Ready to get started?

Easily integrate next-generation payments and financial data into any app. Build powerful products your customers love.

Collecting payments through Xero should feel effortless. Clients should be able to pay you in seconds, finance teams should have instant visibility on cash flow, and fees should not eat into margins. Today, the simplest and most cost-effective way to achieve that is by letting customers pay directly from their banking app using Pay by Bank.

Atoa for Xero: The fastest, lowest-cost way to get paid

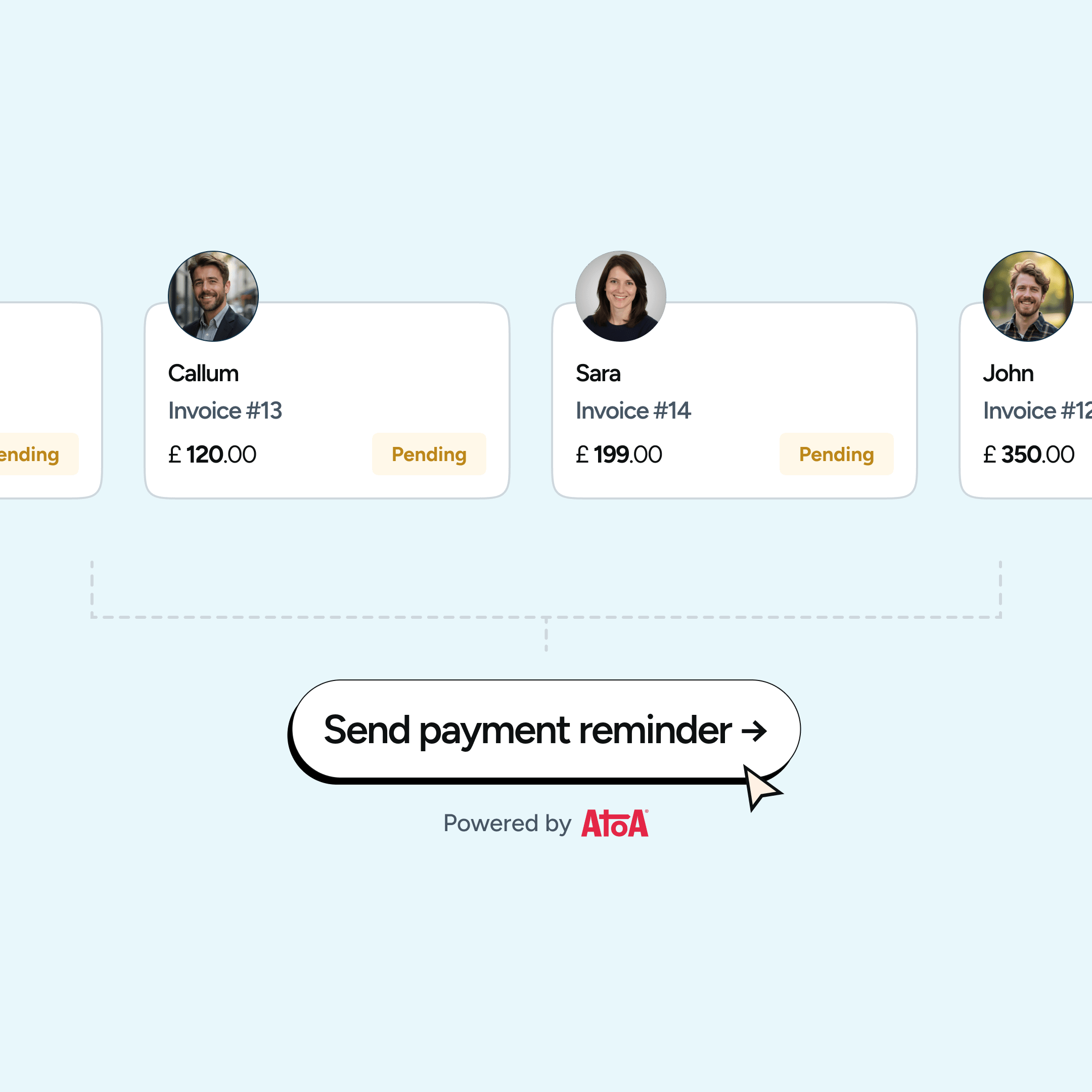

Atoa is a Xero App Store app that adds a native “Pay by Bank” button to every Xero invoice. When clients click “Pay now,” they are taken to a secure Atoa Pay by Bank page and confirm payment instantly through their mobile banking app.

What you get with Atoa for Xero:

- Up to 50% lower fees compared with card payments

- Instant settlement so cash hits your account right away

- No chargebacks because it is account-to-account

- Automatic reconciliation inside Xero as soon as the payment lands

- Seamless client experience, directly from the invoice

- Fewer late payments, since the flow takes seconds

This is the smoothest way to turn Xero into a modern, low-cost payment system.

Why collecting payments through Xero can still be hard

Even with Xero’s strong invoicing system, many businesses struggle with slow payments and unnecessary admin.

Typical pain points:

- Card fees with Stripe or similar gateways reduce margins

- Manual payment chasing takes time

- Bank transfers introduce errors in references or amounts

- Clients forget to pay when the process feels clunky

- Slow settlement slows down cash flow forecasting

The question most finance leaders ask is simple: “How do we make it effortless for clients to pay correctly and on time?”

The easiest ways to collect payments through Xero (ranked)

Below are the mainstream options businesses use today, ranked by simplicity, cost, and admin burden.

1. Pay by Bank via Atoa (fastest, lowest cost, zero admin)

Atoa’s native integration with Xero gives your clients a one-tap checkout from the invoice itself. They confirm payment in their mobile banking app and you receive funds near-instantly.

Why businesses choose Atoa:

- Cuts payment costs significantly

- Eliminates late payments caused by friction

- Removes reconciliation work

- Protects against card disputes

- Works perfectly for one-off invoices and high-value payments

Example:

A dental equipment supplier using Xero added Atoa’s Pay by Bank button to invoices. Their customers now pay within minutes, late payments fell sharply, and the business cut thousands per month in card processing costs.

2. Card payments (simple but expensive)

Stripe, Square, and similar providers can also add a payment button to Xero invoices.

Pros:

- Familiar experience for clients

- Useful if you take lots of online B2C payments

Cons:

- Higher fees

- Slower settlement

- Chargeback exposure

- Not ideal for high-value invoices

3. Manual bank transfers (free but high admin)

Some businesses still rely on clients manually sending bank transfers.

Pros:

- No gateway fees

Cons:

- High admin due to matching payments

- Mistyped references create reconciliation issues

- Clients often delay payment

- No automated reminders or tracking

4. Direct Debit (great for recurring, slow for one-offs)

Direct Debit providers integrate well with Xero. They are strong for recurring billing but less useful for ad-hoc, high-value invoices.

Best for:

- Retainers

- Subscription contracts

Not ideal for:

- One-off invoices

- Businesses needing instant settlement

Which method is truly the easiest?

If you want the cleanest, fastest, lowest-cost way to collect Xero payments without adding friction for clients, Pay by Bank via Atoa is the clear leader.

Card payments still work, but the economics make less sense for many UK businesses. Manual transfers waste time. Direct Debit is excellent for subscriptions but too slow for single invoices.

Atoa gives you the simplicity of a bank transfer, the convenience of a checkout button, and the automation of modern payments.