Ready to get started?

Easily integrate next-generation payments and financial data into any app. Build powerful products your customers love.

Just imagine that you run a theatre with multiple shows, each with different ticket prices, filling up at different times. Or maybe you’re managing an online course, juggling dozens of students across various cohorts. Payments are coming in from all directions. Some via bank transfers, some in cash, and some through online payments, making it hard to keep track. Accepting and managing payments shouldn’t feel like another production of its own, right? That’s where Payment Pages come in.

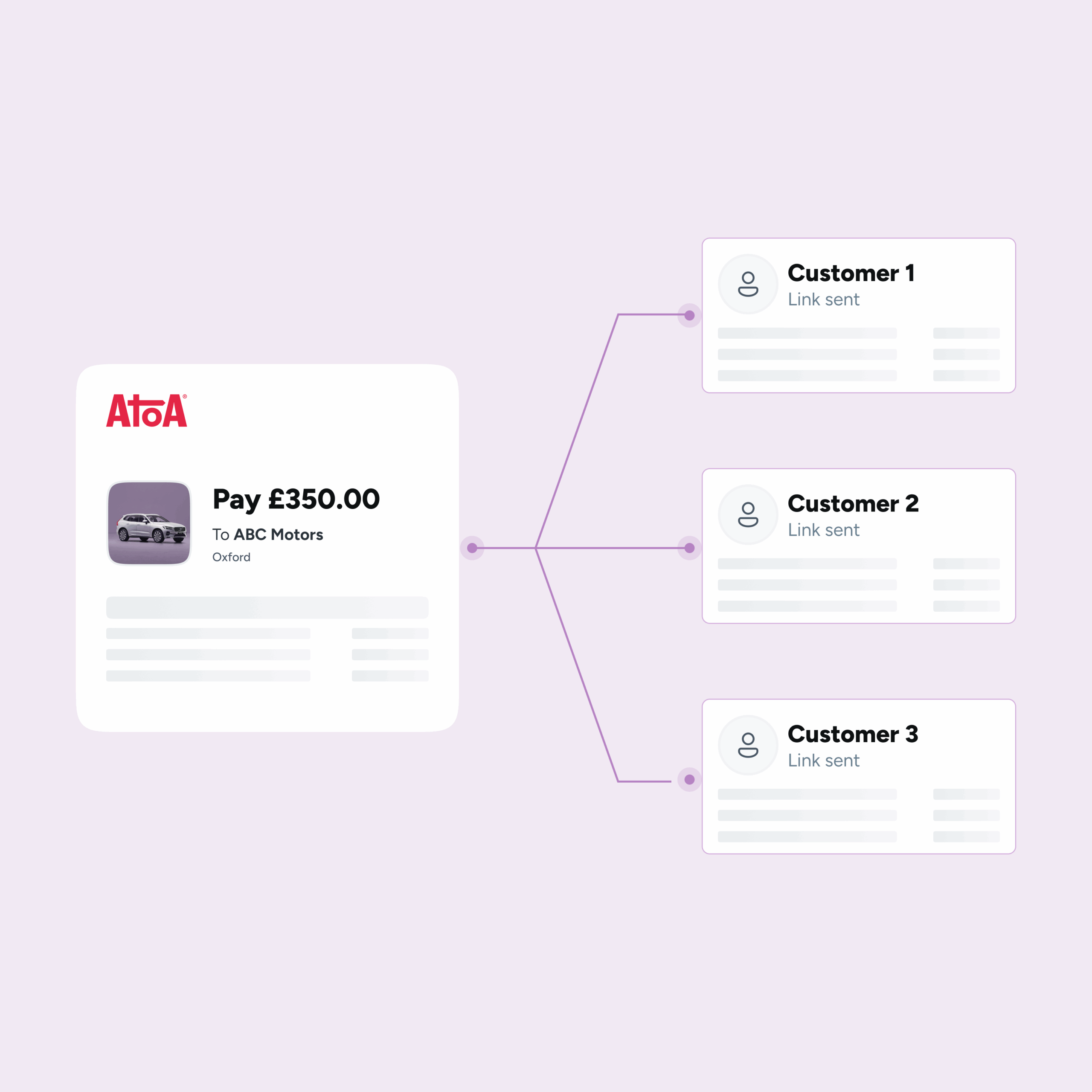

Atoa’s Payment Pages bring structure to the chaos, letting you create a single, reusable payment link or QR code that anyone can use to pay. You decide what to collect – names, emails, phone numbers, even custom details, and every payment is tracked in real time, all in one place.

Why this changes everything

Let’s say you’re running a theatre production. Instead of manually sharing payment links for each booking, you just send out one Payment Page for the event. As people book, you collect not only their payment, but also their details, automatically. You see who’s paid, who hasn’t, and what exactly they’ve signed up for, without sifting through DMs or invoices.

The same logic applies whether you’re:

- Hosting workshops or fitness classes

- Managing school or college fee collections

- Collecting deposits for trips or events

- Running clubs, summer camps, or property viewings

If multiple people are paying for the same thing, this is the tool you’ve needed.

Made for scale, not spreadsheets

Payment Pages are built for businesses that are ready to scale without multiplying admin. You can create as many pages as you need, keep them live or turn them off as things change, and track everything in real time. It’s a self-serve setup for your customers and a stress-free one for your team.

All of this is available with Atoa’s Advanced Add-on, which unlocks a range of powerful features designed to give you more control, better tracking, and smoother operations.

Want to see it in action?

Head to the Help Centre for a step-by-step guide on setting up your first Payment Page. And if you ever get stuck or need a hand, our friendly UK-based support team is just an email away at hello@paywithatoa.co.uk. We’re here to help.

FAQs

What are Payment Pages used for?

Payment Pages are ideal for collecting payments from multiple customers for the same offering—like courses, events, tickets, subscriptions, or fees.

Can I customise what customer information I collect?

Yes. You can collect names, phone numbers, emails, and even add custom fields like dropdowns or text boxes—whatever suits your business.

Do I need to create a new payment link for every customer?

No. A single Payment Page link or QR code can be reused by multiple customers. All their payments and details are tracked separately on your dashboard.

Can I disable a Payment Page later?

Yes, you can turn a Payment Page on or off anytime using the ‘Live’ toggle in your Atoa dashboard.

Is this feature included in all plans?

Payment Pages are available with Atoa’s Advanced Add-on. You can visit our pricing page to see what else is included.