Ready to get started?

Easily integrate next-generation payments and financial data into any app. Build powerful products your customers love.

A Shopify order confirmation has a reassuring definitive feel. Payment goes through. The customer gets their email. Stock is allocated. Fulfilment begins. For many UK merchants that moment feels like the finish line.

But with card payments, it often isn’t.

Chargebacks can arrive weeks later. Long after the product is sent or the service delivered. Even when everything seems straightforward at checkout, a transaction can be disputed and reversed. For Shopify merchants this is part of the landscape. Data suggests that Shopify merchants typically experience chargebacks on around 0.5-0.9% of sales, a rate that, while not huge, can still eat into margins and add uncertainty to cash flow. These are not occasional mistakes. Chargebacks are part of how card networks are built to work.

Why chargebacks exist in the card world

Card payment systems prioritise consumer protection. If a customer does not recognise a transaction or believes it was unauthorised, they can raise a dispute with their card issuer. The card network can then reverse the payment even if the merchant has already fulfilled the order.

This mechanism works very well from a buyer’s perspective. For merchants, it introduces a persistent uncertainty. A sale that looked settled at the point of purchase may not be truly final for weeks or even months.

In a Shopify store environment, where speed and volume matter, this delayed risk changes how revenue is treated. Funds can be booked in reports and yet still be subject to reversal later.

The hidden cost of living with chargebacks

The financial impact of chargebacks is straightforward. Merchants lose the order value and pay a fee for each dispute. But the operational and psychological costs are harder to quantify.

Teams spend time gathering evidence and responding to disputes. Cash flow planning becomes cautious because part of revenue is always “on hold.” High-value orders are treated with caution, not confidence, because there is always a chance that some portion may be pulled back later.

Why the risk grows with scale

As a Shopify store grows, the exposure to chargebacks grows too. More transactions mean more opportunities for disputes. International orders and digital goods tend to produce a higher incidence of chargebacks. Friendly fraud, where customers dispute legitimate transactions because it feels easy, is becoming a larger share of all disputes.

For larger or high-ticket Shopify sellers, the delay and uncertainty of chargebacks add a hidden cost to growth.

