Ready to get started?

Easily integrate next-generation payments and financial data into any app. Build powerful products your customers love.

Most businesses don’t realise how much time they lose to finance admin because it rarely happens in one big chunk. It happens in small moments. Five minutes here to check a reference. Ten minutes there trying to match a payment. A quick email asking a customer what an amount relates to. It feels manageable day to day. Over a month, it quietly becomes hours.

For companies using Xero, one of the biggest opportunities to reclaim that time sits in a feature that is often underused or misunderstood: instant bank reconciliation.

This is not about accounting theory. It is about practical time-saving in the middle of a busy working week.

What bank reconciliation actually means in real life

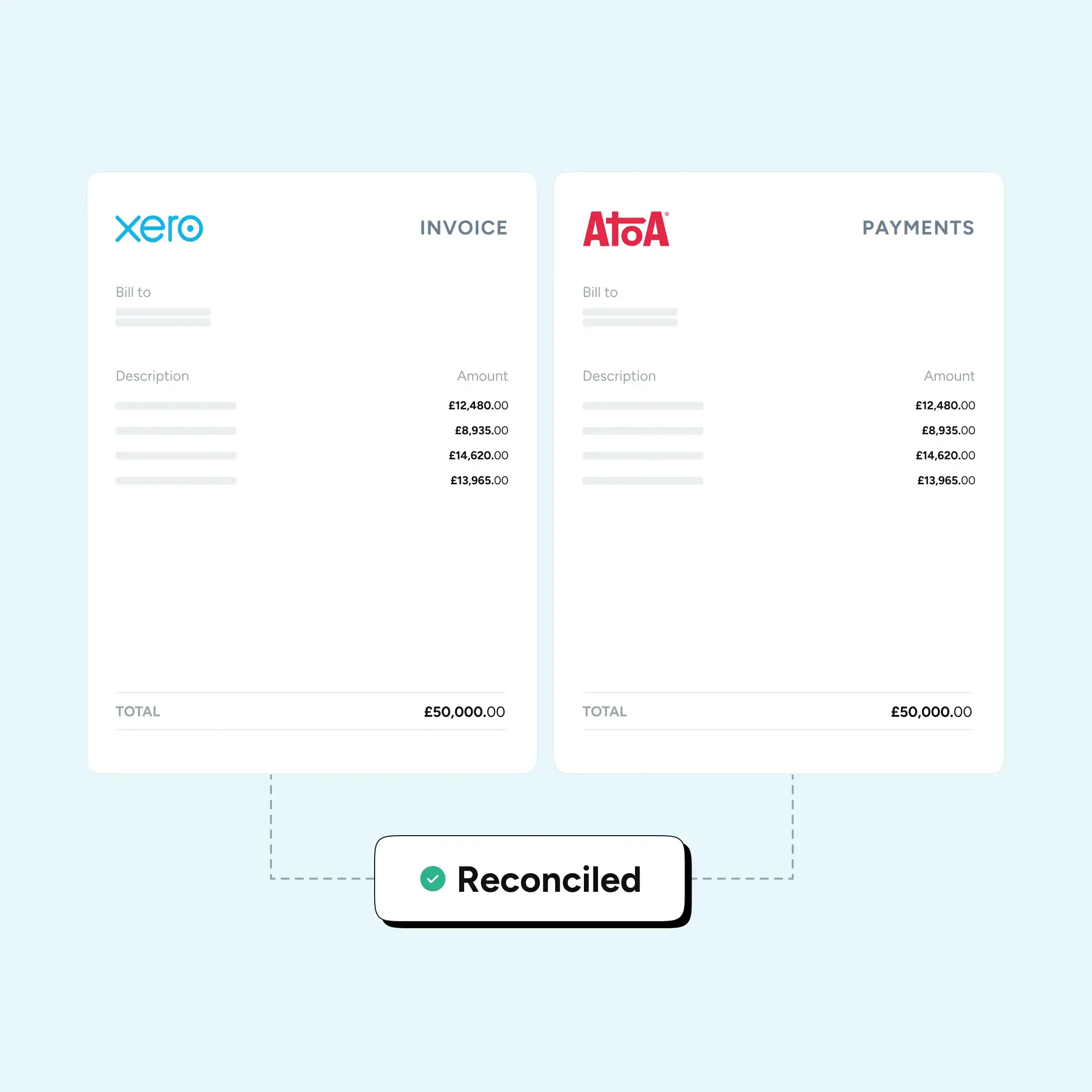

At its simplest, reconciliation is the process of making sure the money that arrives in your bank account matches the invoices in your accounting system. Every payment needs to be matched to the right customer and the right invoice. When everything is clean and consistent, this can happen automatically. When it isn’t, someone has to step in and figure it out manually.

Most finance teams will recognise the common problems:

- Bank transfers arriving with unclear or missing references

- Multiple invoices paid in one lump sum

- Card settlements appearing as batched amounts

- Payments received but no easy way to see which invoice they belong to

The issue is not poor processes or lack of effort. The issue is that the inputs are messy, so the system cannot do the work for you.

Why payment method matters more than most people realise

Xero’s instant reconciliation works best when payments arrive with structured, reliable data. That is when invoices can be marked as paid automatically, reports stay accurate, and dashboards reflect reality without manual intervention.

But when customers pay using methods that strip out useful information, such as vague bank transfers or aggregated card settlements, reconciliation becomes guesswork. The accounting software cannot confidently match what it cannot clearly see.

This is where many businesses feel like they are “using Xero properly” but still spending too much time fixing things.

Where Atoa fits naturally into this flow

For businesses that send invoices from Xero, there is an opportunity to improve the entire workflow by improving how customers pay.

Atoa partners with Xero to allow businesses to embed Pay by Bank payment links directly into Xero invoices, displayed clearly as a “Pay now” button. When a customer pays through that link, the payment arrives with the right context and reference attached.

The practical effect is simple but powerful: Invoices can reconcile automatically instead of sitting in a queue waiting for someone to manually match them. This is not about speed for the sake of speed. It is about removing the need for human involvement in routine payment matching. That is where the real admin reduction happens.

The outcomes businesses actually notice

When reconciliation works properly, the benefits are tangible:

- Fewer hours spent matching payments to invoices

- Less time chasing customers for references

- More confidence that reports reflect real cash position

- Cleaner month-end close without frantic clean-up

- Finance processes that scale as transaction volumes grow

It also reduces the mental load. Business owners and finance teams spend less time wondering whether everything has been accounted for and more time trusting the numbers in front of them.

Final thoughts

Tools like Xero are designed to simplify financial operations, but they only reach their full potential when the surrounding workflows support them. Payment method is a key part of that ecosystem.

For businesses already using Xero, improving how customers pay is often the missing piece in unlocking the true value of instant reconciliation. When payments arrive cleanly and consistently, the system does what it was designed to do. Admin drops. Visibility improves. And finance stops being a constant background task competing for attention.