How Atoa works

in online checkouts

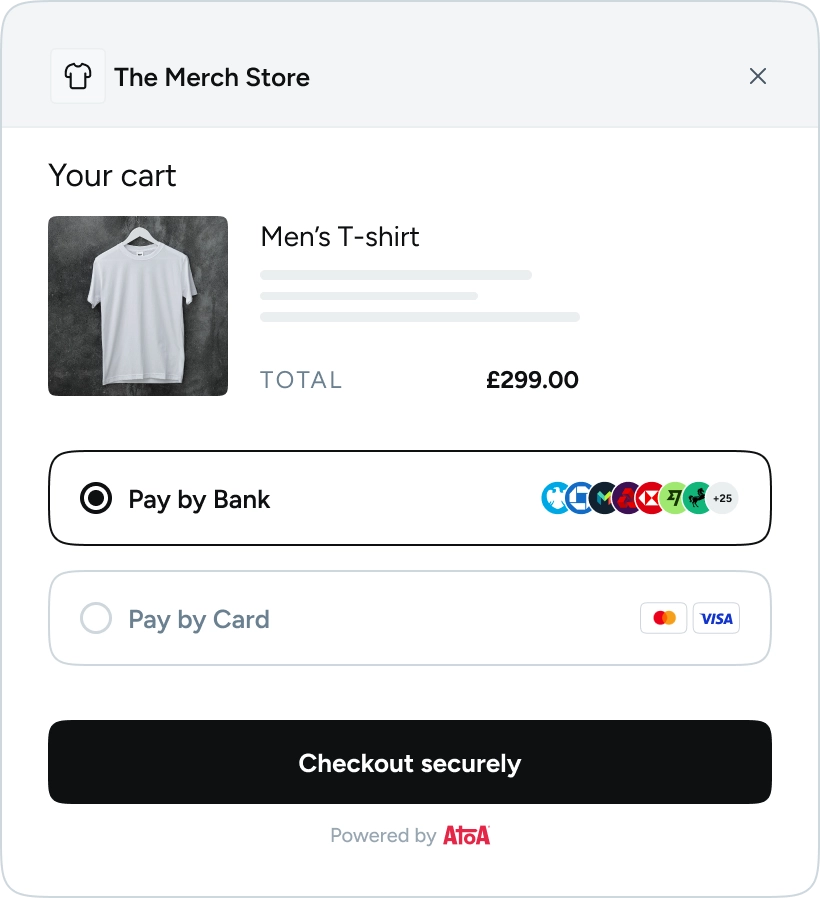

Atoa lets businesses accept Pay by Bank and card payments without rebuilding their checkout. Choose the integration that fits your stack and start collecting payments at lower fees and with better financial reporting.

