Ready to get started?

Easily integrate next-generation payments and financial data into any app. Build powerful products your customers love.

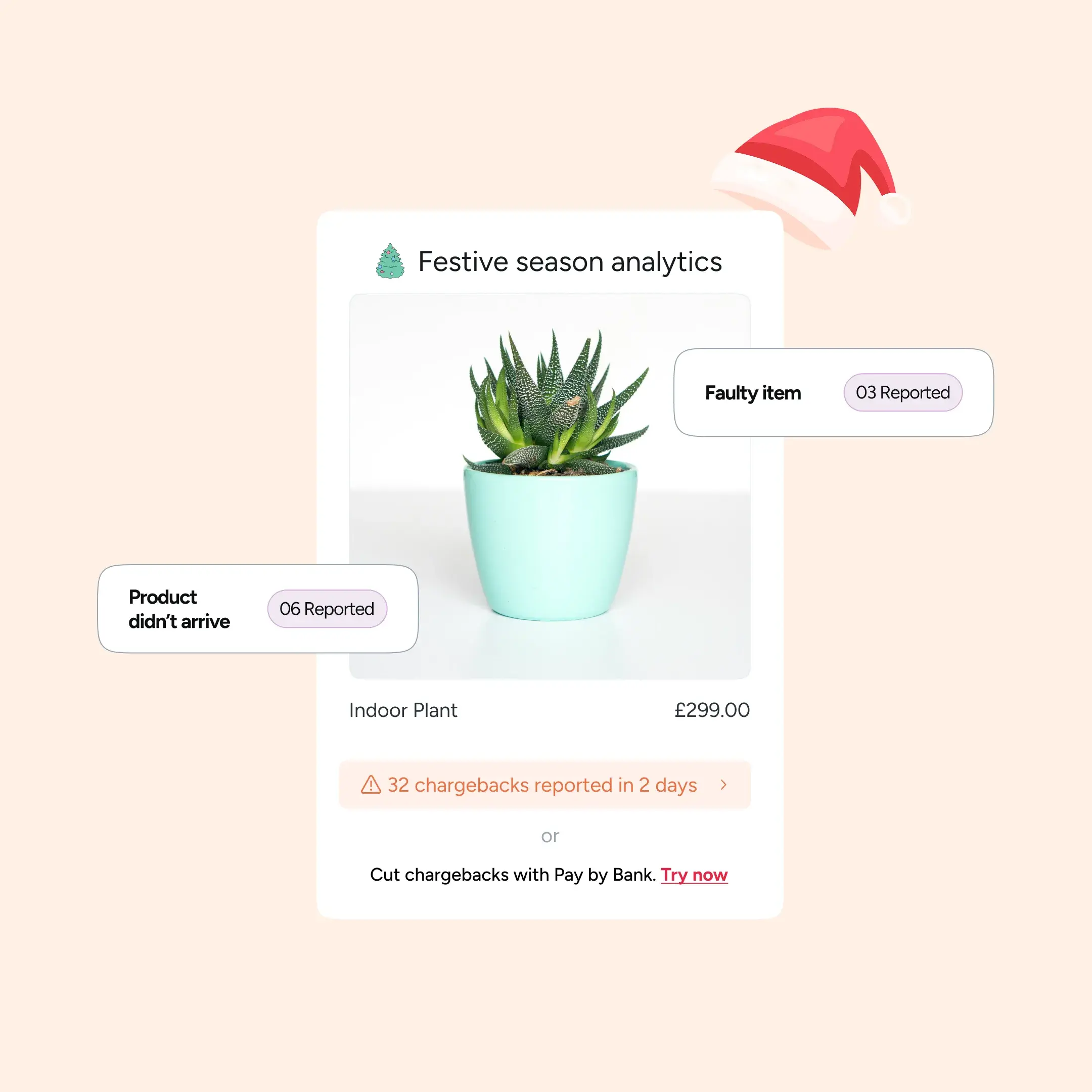

The holiday season is a time of festive cheer… and for many UK merchants, a spike in what’s known as “friendly fraud.” With higher order volumes, last-minute purchases, gift deliveries, and stretched holiday return windows. It’s also a peak period for disputes, chargebacks, and refund abuse. If merchants don’t prepare, the December–January rush can quietly turn into a drain on profits and cash flow.

This guide explains why friendly fraud rises during the holidays. What it actually means for retailers, and how switching to open banking payments can build a strong defence, without sacrificing checkout convenience or customer experience.

