Ready to get started?

Easily integrate next-generation payments and financial data into any app. Build powerful products your customers love.

Trust is the quiet factor behind almost every online payment decision. It is also increasingly fragile. In 2024, the UK recorded 3.13 million unauthorised fraud cases, showing just how common payment-related anxiety still is for consumers. When people feel unsure at checkout, they hesitate, abandon the purchase, or look for a brand that feels safer.

Pay by Bank is changing that dynamic. Instead of asking customers to trust another checkout page, it asks them to trust something they already rely on daily: their bank. Let’s understand a little bit more about this payment method and how it benefits both the business and the customer.

The trust gap in traditional card payments

Card payments are familiar, but familiarity does not always equal confidence. Many customers have grown wary of typing card details into multiple websites, especially when the brand is new to them. Concerns about data breaches, card details being stored, or payments being misused are now part of everyday thinking.

Even when the merchant is legitimate, the experience often asks the customer to place their trust in the site itself. That is a big psychological leap, particularly for higher-value payments.

What bank authentication actually means

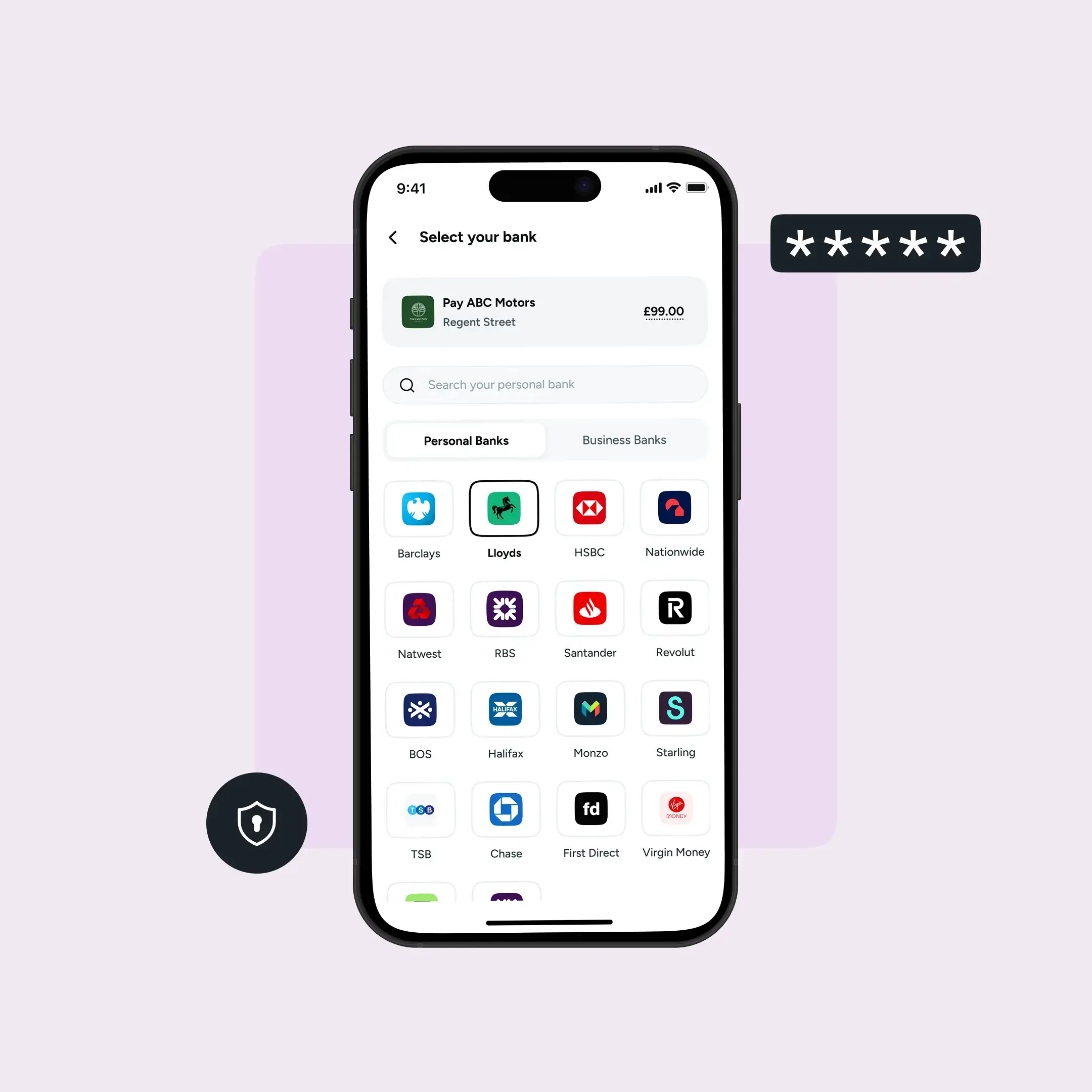

Pay by Bank works differently because authentication happens inside the customer’s own banking environment. The journey is simple. The customer chooses to pay by bank. They select their bank. The payment details appear inside their banking app. They then approve the payment using the same security they already use for everyday banking, such as a PIN, fingerprint, Face ID, or in-app confirmation.

Crucially, the bank is the one verifying identity and intent before the payment happens. This is not a superficial check added by a merchant. It is the bank confirming that the account holder genuinely approves the transaction. That distinction matters.

How open banking powers Pay by Bank

Pay by Bank is made possible through open banking technology. Open banking is a regulated UK framework that allows customers to initiate secure account-to-account payments through authorised third-party providers, without card networks acting as intermediaries.

Its adoption is accelerating. According to the FCA, open banking payments grew by 53% year on year, showing that consumers and businesses are increasingly comfortable using this model. Pay by Bank leverages this technology to deliver a payment experience that feels familiar, because it happens inside the customer’s own banking app or platform, and reassuring, because authentication happens at the highest level.

Why Pay by Bank builds real trust

From the customer’s perspective, several trust signals appear at once:

- They recognise the environment because it is their own bank

- They see the exact payment amount and recipient before approving

- They confirm the payment using bank-grade security

- They receive clear confirmation once the payment is complete

This changes the emotional tone of checkout. Instead of wondering whether a site is safe, customers are reassured by the fact that their bank is directly involved in the approval process.

For businesses, this often translates into fewer payment hesitations, stronger confidence on higher-value transactions, and a more credible brand perception. Research from Experian found that 82% of UK consumers trust biometric authentication as an effective way to prevent fraud, which helps explain why bank-based approval flows feel more reassuring than traditional card checkouts.

Final thoughts

Customers today are more aware of security than ever. They want to understand where their money is going and who is protecting them when they pay. Pay by Bank meets that expectation by placing bank-level authentication at the centre of the experience. It gives customers clarity and reassurance, while giving businesses a payment method that supports trust rather than asking for it. Choosing the right payment provider also matters, because the quality of the payment journey, the transparency of the flow, and the reliability of the technology all shape how much confidence customers ultimately feel when they reach the point of payment.