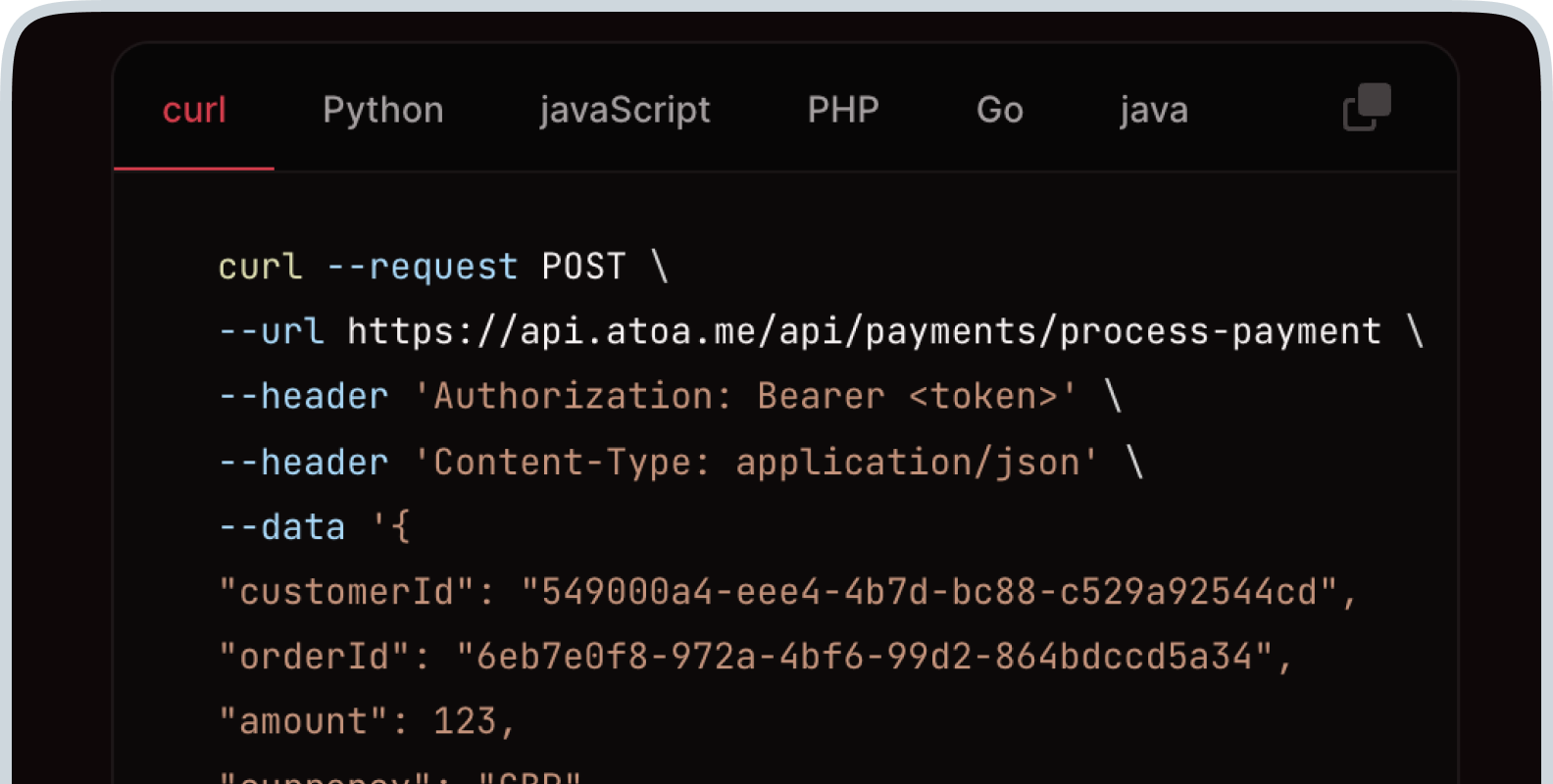

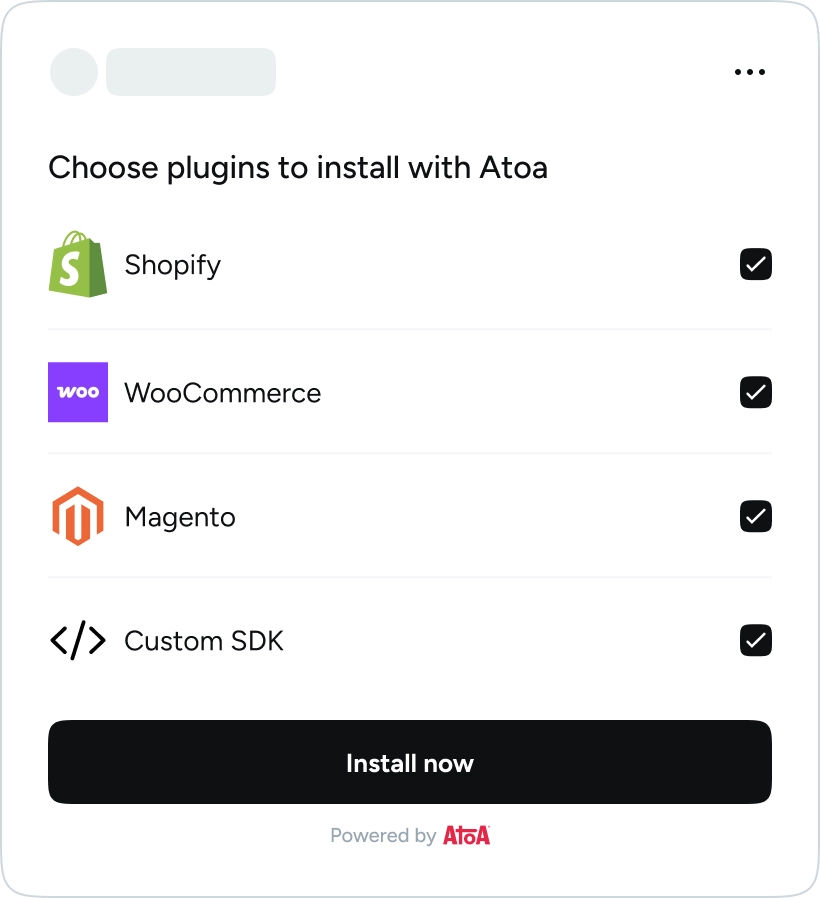

Add Atoa to your checkout

Plug in via SDKs or WordPress, WooCommerce, Shopify, and Magento.

