Ready to get started?

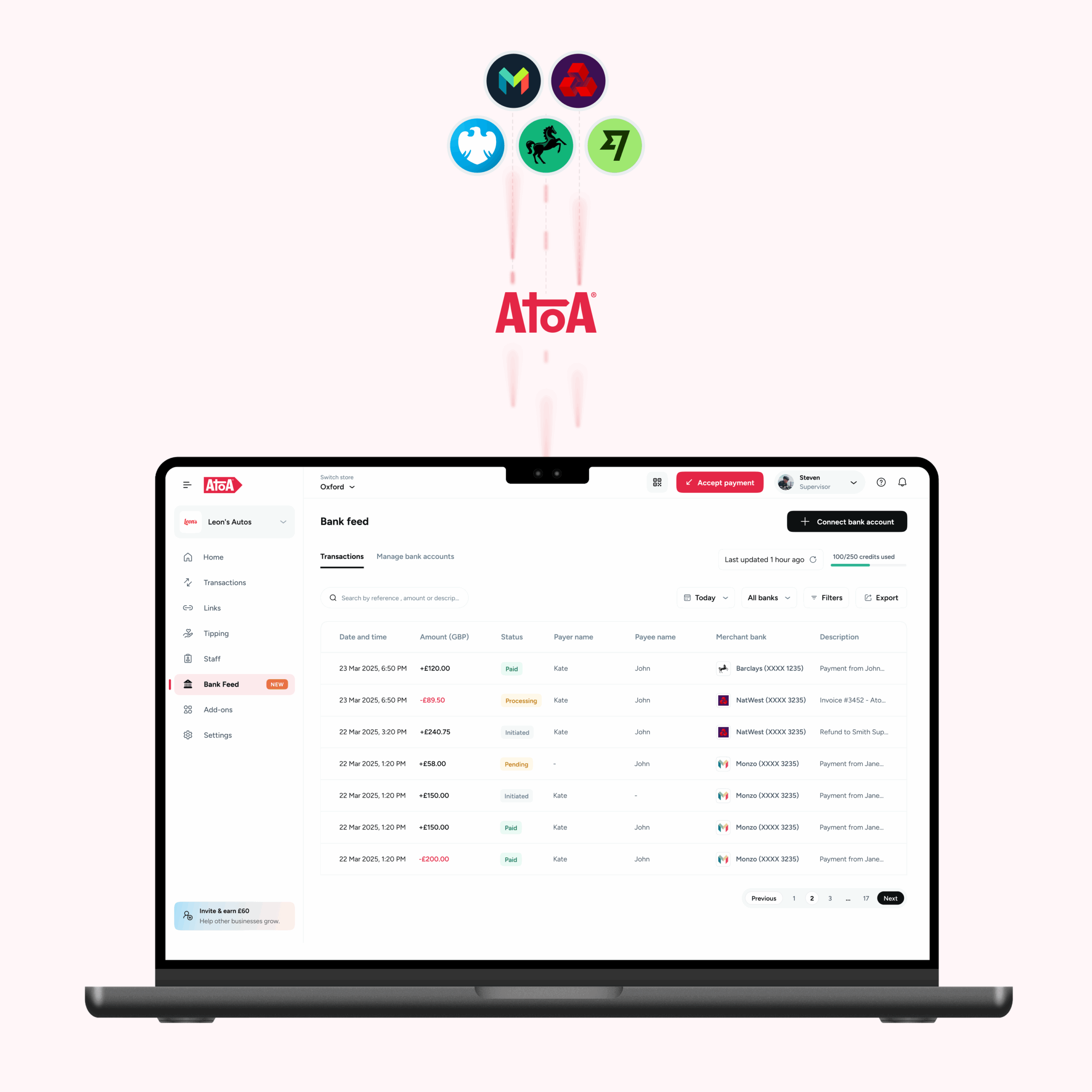

Easily integrate next-generation payments and financial data into any app. Build powerful products your customers love.

Recurring payments power everything from gym memberships and streaming services to software subscriptions and utility bills. Yet the infrastructure behind these payments has barely changed in decades. Direct Debits are slow and rigid. Card-on-file subscriptions are fragile and expensive. Standing orders lack flexibility. A new payment model is now emerging in the UK that could fundamentally change how recurring payments work. It is called Variable Recurring Payments, or VRP.

What are Variable Recurring Payments?

