Ready to get started?

Easily integrate next-generation payments and financial data into any app. Build powerful products your customers love.

For many Shopify stores, payment fees are one of those costs that quietly grow in the background. They do not show up as a single line item that demands attention. Instead, they appear as small percentages on every transaction, currency conversion fees on international orders, and extra charges that only become obvious once volumes increase.

The good news is that reducing Shopify payment fees does not require changing platforms or rebuilding checkout from scratch. In many cases, it comes down to understanding where costs arise and adjusting the mix of payment methods you offer.

What Shopify payment fees look like in the UK

Shopify payment costs are made up of several layers. When using Shopify Payments, merchants pay card processing fees that vary depending on the card type and whether the card is issued domestically or overseas. Premium and international cards typically cost more to process than standard UK debit cards.

On top of that, stores selling in multiple currencies may also pay a currency conversion fee when the customer’s currency differs from the merchant’s payout currency. These fees are not refunded when a transaction is refunded, which can further increase effective costs over time.

For merchants using third-party payment providers, Shopify may also apply a transaction fee depending on the plan. While each individual charge can seem small, together they add up quickly as sales grow.

Why card payments are often the most expensive option

Card payments remain popular with customers, but they are usually the most expensive way for merchants to get paid. Card fees scale with order value, which means higher-ticket purchases attract proportionally higher costs. Cross-border card payments increase fees further, and chargebacks introduce both direct fees and indirect admin costs.

Cards are also built on complex infrastructure involving multiple intermediaries, each taking a share of the transaction. For stores selling higher-value items, relying solely on cards can significantly compress margins.

The cheapest payment method for Shopify is not always obvious

When merchants think about reducing Shopify transaction fees in the UK, they often focus only on headline processing rates. In reality, the true cost of a payment method also includes settlement speed, failed payments, refunds, and dispute handling.

This is where bank-based payments start to look compelling.