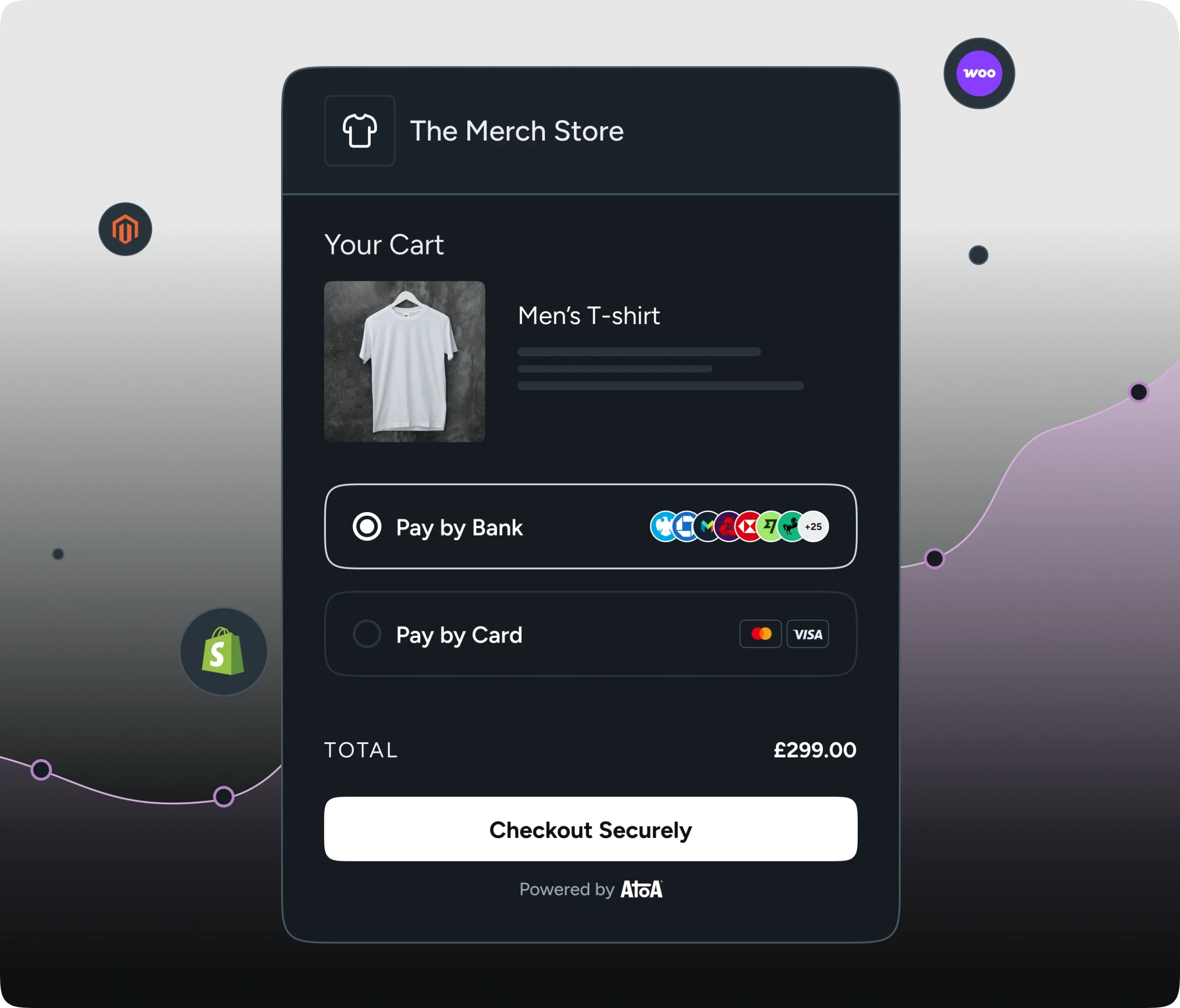

Customers choose how they pay

Shoppers choose Pay by Bank or card at checkout.