What open banking payments and Pay by Bank actually are

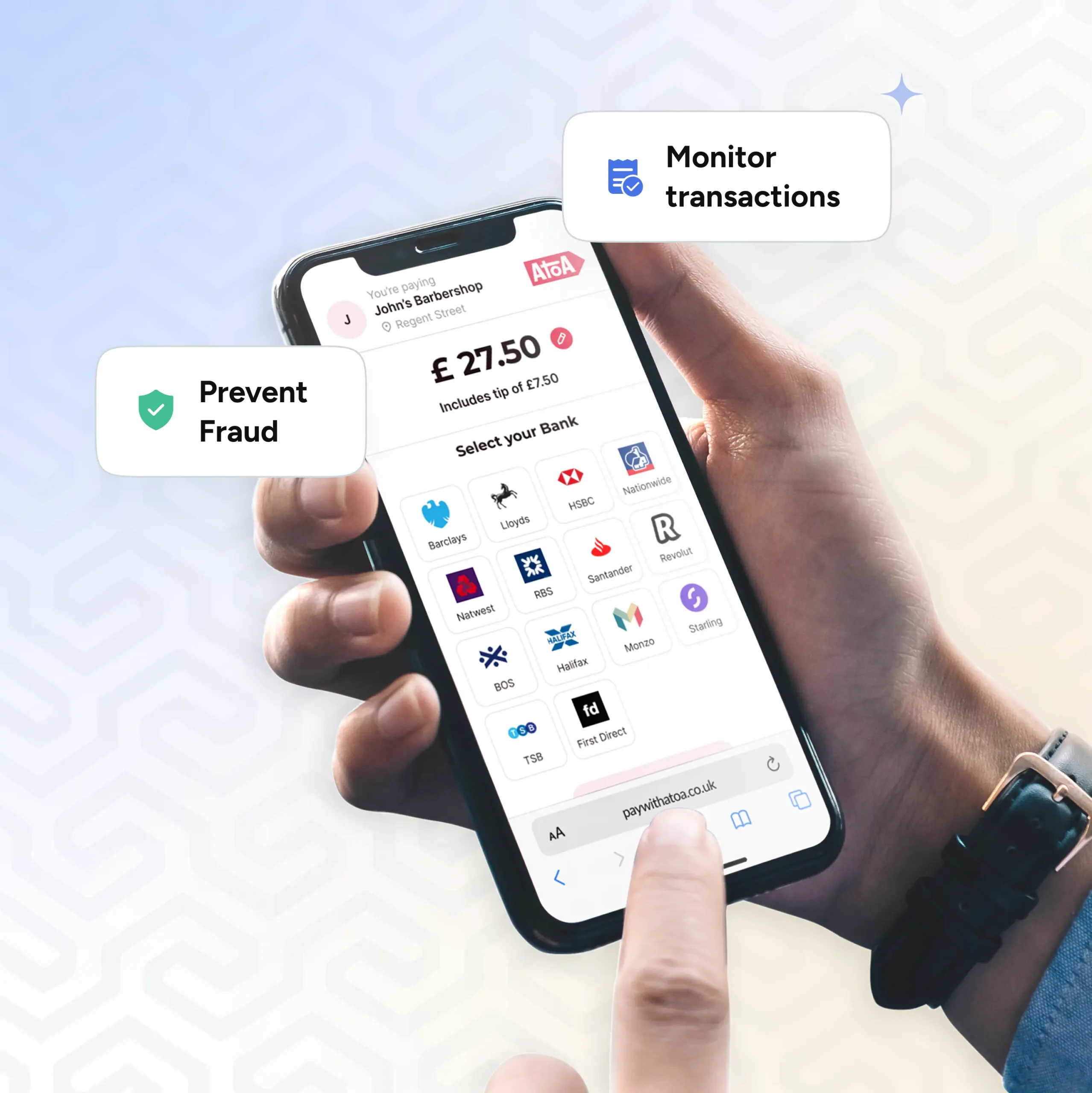

Pay by Bank is one of the payment methods emerging from open banking technology in the UK. Open banking is a regulated framework that allows customers to securely initiate payments directly from their bank account through authorised third-party providers, without card networks acting as intermediaries. Pay by Bank leverages this technology to let customers authorise payments in their own banking app before funds move.

This is fundamentally different from a card transaction. Instead of charging a card, open banking payments move money account to account. The customer sees the payment details, confirms them inside their own banking app using a PIN, fingerprint, or Face ID.

What “no chargebacks” really means

With Pay by Bank, there is no chargeback mechanism built into the payment model. The customer’s bank confirms identity and intent at the time of payment and moves the funds. There is no later reversal via a card network dispute. Payments are final once authorised.

This does not remove the ability to refund a customer if there is an issue. Refunds remain part of good customer service. But the structural risk of a chargeback, a payment being pulled back after fulfilment, no longer exists.

For Shopify merchants this changes the risk equation. Revenue is more predictable. Cash flow planning becomes more reliable. Orders can be processed with confidence that the sale will stick once it is approved.

Platforms like Atoa help Shopify merchants offer Pay by Bank checkout options alongside existing payment methods. They connect open banking payments at the point of purchase, giving customers a secure way to pay that does not expose merchants to post-purchase reversals. The result is fewer disputes, fewer administrative headaches, and more predictable income.

A more sustainable approach to ecommerce risk

Good customer service, clear refund policies, and transparent communication still matter. Pay by Bank does not replace all aspects of those practices. However, it does change the underlying assumption that every payment can be reversed long after it is made. Chargebacks are not inevitable. They are a feature of card networks, not of commerce itself.

For UK Shopify stores focused on sustainable, predictable growth, Pay by Bank offers an alternative risk model. One where payments are final at the moment they are made and where merchants can run their businesses with confidence rather than caution.