How Pay by Bank helps reduce Shopify payment fees

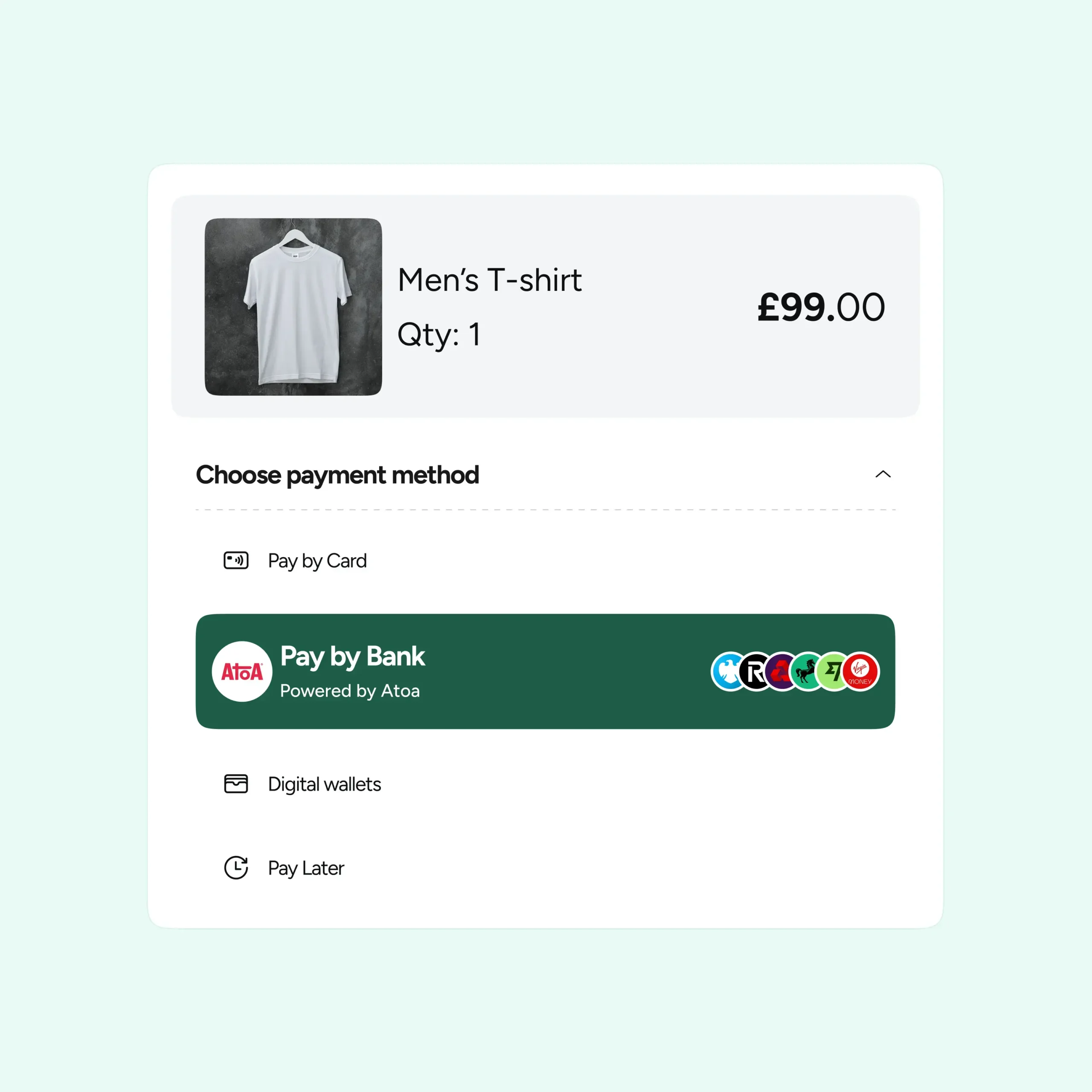

Pay by Bank, also known as instant bank payments, leverages open banking technology. It allows customers to pay directly from their bank account to the merchant’s account by approving the payment inside their banking app.

Because Pay by Bank moves money directly from bank to bank, it avoids card networks entirely. That usually means lower processing fees, faster settlement, and fewer disputes. There are no card numbers to enter and no risk of expired card details causing failed payments.

For Shopify stores, this makes Pay by Bank particularly effective for higher-value purchases where card fees are most painful. Plus, there’s zero chargeback fees.

Cutting payment fees without changing platforms

Reducing Shopify payment fees does not mean abandoning cards altogether. The most effective approach is to offer Pay by Bank alongside existing card options.

When customers are given a choice, many naturally select the method that feels easiest and most reassuring. Over time, higher-value payments often shift towards Pay by Bank, while cards remain available for customers who prefer them. This gradual shift can materially reduce average payment costs without disrupting the checkout experience or forcing customers into a single method.

Where this makes the biggest difference

Optimising payment mix is especially impactful for Shopify stores selling higher-ticket products or services, including furniture and home improvement, automotive parts and accessories, professional services, and premium ecommerce brands. It is also valuable for stores with international customers, where card and conversion fees are higher.

Choosing the right payment provider

Not all Pay by Bank providers are equal. Merchants should look for a provider that integrates cleanly with Shopify, offers clear pricing, supports both Pay by Bank and card payments, and provides reliable reporting and reconciliation.

A provider should make it easy to optimise payments without adding operational complexity.

Final thoughts

Payment fees are one of the fastest ways to erode profit, especially as a Shopify store scales. The solution is not to change platforms, but to be smarter about how customers pay and to offer flexible payment options. Adding Pay by Bank alongside card payments allows merchants to reduce costs, improve settlement speed, and build a more resilient checkout.

Book a demo with the Atoa teamto see how you can reduce Shopify payment fees by adding Pay by Bank without changing your platform. Thousands of UK businesses are already benefiting from Atoa’s platform, which supports both Pay by Bank and card payments.