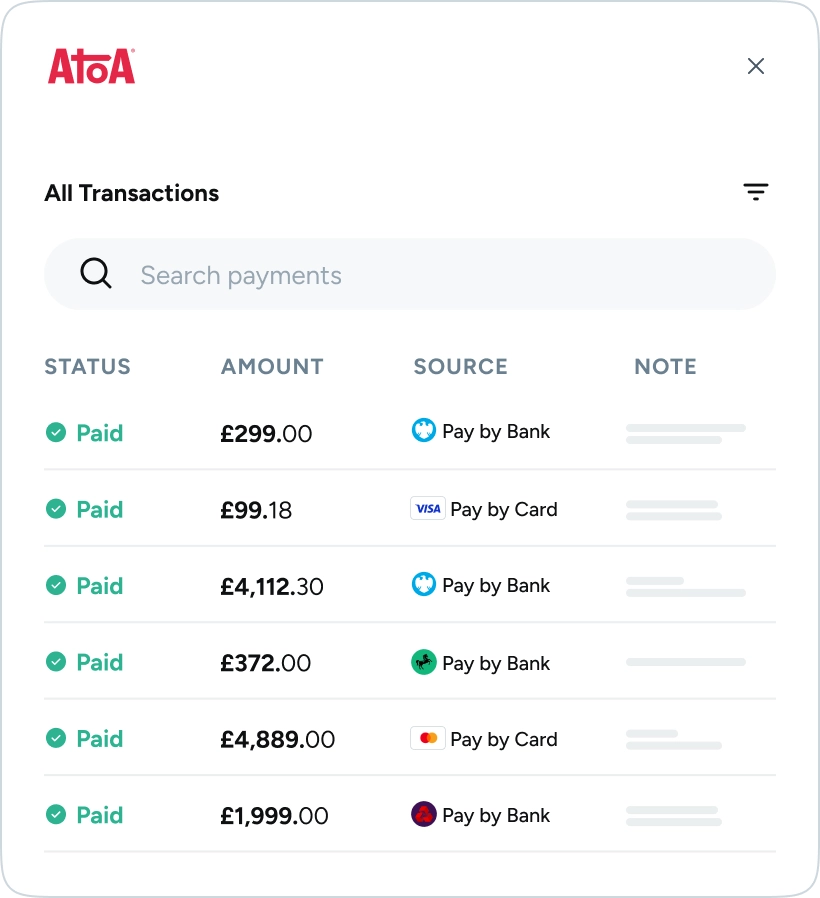

You get paid with clear visibility

Confirmed instantly, tracked in one place, settled next day.

