Ready to get started?

Easily integrate next-generation payments and financial data into any app. Build powerful products your customers love.

Every time a customer swipes their card, your business pays a price—but is it too high? For many companies, expensive payment processing fees eat away at profit margins. Worse yet, these fees often come with hidden costs, slower cash flow, and increased risks of fraud. In 2024, the UK’s Payment Systems Regulator (PSR) reported that UK businesses are paying over £250 million extra annually due to increases in card scheme and processing fees by major card networks.

With the right strategies, it’s possible to cut these fees by up to 50% without interrupting your operations. This guide will walk you through understanding payment processing fees, and practical steps to achieve significant savings.

Why are UK businesses paying so much in payment processing fees?

To understand how to reduce fees, you first need to know where they come from. Every card transaction incurs multiple charges from different parties.

1. Card network fees: Visa, Mastercard, and Amex charge fees for using their networks.

2. Merchant service provider fees: Payment processors (Stripe, PayPal, etc.) charge a percentage per transaction.

3. Interchange fees: Banks and card networks take a cut, depending on the card type and region.

4. Chargeback fees: If a customer disputes a charge, businesses often are expected to foot the bill.

5. Hidden costs: Monthly service fees, terminal rental fees, PCI compliance charges, and other charges add to the final cost.

6. Additional hardware fees: Depending on your provider, you may need to spend on card readers or other equipment.

Many businesses unknowingly overpay due to dynamic pricing models, where fees fluctuate based on transaction type. These models often lack transparency, leaving businesses susceptible to overcharges.All these costs add up quickly and cut deep into profit margins, especially for businesses that rely heavily on card transactions.

How to reduce payment fees without disrupting your business?

Many UK businesses pay more than they should in processing fees. The good news? There are ways to cut costs without disrupting your business. Here are some effective strategies.

- Negotiate with your payment processor

Most businesses accept the first rates they’re offered, but payment processors are often open to negotiation—especially if you have high transaction volumes or a long-term relationship. Regularly reviewing your statements and comparing providers gives you leverage. You might also secure better terms by bundling services or signing a longer contract. - Run other payment methods

Some payment types come with lower fees. Debit card transactions usually cost less than credit cards, and instant bank transfers through open banking can be even cheaper. Encouraging customers to use these options—perhaps with a small discount—can help keep costs down. - Incentivise instant bank payments

Encourage adoption by offering discounts or loyalty points for customers who choose bank payments over card transactions. - Adopt open banking solutions

Open banking enables direct bank-to-bank transfers, skipping card networks (and their fees) altogether. It’s not just cheaper—it’s faster and more secure too. By integrating open banking payments, you can offer customers a seamless experience while reducing your processing costs. - Educate customers and staff

Train staff to highlight the benefits of bank payments and provide simple instructions for customers.

What are the potential challenges and how to overcome them?

- Customers hesitant to switch?

People stick to what they know, so new payment methods might meet some resistance. Ease the transition by highlighting benefits like better security and lower costs. A little incentive—like discounts or loyalty perks—can also do the trick! - Worried about integrations?

Updating payment systems can feel overwhelming, but it doesn’t have to be. Opt for solutions that integrate smoothly and offer hands-on support.

Why is Atoa an easy way to cut payment costs?