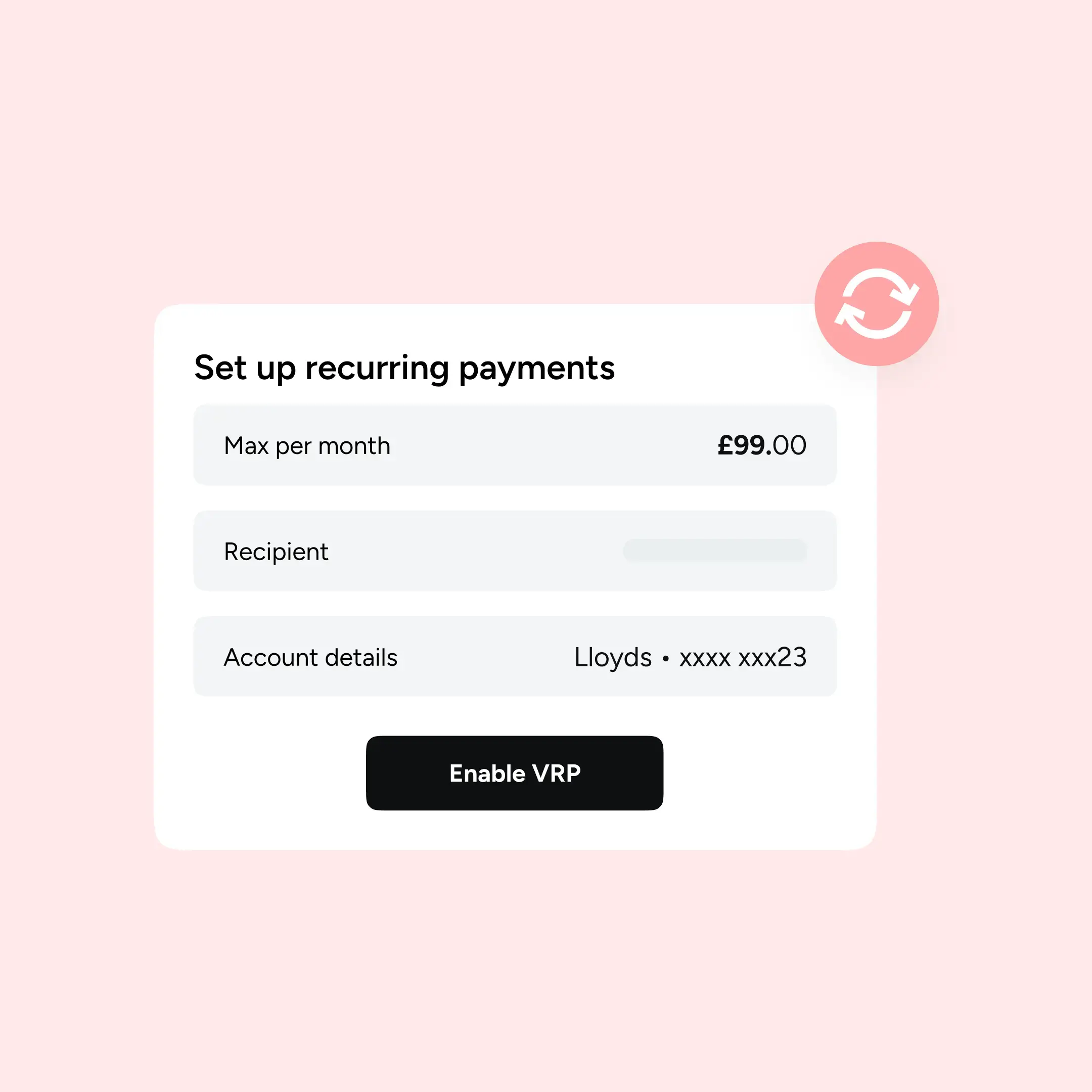

Variable Recurring Payments are a new type of payment instruction enabled through open banking. They allow customers to securely connect an authorised payment provider to their bank account and give permission for payments to be made on their behalf within agreed rules.

Unlike traditional recurring payments, this permission is not vague or open-ended. The customer sets clear parameters at the start. These can include:

- How much can be taken over a defined period, such as per day, month, or year

- Whether the payment permission has an end date

- Which organisation is allowed to collect the payment

Crucially, these permissions are visible inside the customer’s own banking app. The customer remains in control throughout.

Why VRPs are considered a breakthrough

VRPs offer something that existing recurring payment methods struggle to provide: clarity and control for both sides.

With card subscriptions, banks can usually only show the transactions that have already happened. They cannot show which subscriptions are active or what future amounts might be. With Direct Debit, customers can see mandates, but there is typically no cap on how much can be taken in future.

VRPs change that dynamic. Customers can see who has permission to collect payments, what the limits are, and how long the permission lasts. They can amend or cancel permissions directly, often right up until the moment the payment becomes irrevocable.

This level of transparency has not existed in mainstream recurring payments before.

Why regulators care about VRPs

The Competition and Markets Authority recognised the potential of this technology early. It required nine major UK banks, known as the CMA9, to implement VRP APIs as part of the open banking framework.

The initial mandate focused on a use case called sweeping, which involves moving money between a customer’s own accounts. For example, transferring surplus funds into savings or automatically repaying borrowing when funds become available.

Sweeping might sound niche, but it has powerful implications. It can help customers build savings habits, reduce reliance on short-term credit, and manage money more intelligently. It also increases competition between banks by making it easier for customers to move money across providers.

What VRPs unlock beyond sweeping

While only sweeping VRPs have been mandated, there is growing recognition that non-sweeping VRPs could deliver significant value for everyday payments.

Potential use cases include:

- Subscriptions such as streaming services, software, or memberships

- Regular bills like utilities and telecoms

- Helping individuals set aside tax or VAT automatically

- Reducing the complexity and disputes associated with Direct Debit indemnity claims

For businesses, this could mean more predictable collections, fewer failed payments, and lower processing costs compared to cards. For consumers, it means fewer surprises, less manual form filling, and greater confidence in long-term payment commitments.

How VRPs differ from existing methods

Traditional recurring payments are built around the idea that once permission is given, control shifts largely to the organisation collecting the money. But VRPs reverse that. Control stays visibly with the customer. Limits are explicit and visibility is built in. Moreover, changes can be made in real time.

That combination of real-time authorisation, transparent permissions, and customer-defined boundaries is what makes VRPs fundamentally different.

What this means for the future of payments

VRPs signal a shift in how recurring payments are designed. Away from rigid mandates and fragile card dependencies. Towards systems that are digital-first, transparent by default, and designed around customer control.

The infrastructure is still evolving and bank support is expanding too. Commercial use cases are still being explored. But the direction is clear. Recurring payments are being rebuilt. And for businesses that rely on subscriptions, instalments, or regular billing, understanding VRPs now is not just useful but also strategic.