Reach customers across every online channel

Online payments built to improve margins and conversion

A trusted partner

for businesses in the UK

Atoa allows customers to pay automotive retailers using their UK bank app. Our name is short for “account-to-account payments”.

Atoa uses the UK Government’s Open Banking network, which lets customers make an instant ‘bank transfer’ to businesses without entering their bank details. Atoa helps local auto businesses save on card fees and get paid faster. We sidestep card networks like Visa and Mastercard, which lowers business owners’ costs and improves cash flow.

Customers enjoy a safe and secure payment experience with Atoa. All they need is a UK bank app on their phone to pay your dealership or garage instantly without signing up or downloading any new apps.

Read our beginner’s guide to open banking to find out more.

When clients are ready to pay, they simply scan a QR code stand in the salon or clinic, which starts an account-to-account (A2A) payment in their smartphone browser. The customer enters the amount they wish to pay and selects their bank. They are then automatically redirected to their bank app to securely confirm the payment using their face ID or fingerprint scan. Once the payment is approved, funds are released to the business instantly.

Find out how in-store and phone QR payments work under ‘Features’ at the top of this page.

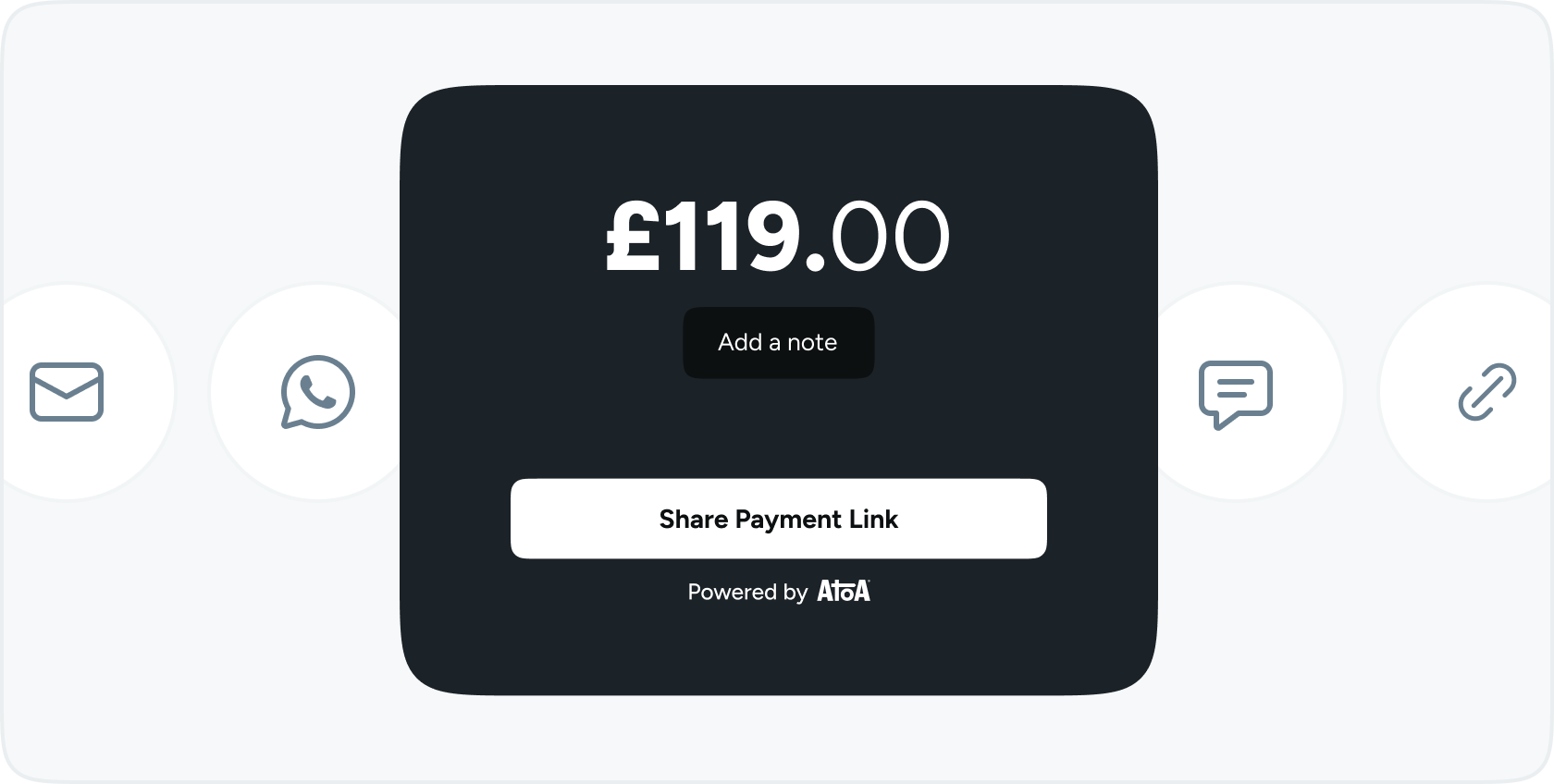

Our payment links are great for collecting deposits and can be shared with clients over SMS, WhatsApp, social media or email. When the client clicks the link, they’ll see the amount due and an optional reference or note from the business. The client selects their bank from the list provided and securely approves the payment in their bank app using their face ID or fingerprint scan.

When customers are ready to pay, they scan a QR code stand in the showroom, which starts an account-to-account (A2A) payment in their smartphone browser. The customer enters the amount they wish to pay and selects their bank. They are then automatically redirected to their bank app to securely confirm the payment using their face ID or fingerprint scan.

Once the payment is approved, funds are released instantly to the car dealership. The salesperson gets a real-time notification that payment was successful without needing access to the dealership’s bank account or contacting the finance department.