What is friendly fraud and why it matters

Friendly fraud happens when a customer disputes a legitimate order, often after receiving the goods, claiming it was unauthorised, never arrived, or was unsatisfactory. This isn’t identity theft or stolen-card fraud. It’s first-party, the buyer intentionally or mistakenly triggers a chargeback.

For merchants, friendly fraud carries heavy costs. This includes lost stock (since the buyer keeps the goods), chargeback fees, administrative overhead, disrupted inventory and cash flow. Because card networks tend to side with consumers by default, many valid disputes go in favour of buyers.

During the holiday rush, when order volumes soar and returns increase, especially with gifts and last-minute purchases, friendly fraud tends to spike. One recent global survey estimated friendly-fraud claims could rise by 25% during peak holiday shopping days.

Where traditional payment rails fall short

Card-based payments add several vulnerabilities when order volumes are high, especially at holiday scale:

- Ease of chargeback claims: Customers can dispute many legitimate orders with minimal friction (claiming “item not received,” even when delivery was confirmed).

- Delayed settlement: Merchants may ship or fulfil orders before the funds are fully settled. This means that if a chargeback hits, they’ve already lost stock.

- High return and refund load: Returns, delayed deliveries or worn-item returns multiply complexity and increase dispute risk.

- Administrative burden: Managing and contesting multiple chargebacks wastes time and adds costs, often outweighing profit from the sale itself.

Combined, these create a perfect storm: high volume + high risk.

Why open banking payments are a better defence

Open banking payments offer structural advantages that help curb friendly fraud:

- Bank-authenticated payments: Customers approve payments directly within their banking app (with strong authentication). This makes unauthorised chargeback claims harder for those who actually bought legitimately.

- No card network chargeback system involved: Since there’s no reliance on cards or networks, the classic chargeback mechanics don’t apply. That removes a major fraud/abuse vector.

- Instant or near-instant settlement: Funds clear right away, reducing merchant exposure during delivery or returns, and improving cash flow and working capital.

- Better traceability and clarity: Bank-to-bank transaction records provide clear, auditable proof of payment. This is helpful if delivery tracking or customer disputes get messy.

For a holiday-season order (especially gifts, high value goods, or multiple ship-to addresses), this adds up to far stronger protection, without adding friction for genuine customers.

Holiday-ready payment & fraud best practices for UK merchants

To make the most of open banking payments and minimise friendly fraud risk, merchants can combine smart payment rails with operational hygiene. They would:

- Require bank-authenticated payments for high-value or gift orders — customers complete payment through their bank app before fulfilment.

- Use tracked and signed delivery / courier services — delivery confirmation helps in case of disputes.

- Maintain clear audit trails — keep order confirmation, delivery proof, payment receipts; if a dispute arises, you have evidence.

- Be transparent about returns/refunds — clear policy helps reduce “buyer’s remorse” disputes or abuse.

- Set higher thresholds or extra verification for repeat dispute-prone accounts — monitor and flag suspicious repeat returns/disputes.

- Educate customers upon checkout — letting them know payment is bank-authenticated and final can deter misuse of chargebacks.

- Monitor payment rails and supplier commitments — faster settlement helps with inventory planning, especially during busy holiday stock turnover.

Holiday-friendly fraud in action

Take a typical Christmas purchase: a £450 gift ordered online and shipped with tracking confirmed. If the buyer paid using a card, they can still call their bank after the holidays and claim they never received the item. The bank then steps in, pulls the money back from the merchant, and launches a chargeback investigation. Even if the merchant proves delivery, they still face admin costs, lost time, and no guarantee of winning the dispute. Card schemes are designed to protect consumers first, which means honest businesses often pay the price when claims are exaggerated or simply untrue.

Pay by Bank works differently. Because customers authenticate payment directly through their bank app using Face ID or fingerprint. This way, the transaction is already verified as genuine. If a customer later disputes delivery, they must raise that issue directly with the business rather than triggering an automatic forced refund through their bank. The merchant stays in control of both the funds and the evidence, and refunds only happen once the claim has been properly reviewed. Delivery disputes are still possible, of course, but without the chargeback shortcut, so-called “friendly fraud” becomes far harder to exploit.

Why now is the right time to act

Open banking adoption in the UK continues to grow, supported by regulation and infrastructure improvements. As ecommerce volume increases and holiday-season peaks approach, relying on legacy card rails with their chargeback risks becomes an increasingly dangerous gamble.

By combining secure, bank-authenticated payments with clear fulfilment and return processes, merchants can treat friendly fraud like the business risk it is and not an unavoidable cost of doing business. If there’s one proactive step to take ahead of the next busy season, it’s this: give customers a friction-free, bank-to-bank payment option and protect your store from a surge in friendly fraud.