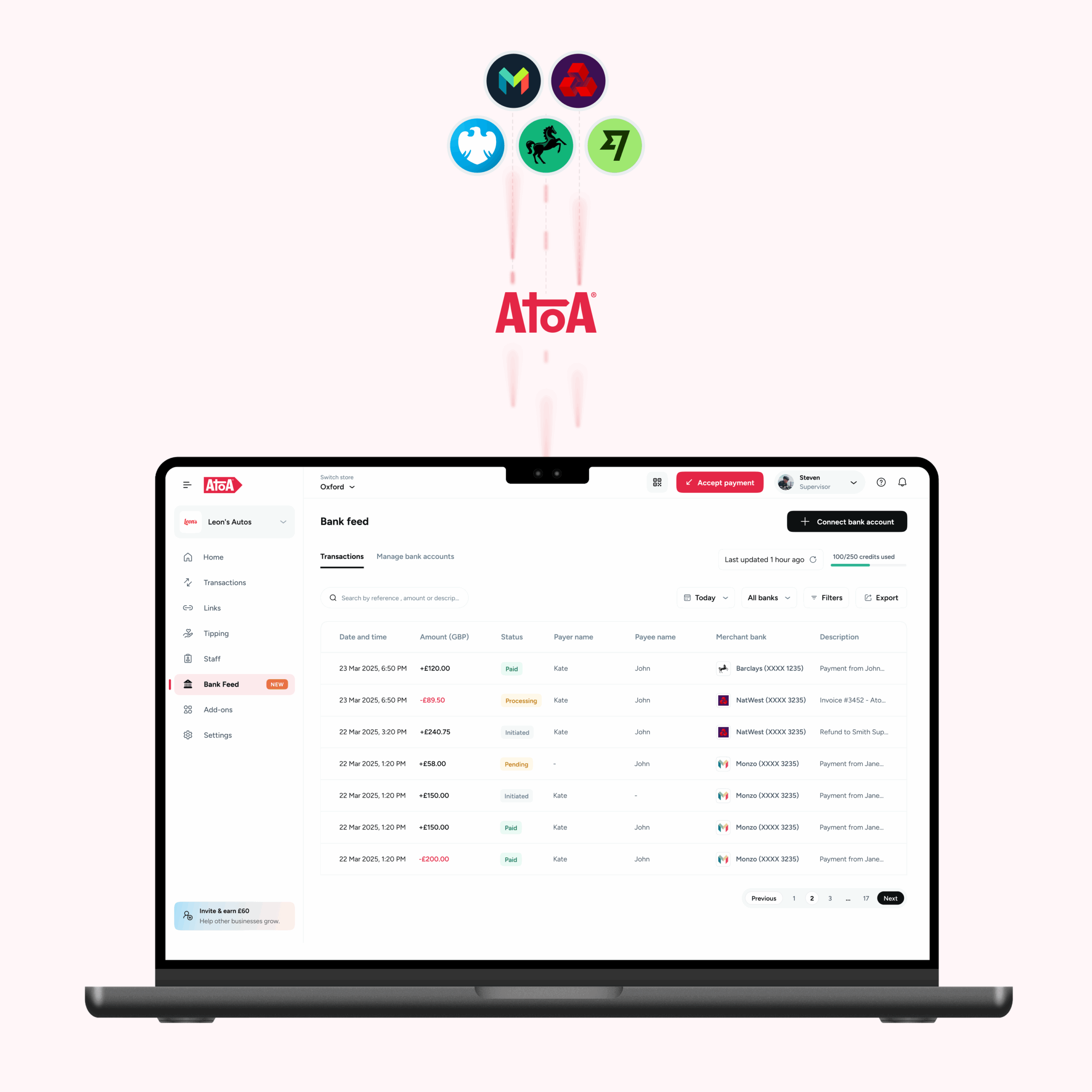

Bank Feed on Atoa lets you connect your bank accounts and view all your transactions in one place. Not just those made through Atoa, but any payment across your linked accounts. It’s a smarter way to stay in control of your cash flow, streamline bookkeeping, and reduce the back-and-forth across apps and spreadsheets.

Why it matters now

UK businesses are managing payments remotely, digitally, and across multiple channels. According to UK Finance, 87% of UK adults used remote banking in 2023—with 62% using online banking and 60% using mobile banking. While payment behaviour has rapidly modernised, reconciliation processes often lag behind.

That’s where the real-time view of your bank feed steps in, not just to centralise your view, but to automate the admin that comes with managing multiple accounts and payment sources. Whether you’re checking if a client has paid, confirming a supplier transaction, or just getting a real-time snapshot of balances, having your bank feed on Atoa makes it easy.

How will your business benefit from Bank feed

Whether you’re the one reviewing transactions or you’re giving your finance team the tools to work smarter, it brings clarity to the chaos.

- Connect multiple bank accounts and view all transactions, not just Atoa ones

- Cut down manual data entry and speed up reconciliation

- Improve visibility over daily cash flow and payment status

- Give staff tailored access, from view-only to account management

- Eliminate time lost switching between banking platforms

How to access Bank feed on Atoa

To enable your Bank feed, you’ll first need to contact the Atoa team at hello@paywithatoa.co.uk. Once it’s turned on for your business, setup takes just a few minutes.

You can connect existing bank accounts already linked to Atoa or add new ones securely through your banking app. And if you need a full walkthrough, our Help Centre article covers every step, including screenshots and tips.

Clearer books. Less chasing. More control.