With Atoa, when a customer pays you, the full amount is paid into your bank account within seconds. We recommend setting up a direct debit to cover monthly transaction fees on Atoa. This way, your bill is paid automatically each month, helping you keep your cash flow smooth and your accounting simple.

Atoa lets customers pay your business directly from their UK bank app. It’s fast, secure, and cheaper than accepting card payments.

- Scan or click: Scan the Atoa QR code or click the payment link.

- Confirm in your bank app: You’ll be taken to your bank app to confirm the payment.

- Done! The money is sent instantly to the business.

We call this “Instant Bank Pay” but the finance term is account-to-account payments.

Atoa is safer than card payments. Unlike cards that can be lost or stolen, Atoa transactions are made from the customer’s bank app. Every payment is approved by the consumer’s bank and confirmed using a face ID or a fingerprint scan, removing the chances of chargeback fraud.

Atoa skips Visa and Mastercard’s card rails and instead taps directly into the UK government’s secure Faster Payments and Open Banking networks. The UK Financial Conduct Authority monitors every transaction, and banks handle all funds directly, meaning Atoa never touches your money. We’re rated “Excellent” on Trustpilot and trusted by thousands of UK businesses.

No. Atoa uses the open banking network for payments. To use Atoa, the client needs a UK bank account and banking app on their smartphone.

The client scans an Atoa QR code or clicks a payment link, which takes them straight to their bank app to approve the payment. Once confirmed, funds are transferred to the business bank account in seconds. This offers instant cash flow and up to 50% savings compared to traditional card payments. We call this technology “Instant Bank Pay” but it’s also known as an “account-to-account (A2A) payment” or “pay by bank”.

Yes. When partial payments are enabled, the customer can enter any amount up to the total balance. They’ll see the remaining balance each time they open the link.

No. Atoa uses the open banking network for payments. To use Atoa, the customer needs a UK bank account and banking app on their smartphone.

The customer scans an Atoa QR code or clicks a payment link, which takes them straight to their bank app to approve the payment. Once confirmed, funds are transferred to the business bank account in seconds. This offers instant cash flow and up to 50% savings compared to traditional card payments. We call this technology “Instant Bank Pay” but it’s also known as an account-to-account (A2A) payment or “pay by bank”.