Ready to get started?

Easily integrate next-generation payments and financial data into any app. Build powerful products your customers love.

Getting paid on time is still one of the biggest headaches for UK businesses. Businesses send invoices, but customers delay payments. Card fees quietly eat into margins, and reconciliation consumes hours that business owners could spend elsewhere. For companies using Xero, the problem isn’t creating invoices but making sure they’re actually paid, quickly and cost-effectively. That’s why more businesses are now turning to Pay by Bank. It’s a modern alternative to cards and Direct Debit that saves money, speeds up cash flow, and gives customers a smooth, secure way to pay.

In this guide, we’ll show you how to enable Pay by Bank in Xero and what it looks like in practice when you use a provider like Atoa.

What is a Xero invoice?

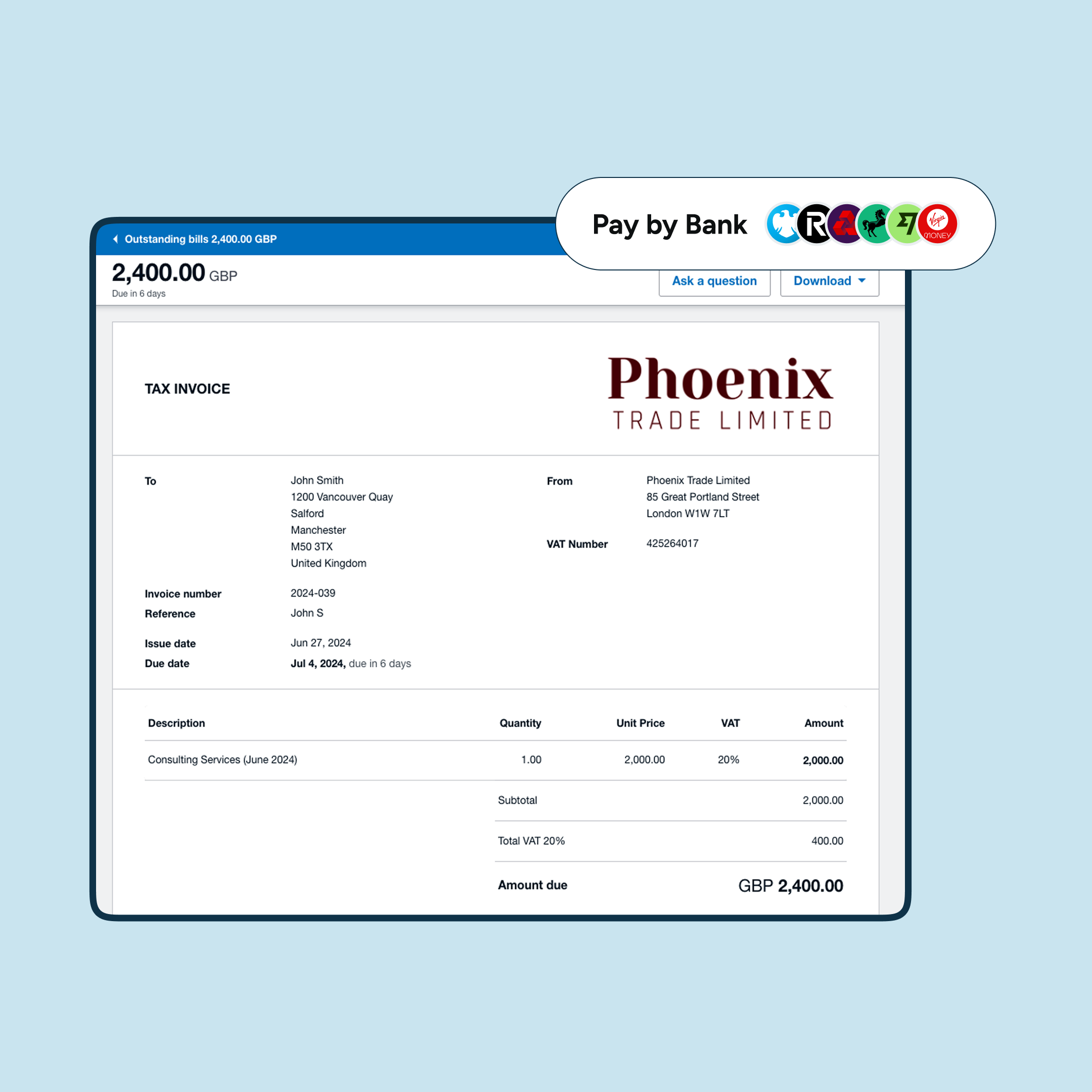

Xero is a cloud-based accounting software that lets you create customised invoices in seconds and send them directly to customers. So with online payment options built in, customers can settle their invoices in just a few clicks. Atoa is an official Xero-certified partner. This means our Pay by Bank integration works smoothly within the platform. This allows businesses to add a “Pay now” button to invoices so customers can pay directly from their bank account, no cards, no manual transfers, and no hidden fees.

What is Pay by Bank and why use it in Xero?

Pay by Bank is a payment method that allows customers to pay you directly from their bank account in real-time. Instead of going through card networks, the payment moves instantly from account-to-account, and is completely authorised by the customer in their mobile or online banking app.

Compared to cards or Direct Debit:

- Cheaper: no interchange or scheme fees.

- Faster: money lands in your account within seconds, not days.

- More reliable: no expired cards, fewer failed payments.

- Secure: customer authorises using face ID, fingerprint, or login.

For businesses using Xero, it means invoices get paid quicker, reconciliation happens automatically, and, of course, cash flow improves, too.

How to Activate Pay by Bank in Xero

It’s very simple to switch your payment method to Pay by Bank on Xero to switch on Pay by Bank. Here’s how:

- From your Xero Dashboard, go to Business → Online Payments.

- In the Manage payment methods tab, click Turn On next to Pay by Bank.

- This enables Pay by Bank for all future invoices and any unpaid invoices you’ve already sent.

- You can enable or disable Pay by Bank for each invoice as needed.

Using a provider to connect Pay by Bank with Xero

Turning on Pay by Bank in Xero is just the first step. You’ll also need to connect with a provider that powers the payments. There are several providers in the UK offering this service, each with slightly different features and pricing. To give you a clear example of how it works in practice, here’s what it looks like when you use Atoa, a Xero-certified Pay by Bank partner.

To use Pay by Bank in Xero through Atoa, you’ll first need an Atoa account. Setup is quick:

- Create an account in Atoa and link your business bank account.

- Connect Xero from the Integrations tab in your Atoa dashboard (this takes about 30 seconds).

- Choose the bank account where payments will be received.

Once connected, every Xero invoice you send will display a “Pay now” button powered by Atoa.

Customer experience

- On a smartphone: Your customer scans a QR code, picks their bank, and authorises with Face ID or fingerprint. Payment then lands instantly in your bank and reconciles automatically in Xero.

- On a computer: They click “Continue on this Device”, select their bank, and authorise the payment online. The funds then arrive instantly and sync with Xero.

Takeaway

Pay by Bank in Xero is a simple way to reduce costs, speed up cash flow, and give customers a secure, frictionless way to pay. With Atoa’s certified integration, payments land instantly, reconciliation is automatic, and businesses save up to 50% compared to card fees.If you’re ready to see how it works in practice, you can book a demo with Atoa to explore the benefits for your business. Or take the interactive tour below to see exactly how Pay by Bank in Xero works.