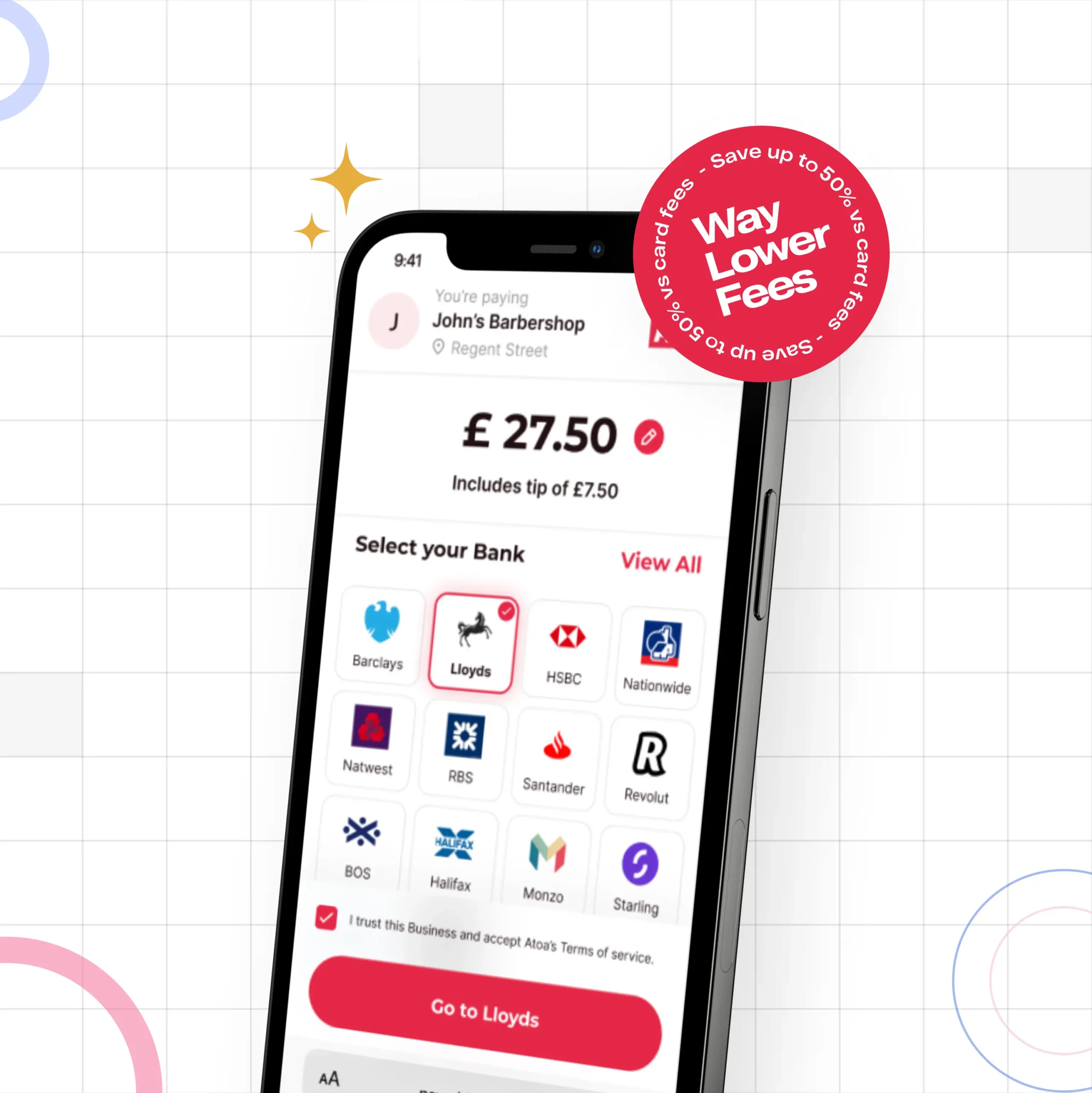

If you want to reduce transaction fees without the hassle of a complicated transition, Atoa provides an fast, fair, and secure account-to-account payment solution. Below are the key features of Atoa.

- Lower transaction fees: Save up to 50% compared to traditional card fees. ✔

- Instant settlements: Get paid instantly instead of waiting days and manage your finances better. ✔

- Easy integration: Works alongside your current card payment system. ✔

- QR code scanning & payment links: Accept payments in-store with QR codes or remotely through SMS or email. ✔

- Enhanced security: No chargebacks, no fraud risks associated with card transactions. It has water-tight security, including fingerprint and face ID verification. ✔

- Connecting any accounting software: Sync payments directly with Xero, Sage, and QuickBooks and reduce manual administrative tasks. ✔

- Staff management tools: Keep a check on employee transactions, and manage your team, and the staff access you give them. ✔

- Include customer reviews: Encourage customers to leave Google reviews after payments to build a positive online reputation that will bring in new customers. ✔

Try Atoa risk-free

Customers could pay directly from their bank account to yours, without card networks or excessive processing fees. 1000s of UK businesses have already switched to instant bank payments to cut fees and improve cash flow.

Now it’s your turn.

Atoa offers a 7-day free trial so you can experience the benefits risk-free.See how much you could save—contact us or sign up today.

FAQs

How does Atoa reduce payment processing fees?

Atoa bypasses card networks and allows direct bank-to-bank transfers, eliminating interchange and merchant fees.

Is Atoa suitable for small businesses?

Yes! Atoa works for businesses of all sizes, including law firms, car dealerships, and restaurant owners.

Do I need to change my bank or POS system?

No—Atoa works alongside your current payment methods. You can keep accepting card payments while introducing bank transfers.

How secure is Atoa?

Atoa uses bank-level encryption and authentication, making it as secure as your banking app.